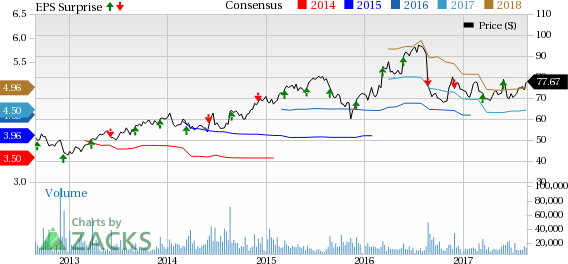

Dollar General Corporation (NYSE:DG) is scheduled to report second-quarter fiscal 2017 results on Aug 31. In the preceding quarter, the company recorded a positive earnings surprise of 4%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the quarter is $1.09, marginally up from $1.08 reported in the year-ago period. Analysts polled by Zacks anticipate revenues of $5,814 million, up roughly 8% from the year-ago quarter. Well the obvious question that comes to mind, will Dollar General be able to post positive earnings surprise in the quarter under review. Let’s take a look at factors influencing the quarter.

Factors at Play

We believe that the company’s commitment toward better price management, cost containment, private label offering, effective inventory management, merchandise and operational initiatives should drive sales and margin trends. Moreover, in order to increase traffic, Dollar General is focusing on both consumables and discretionary items. Additionally, the company is expanding its cooler facilities to enhance the sale of perishable items, and is also rolling out DG digital coupon program.

Of late, Dollar General has been bearing the brunt of price deflation and the reduction in SNAP benefits that may weigh on comparable-store sales performance. The current administration is suggesting on reducing food stamps program. Cut in SNAP benefit may hurt Dollar General performance as people with low income will have less money to spend and could restrict their spending to low margin products.

What the Zacks Model Unveils?

Well our proven model does not conclusively show that Dollar General is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. Here, Dollar General carries a Zacks Rank #2 but has an Earnings ESP-0.32%, consequently making surprise prediction difficult. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

G-III Apparel Group, Ltd. (NASDAQ:GIII) currently has an Earnings ESP of +4.76% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) currently has an Earnings ESP of +2.75% and a Zacks Rank #3.

Zumiez Inc. (NASDAQ:ZUMZ) currently has an Earnings ESP of +16.67% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post