End of Day Update:

On Tuesday the S&P 500 stumbled for the fourth time out of the last six sessions. In mid-morning trade the index undercut 2,570, but selling stalled and prices rebounded shortly thereafter. Despite multiple down-days, prices have been resilient so far are still within 1% of all-time highs.

Tax Reform continues to be the only thing that matters. Last month we kept inching higher despite the dark clouds forming around the tax debate. Not a lot has changed to the fundamental story since then, but traders are taking a less optimistic view of those same headlines as this story drags on. Previously Trump was hopeful a deal could be struck before Thanksgiving. Now it appears like we will be lucky if we have something by yearend.

A few weeks ago I told readers this was a better place to be taking profits than adding new positions. Given this recent bout of weakness, anyone who chased prices higher in November is currently sitting on losses and wondering if they should get out before things get worse. Buying when everything looks and feels good rarely works out. These reactive buyers are typically late to the party and more often than not, the last buyers before the up-wave crests and the next consolidation starts.

That said, this market has been remarkably resilient. Confident owners refuse to sell any bearish headline and negative price-action. That means these dips stall and bounce within hours. If this market was fragile and vulnerable, we would have crashed by now. As I said last month, markets consolidate one of two ways. The fastest is a pullback to support. That scares out the weak and clears the way for the next move higher. The other way is a sideways grind that bores everyone out the market as we patiently wait for the moving averages to catch up.

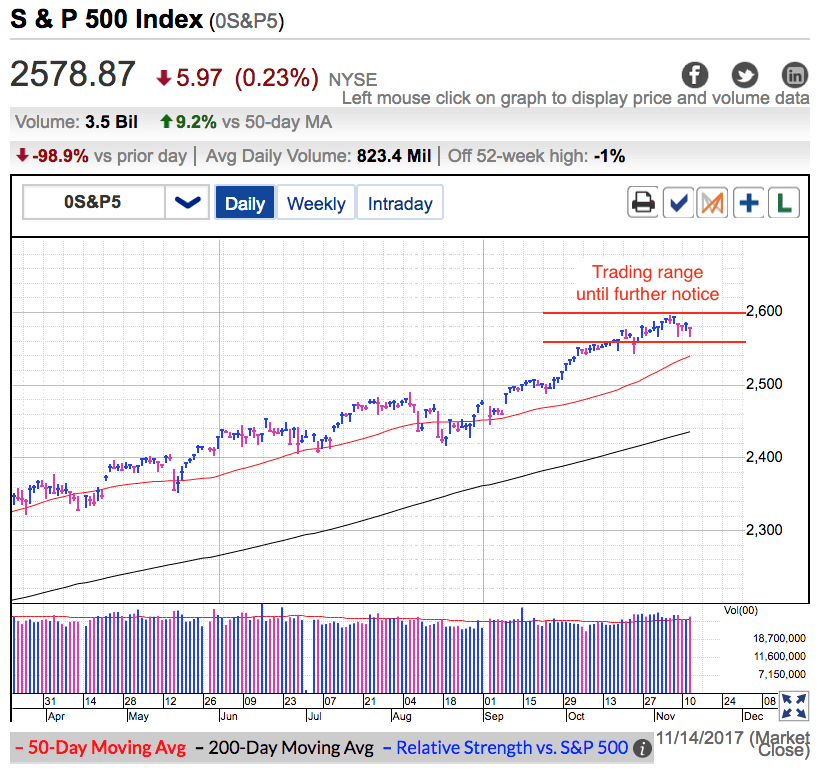

If this market was going to pullback to 2,500 support, it would have happened by now. There have been more than enough reasons for owners to dump stocks. But their stubborn confidence is keeping supply tight and putting a floor under prices. This means the most likely outcome is an extended trading range as the Tax debate drags on.

The thing to remember about trading ranges is they include moves to the upper and lower edges of the range. In this case that means dips under 2,560 and surges above 2,600. Because we are range bound, those “breakouts”/”breakdowns” will be false signals and should be traded against. For the nimblest of traders, that means buying weakness and selling strength.

Since the only thing that matters to this market is Tax Reform, that is also the only thing that will get us out of this range. Until this thing comes together or blows up, expect the market to remain range bound. Personally I don’t like owning sideways markets because that means I am holding risk and not getting paid for it. Long-term investors should stick with their favorite positions, but traders should wait for a better opportunity.