Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup November 4, 2019

All of the major currencies traded lower today on reports that the first part (phase one) of the U.S.-China trade deal could be delayed until December. After years of back and forth, no one is surprised that there are more setbacks. When President Trump made the initial announcement, the lack of a written agreement or details should have been the first sign of trouble. Investors were hopeful that when finalized, the deal would entail a delay to the December 15 tariffs. U.S. officials suggested that the tariffs can be eliminated completely, which would make the wait worthwhile. Still, a lot can change between now and then. There remain key areas of disagreement that could scuttle the deal last minute.

The Australian dollar was the most sensitive to today’s reports but USD/JPY, euro, sterling and the New Zealand dollar fell as well. AUD/USD in particular could extend its slide below .6850 if tonight’s trade data miss expectations. Weaker economic reports from New Zealand and Canada should keep those currencies under pressure. We learned last night that the unemployment rate in New Zealand increased from 3.9% to 4.2% in the third quarter as average hourly earnings growth slowed to 0.6%. With this slowdown in the labor market, the Reserve Bank of New Zealand will need to think hard about another rate cut before the end of the year. As for CAD, the continued contraction in manufacturing activity will not only worry their central bank but should also drive USD/CAD above 1.32.

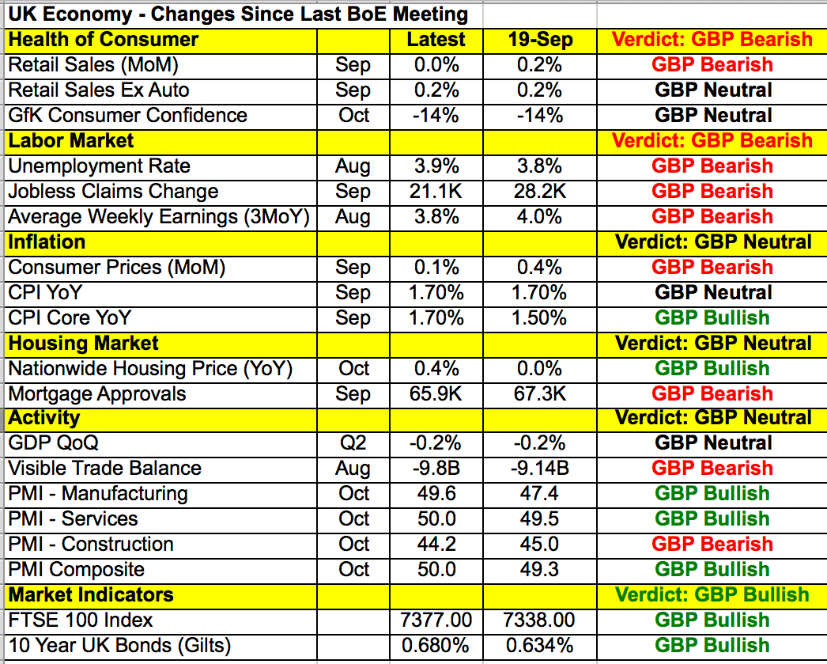

Thursday's focus will be on sterling, which is easing off 5-month highs ahead of the Bank of England’s monetary policy announcement. The BoE is widely expected to leave interest rates unchanged but the decision may not be unanimous. The table below shows uneveness in the UK’s economy since their last policy meeting. Retail sales stagnated, the unemployment rate increased, earnings growth slowed, CPI rose very modestly but service and manufacturing activity improved. Chances are the decision to keep rates steady will be unanimous but if one or two members vote in favor of an immediate rate cut, we could see a quick and aggressive sell-off in GBP. The Quarterly Inflation Report comes next and it could entail changes to their growth and inflation forecasts. There is no longer a serious risk of a no-deal Brexit but Brexit itself has hurt investment and growth at a time when inflation is lower across the globe. All of this suggests that Thursday's risk is to the downside for the British pound.

There were no major U.S. economic reports released Wednesday but risk aversion and positive comments from Fed Presidents drove the greenback higher against all of the major currencies. That includes the euro, which extended lower for the third day in a row. Eurozone data was actually better than expected with German factory orders rebounding, EZ retail sales growing and service sector PMIs revised higher. However the German government’s reluctance to provide fiscal stimulus and the risk of auto tariffs has kept the currency under pressure. Today, Germany’s finance minister said “they are able to act if there’s a crisis but there isn’t.” President Trump’s decision on EU tariffs is due later this month.