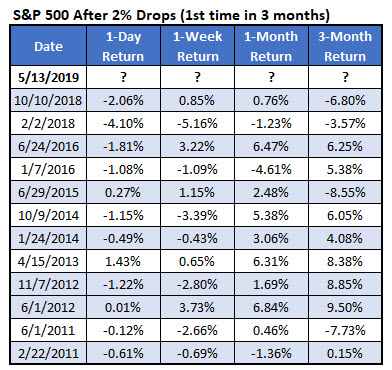

On Monday, China retaliated against increased U.S. tariffs, sending the major stock market indexes to their worst session in months. In fact, the S&P 500 Index (SPX) dropped more than 2% for the first time since early January. The last time the SPX fell more than 2% for the first time in at least three months was Oct. 10, at the start of the fourth-quarter correction. Below, we take a look at how the S&P tends to perform after similar instances, and what stock traders might expect for the short term.

Since 2010, there have been 12 other occurrences when the S&P fell 2% or more for the first time in three months, per Schaeffer's Senior Quantitative Analyst Rocky White. Prior to the October signal -- which preceded a three-month loss of 6.8% for the index --, you'd have to go back to early February 2018 for a similar pullback. That was the first such drop for the SPX since the Brexit drama of June 2016.

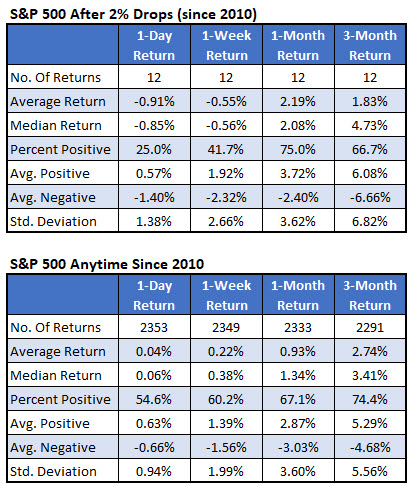

After those 12 instances, the index remained weaker than usual in the near term. To start, the SPX averaged a one-day drop of 0.91% and was positive just 25% of the time. That's compared to an average anytime one-day gain of 0.04%, with a win rate of 54.6%. Today, however, the S&P is attempting to defy the odds, with stocks higher at midday.

One week after signals, the index was down 0.55%, on average, and positive less than half the time. That's compared to an average anytime one-week gain of 0.22%, with a win rate of more than 60%.

While the S&P's three-month returns after signals are still underwhelming compared to its anytime returns, one month after a 2% drop the broad-market barometer was up a stronger-than-usual 2.19% and was higher 75% of the time. That's more than double its average anytime one-month gain of 0.93%, with a win rate of 67.1%.

So, if recent history is any indicator, speculators who hit the sidelines after the recent trade-induced sell-off may want to jump back into stocks before mid-June. However, be aware that the aforementioned Chinese tariffs on U.S. goods are slated to go into effect on June 1, and President Donald Trump could slap 25% tariffs on about $300 billion in additional Chinese goods, which could take effect as early as late June. Further, Trump is expected to meet Chinese President Xi Jinping at the Group of 20 (G-20) meeting late next month, which could also move markets.