Thursday was the ugliest session in weeks. A one-way selloff pushed the S&P 500 down more than 1% by lunchtime. But not long after undercutting 2,570, supply dried up and we recovered more than half of those early losses. Ugly, but it could have been worse.

Before Thursday’s open, Trump appeared to abandon the House’s version of Tax Reform and threw his weight behind the Senate’s yet to be released proposal. Even more unnerving is he claimed the Senate’s version would be a lot more Democrat friendly. The market’s disappointment seems to indicate it is afraid the Senate’s version will be more watered down and populist oriented. Early leaks also tell us the corporate tax cuts will be delayed until 2019, not something the market was happy to hear.

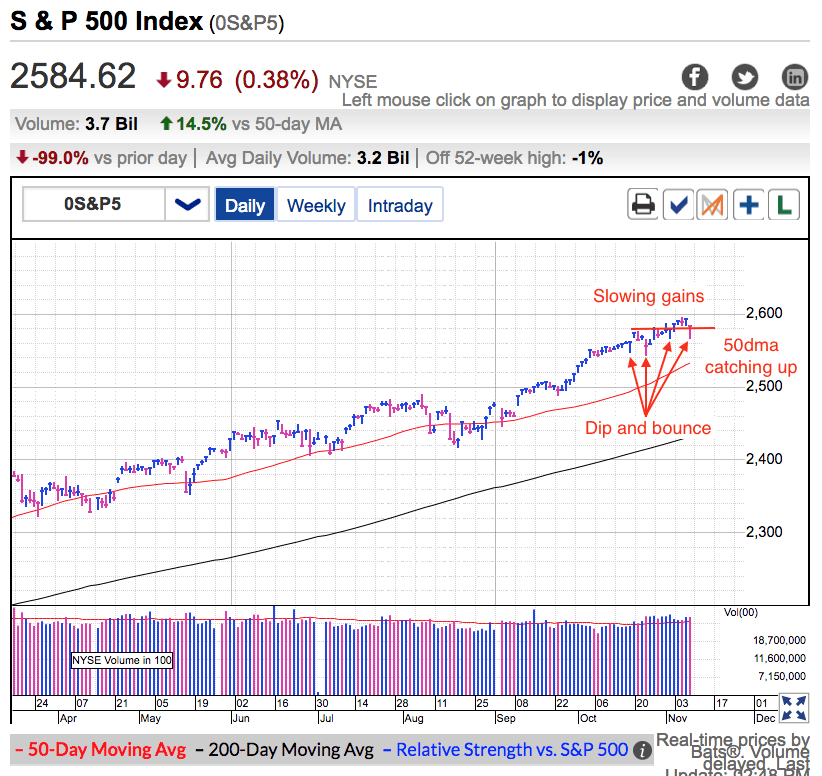

Even though prices has been drifting higher over the last few months, including a record close on Wednesday, volatility has definitely been picking up. This was the fourth whipsaw session in as many weeks. While most of these dips bounced within hours, it reveals a growing struggle over where the market is headed next. Thus far we have been drifting higher as defeated bears were steamrolled by confident bulls. But this volatility tells us the Bulls are losing their grip and Bears are putting up a better fight.

And it shouldn’t come as a surprise. Everyone knows the market moves in waves and there is only so much up we can do before stumbling into a bout of down. The last meaningful dip was nearly three-months ago. While momentum is definitely still higher, without a doubt that next dip is coming. Thursday's whipsaw session tells us the battle is heating up and it will likely get even choppier over coming weeks.

The saving grace is most owners are blissfully complacent and confident. No matter what the cynics claim should happen, if confident owners don’t sell, supply stays tight and it is easy to prop up the market. While Thursday's selloff was dramatic, almost all owners were still sitting on piles of profits and the only ones feeling the squeeze were recent buyers. Once those recent buyers fled, there was no one left to sell and we rebounded.

The real question is where do we head from here? I’ve been cautious the last few weeks. I know the market cannot go up in a straight line and the rate of gains since the August bottom was bound to slow down. That is why I have been telling readers this is a better place to be taking profits than adding new money. And that analysis has been spot on. Even though we continue creeping higher, the gains have been far slower and the choppiness has definitely picked up. The easy gains are long behind us and the road ahead is a lot more difficult.

That said, prices have been holding up amazingly well. Extended markets heal themselves one of two ways. Either they slip back to support and key moving averages, or they trade sideways long enough to allow the moving averages to catch up. While we are still a good ways above the 50dma, the slower rate of gains over the last few weeks is allowing it to catch up.

Thursday's whipsaw session was the fourth bout of volatility we’ve seen recently. And just like the other times, Thursday recovered a big chunk of those early losses within hours. Confident owners are simply not interested in selling no matter what the headlines say or the price-action is. Their determination is keeping a solid floor under our feet.

Previously I was wary of a dip back to support, but the market has held near the highs amazingly well. If we were vulnerable to a pullback, it would have happened by now. That said, this is still a challenging place to own stocks. Volatility will continue to haunt us over the near-term as traders reconcile the flurry of encouraging and disappointing Tax Reform headlines. The rate of gains is definitely slowing down and traders trying to sit through this sideways stretch better buckle in.

Everyone knows picking a top is a fool’s game. As traders that means we must decide if we prefer selling too early, or too late. Personally I like selling too early because it means I get to skip all the heartburn that comes from trying to decide if days like Thursday should be held or sold. Sideways stretches are the worst because you hold all the risk, but you don’t get paid for it. Personally I like watching this choppiness from the sidelines so I am fresh and ready to go when the next opportunity presents itself. It is hard to profit from a dip when you are already fully invested.