The S&P 500 Index (SPX) jumped back above its 200-day moving average on Wednesday, after spending more than two weeks below this closely watched trendline. It marked the index's longest stretch below the moving average since the first quarter of 2016. However, what really piqued our interest was last week's SPX surge while trading beneath the trendline -- a signal that flashed around the March 2009 bottom.

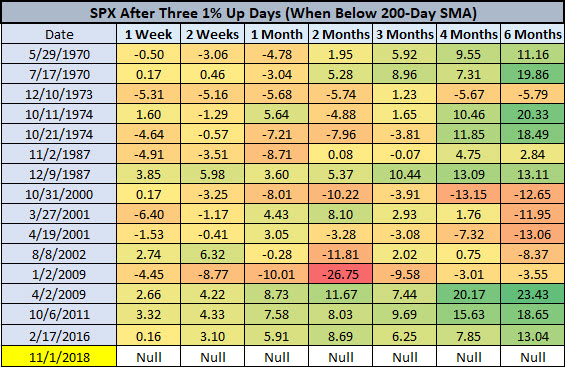

Since 1970, there have been just 15 other times when the S&P achieved three straight gains of at least 1% while trading below its 200-day moving average, according to Schaeffer's Quantitative Analyst Chris Prybal. The last time this happened was around the February 2016 correction. Prior to that, you'd have to go back to October 2011, which was the last signal since April 2009.

In fact, there were two signals in the first half of 2009 -- the first in almost seven years. It should also be noted that these signals sounded after the dot-com bubble burst in the early 2000s, and just after Black Monday in October 1987.

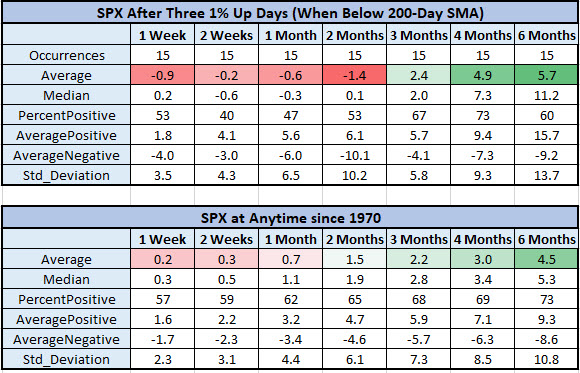

These signals have historically preceded short-term weakness for the SPX. One week later, the index was down 0.9%, on average, compared to an average anytime gain of 0.2%, looking at data since 1970. In fact, S&P returns out to two months after a signal were negative, compared to anytime gains. Right now we're at the one-week checkpoint, though, and already up more than 2%.

What's more, over the longer term, these signals have preceded stronger-than-usual price action for the stock market index. Four months out, the S&P was up 4.9%, on average, and higher 73% of the time. That's compared to an average anytime gain of 3%, with a win rate of 69%. Six months later, the SPX was up 5.7%, on average, compared to 4.5% anytime.

Plus, it's worth noting that since the April 2009 signal, the SPX was higher at every single checkpoint by much more than usual, as evident on the first chart above. After the most recent signal in February 2016, the index went on to rally more than 13% over the subsequent six months. And after the April 2009 signal, the S&P was up a whopping 23.43% six months later.

In conclusion, while many pundits were worried about the S&P's recent break of the 200-day moving average, we were satisfied that another moving average held during the pullback: the index's 80-week trendline. This moving average has had an uncanny knack for predicting poor price action on breaks, per Schaeffer's Senior V.P. of Research Todd Salamone. And while the SPX enjoyed three straight gains of 1% while south of the 200-day, similar signals during the current bull market (since March 2009) have been very bullish for stocks going forward.