The Dow Jones Industrial Average (DJI) is on pace for a 0.5% gain this week, which would mark its ninth straight weekly gain -- something we haven't seen since May 1995. Prior to that, you'd have to go back to 1989 for a similar rally, which was the first of its kind in more than 20 years, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Below is what the early 2019 surge could mean for the blue-chip index if past is prologue.

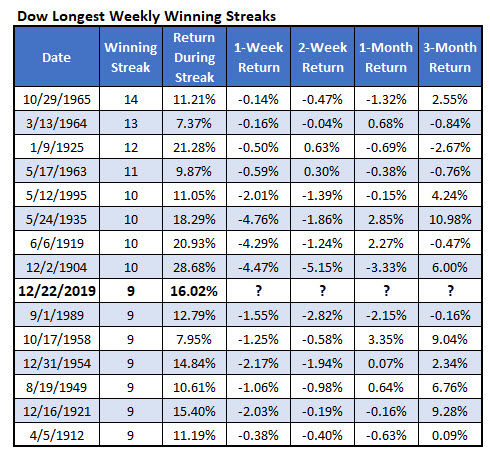

There have been just 14 nine-week winning streaks since 1904, eight of which went on longer than nine weeks. The longest-ever weekly win streak was 14 for the Dow, which occurred in 1965. The last win streak, in 1995, lasted for 10 weeks. So far during this streak, the DJI has gained more than 16% -- better than only four other weeks on the list below, and the biggest since 1935.

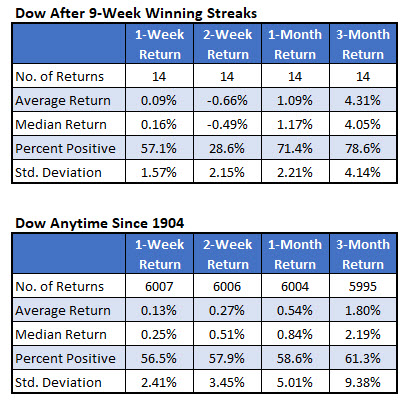

So, does the current rally mean the blue-chip barometer is due to cool off? Possibly -- but not for long, if history is any indicator. The Dow has gone on to extend its win streak to a 10th week 57.1% of the time, averaging a gain of just 0.09%. That's compared to an average anytime one-week gain of 0.13%, with a positive rate of 56.5%, looking at data since 1904. Two weeks later, though, the DJI was down 0.66%, on average, and higher just 28.6% of the time. That's compared to an average anytime gain and a win rate greater than 50%.

However, one month after these streaks, the Dow was up nearly 1.1%, on average, and higher 71.4% of the time. Two months out, the index was up a healthy 4.31%, and higher more than three-quarters of the time. Those returns more than double the DJI's average anytime one- and two-month returns and win rates. As such, even if the Dow cools its proverbial jets after the massive rebound from December lows, history indicates buying power could resume around the ides of March.