Are interest rates back from the dead? It certainly looks like there may be a rise in the patient’s chest. But is it the first of many more breaths, or is it merely a last, desperate gasp?

We’d love to pump our fists and say we’ve walked back from the edge of destruction. But it’s far too soon to tell.

Let’s be clear... Rates have moved on no more than speculation.

Old Man Market clearly thinks a Trump administration will spark inflation and perhaps even real economic growth. So do we. But we’re months away from an inauguration and even further away from any real action.

A lot could change. A lot will change.

Instead, here’s what you should focus on now... It’s a telltale indicator that will tell us whether our patient will soon be walking... or if we’ll be tossing dirt on the casket.

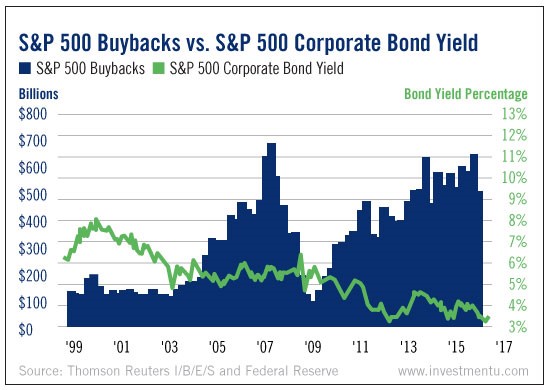

We’ve talked about share buybacks before. Most folks who track such things believe, like us, that the market’s rally has largely been propelled by companies using their cash and fresh debt to buy shares of their company on the open market.

It’s good news for shareholders. Fewer slices of pie means bigger slices for those holding the plate.

But here’s the deal: Many companies have gone too far. They’ve gotten greedy.

According to the most recent data, buyback spending has eclipsed earnings for a whopping 137 companies in the S&P 500. In other words, shares of their firms are rising, but not because of a grand business breakthrough.

No, no... it’s a grand illusion. Smoke and mirrors.

They’re spending more to buy their shares than they are making in profits.

These firms are taking advantage of record-low rates and are borrowing like crazy.

At the end of this year’s second quarter, debt for the companies within the S&P 500 was at record highs. It’s no coincidence that debt and share buybacks are surging in tandem.

And it’s certainly no coincidence that the markets are reaching all-time highs at the same time.

If debt is the fuel for this buyback fire, low interest rates are the stiff oxygen-rich breeze that’s turned it into an inferno.

But what happens when that breeze dies? You’re smart. I’m sure you can connect the dots.

Once the cost of borrowing eclipses the returns on that borrowing, logic dictates the borrowing will stop. When it does... so will the rally that’s propelled so many stocks higher.

Now, this isn’t to say all stocks will crumble. Far from it. After all, plenty of companies were smart enough to keep their feet out of the fire.

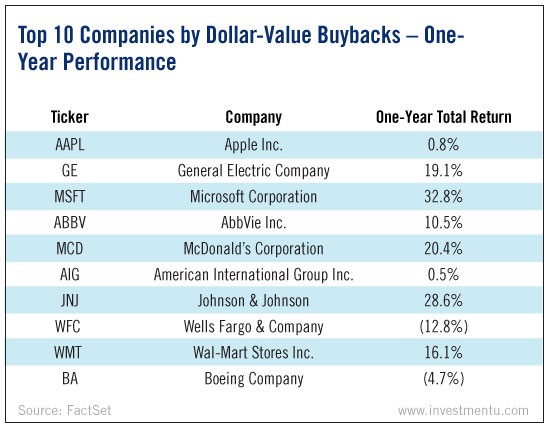

It’s the big buyback culprits you must worry about.

Here’s a handy list of them...

So here's the deal: If companies think their economic outlooks will continue to brighten and their earnings will pull out of the recent slump, the borrowing will continue despite the rise in costs.

As it does, demand for more money will keep rates rising.

But if rates reach too-high territory for these companies, they’ll stop borrowing... and rates will fall.

It’s why the amount of borrowed money used to buy back shares is the top indicator to watch right now. It will give us a much clearer prognosis for our frail patient.

My take? I wouldn’t put away your funeral attire quite yet.

We’ve got a long way to go before rates are back from the dead. There’s a lot at stake and a lot of reasons to keep the cheap money flowing.