Many of you have been waiting for weeks or months for the S&P 500 to pull back. To fall off the cliff. What is keeping this from happening?

There have been some major events the past several weeks. We have been bombarded by Fed Governors stating the case for a rate hike, now or June or in the past. Not the whole board but the hawkish side. What has the S&P 500 done? Nothing. Greece is going to default, or exit the euro or stop exporting olive oil or something. What has the S&P 500 done? Nothing. Earnings have been coming out and the picture, although not rosy and inspiring, is also not as bad as some would have anticipated. And what has the S&P 500 done? Nothing.

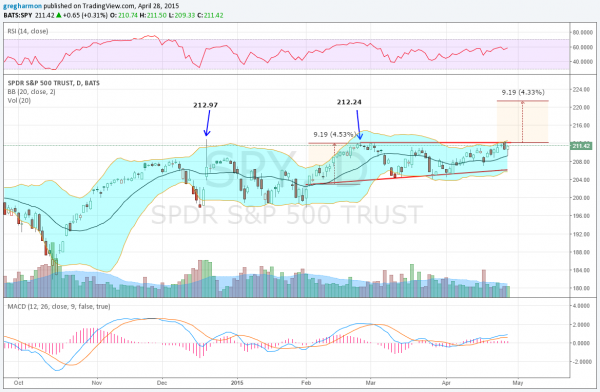

Well, that's not exactly true. Nothing is one way to describe it. But another way to describe it is that it has not fallen. With all the pressures on equities to the downside, they have not fallen. I know that many analysts and traders are looking for that elusive 10% correction. Some are growing their playoff beard’s because they are so convinced it needs to happen. It has been about 100 years since we have had a 10% fall according to many.

So if the repeated hounding of those running monetary policy, the demise of Greece, and the lukewarm earnings cannot bring down this market what will? Maybe that is the wrong question to be asking. A market that is absorbing all the bad news and not budging might be viewed as a strong market. Maybe the right question to be asking is instead, “What is holding back the S&P 500?”

I do not know what the S&P 500 will do next. But a market that can take all this and just move sideways is in pretty good shape. I would think that the market has totally discounted a rate hike in June, or even this year. Federal Funds Rate futures have. But one thing I learned over the years is that it is one thing to have an opinion and quite another to express it with your own (or your clients) money. What happens more than not is the talk turns first and then the money flows when the proof is given.

One of these ‘proof’ catalysts could be the FOMC statement this afternoon. Despite the consensus that rates will not rise until next year, why would you put your or your client’s money in equities ahead of the actual statement of what the full FOMC Committee says? You could be a hero if you got them out ahead of a fall. If the market rises then you will invest and go up to.

So, although it is widely anticipated that there will be no material new news out in the FOMC statement. It would not surprise me in the least for the market reaction to be a big rally.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.