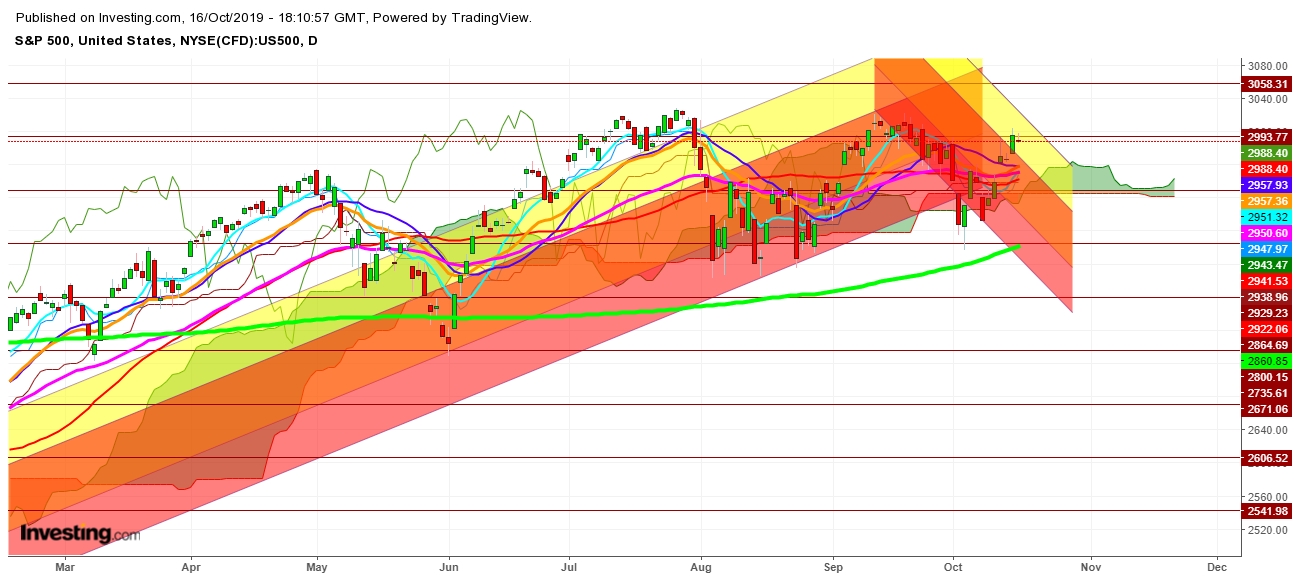

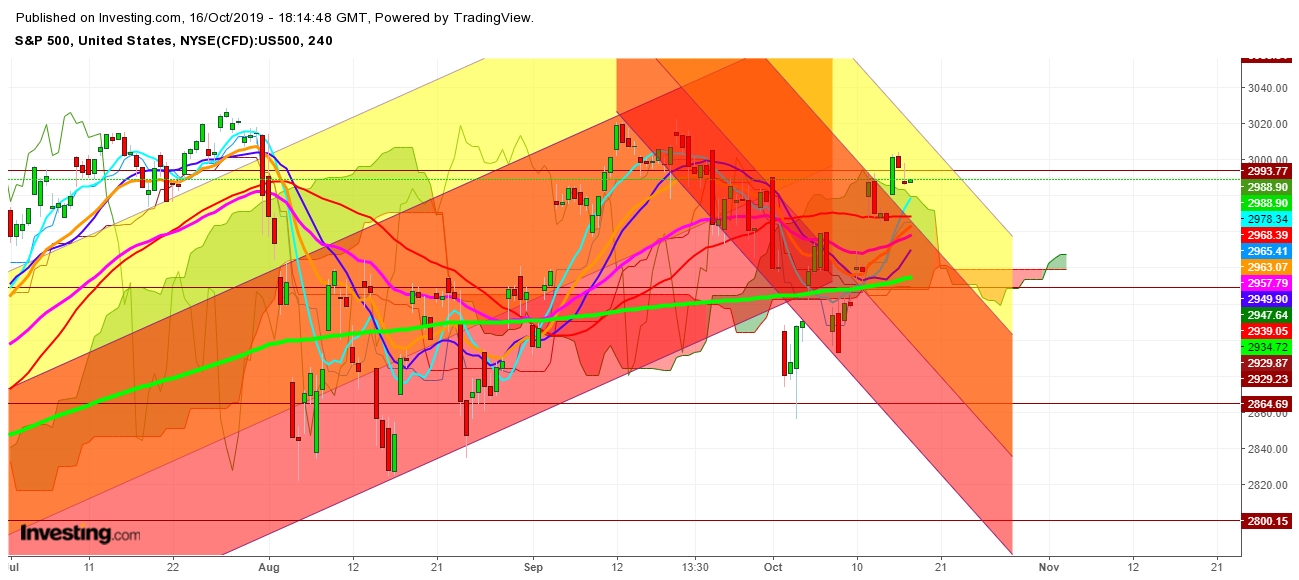

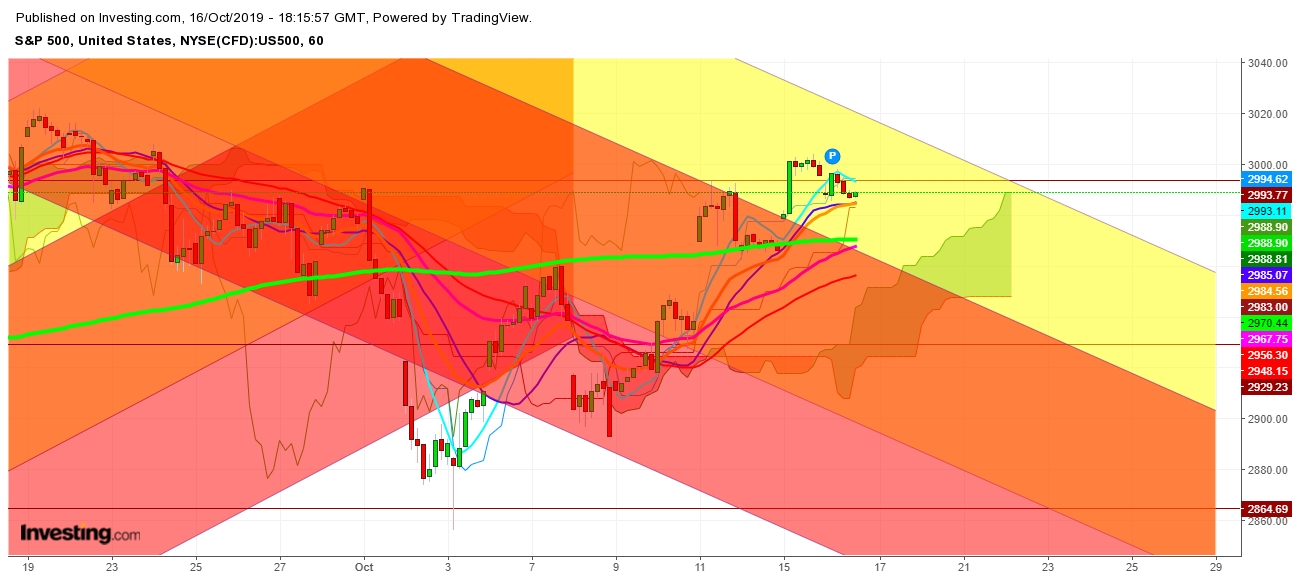

On analysis of the movements of S&P 500 in different time frames, I find that the growing concerns over escalating Sino-U.S. tariff trade war and weak economic data showing a fall in U.S. retail sales for the first time in seven months in September looks evident enough to keep the S&P 500 under bearish pressure during the upcoming weeks. I find that if the S&P 500 remains unable to defend the important support level at 2988, steep fall may be seen shortly; which may drag-down S&P 500 up to the level of 2929 before the weekly closing.

No doubt that the U.S. equity markets have come under pressure after the U.S. House of Representatives on Tuesday passed legislation related to pro-democracy protests in Hong Kong, while data on Wednesday showed a fall in U.S. retail sales for the first time in seven months in September. I find that the falling demand may extend exhaustion in S&P 500. On the other hand, the U.S. President Donald Trump on Wednesday said he likely would not sign any trade deal with China until he meets with Chinese President Xi Jinping at the upcoming APEC Forum in Chile https://www.investing.com/news/economy/trump-says-likely-wont-sign-china-trade-deal-until-he-meets-with-xi-1997147

Finally, I conclude that this statement from the U.S. President to delay in taking final decision may extend uncertainty in global equity markets amid growing bearishness. Watch my videos on S&P 500.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.