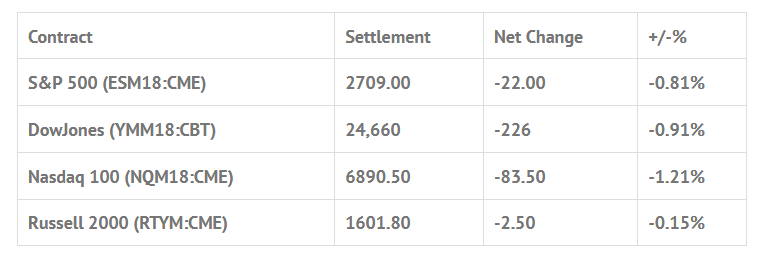

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.70%, Hang Seng -0.13%, Nikkei -0.44%

- In Europe 8 out of 13 markets are trading lower: CAC +0.06%, DAX +0.35%, FTSE +0.11%

- Fair Value: S&P -0.37, NASDAQ +6.16, Dow -24.31

- Total Volume: 1.51mil ESM & 1,026 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Housing Starts 8:30 AM ET, Raphael Bostic Speaks 8:30 AM ET, Industrial Production 9:15 AM ET, Atlanta Fed Business Inflation Expectations 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and James Bullard Speaks 6:30 PM ET.

S&P 500 Futures: #ES Falls, Bond Yields Jump To Highest Level Since 2011

As I have always said, I am not an economist, nor do I think I am smarter that you. I do not have any fancy indicators, I just have my charts and my gut feeling for the markets. Is that enough to make a million? I am not sure about that, but I am sure about what I have been saying for the last few months. When everyone gets long the ES sells off, and when everyone gets short the ES rallies. I am sorry if that doesn’t make total sense to you, but I believe it has something to do with how the bots take the news and control the markets.

Over the last few days I have have been saying that the ES was getting overbought and over extended. After the ES closed higher 8 days in a row you have to get concerned. After Monday’s rally and let day ‘weak’ price action, here is what I said in the view part of Tuesday mornings Opening Print:

“Our view is that we probably see some further weakness today. After closing higher 8 straight days we lean to selling the early rallies, but if the ES opens lower it should rally initially. Will it hold? My gut says the early rallies won’t hold, but we do think the ES can rally from lower levels / later in the day. You can take it from there.”

I think we called that one pretty well. Here is a blow by blow of yesterday’s price action…

The S&P 500 futures opened at the 2716.50 level, down -14.50 handles, and immediately went through a series of failed rallies. There was a double bottom at 2703.00 around 11:00 CT, followed by a pop up to 2714.25, and then a selloff down to 2700.75 just before 1:00.

Why was the ES so weak? Bond yields rose to their highest level since 2011, AMAZON (AMZN) fell sharply, and trade negotiations between the U.S. and China continued.

The ES traded up to a lower high at 2712.00, and then pulled back to 2704.75 as the early MiM started to show over $500 million to sell.

As the final hour continued, the MiM began to pair back down to $392 million to sell, and the ES traded down to 2700.50 just before 2:30. Some buyers stepped in going into the close and pushed the ESM up to 2711.25. The 3:00 pm print on the cash close was 2710.75, and it continued to push up to 2712.25 before settling the 3:15 futures close at 2709.25, down -21.75 handles, or -0.80%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.