On analysis of the movements of S&P 500 Futures in different time frames, I find that the investors still look under confusion over the growing uncertainty about if and when a trade deal will be signed.

The absence of a fixed date for sealing a partial deal may shift the command in favor of equity bears. I find that a lower opening of U.S. equity indices may extend current exhaustion on November 18th, 2019.

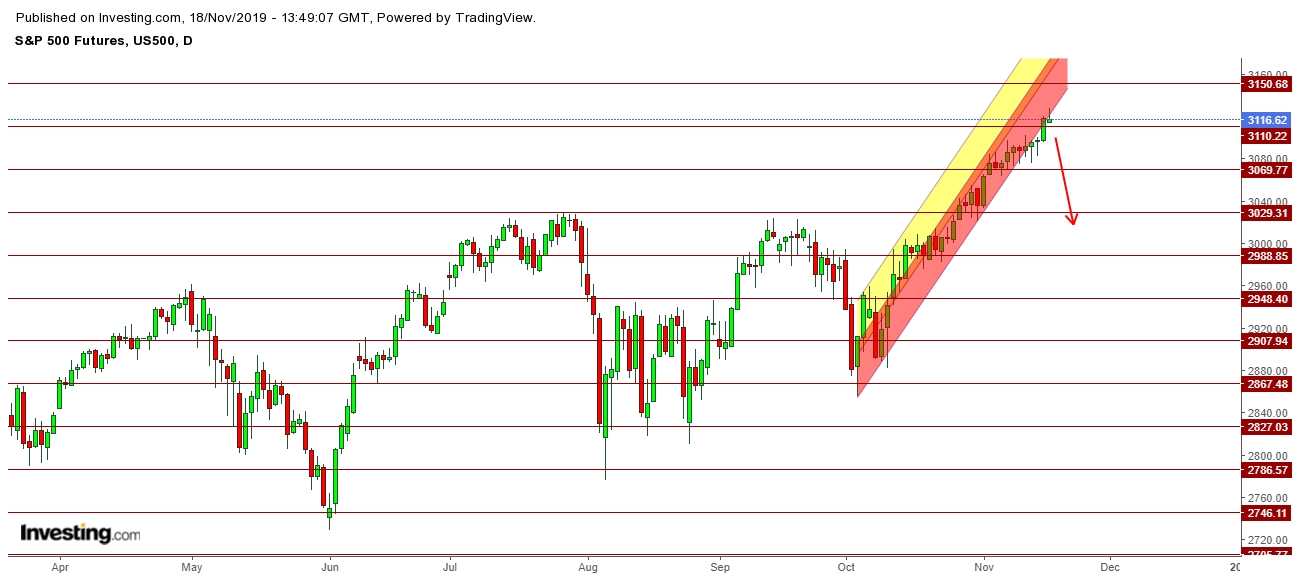

No doubt that the currently prevailing exhaustion in S&P 500 Futures has resulted in formation of an “Exhaustive Candle” in a daily chart; which may get confirmation from the today’s move, if S&P 500 Futures are not able to defend the level of 3102 on November 18th, 2019; which may continue to extend this exhaustion during this week.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.