Rate Cut?

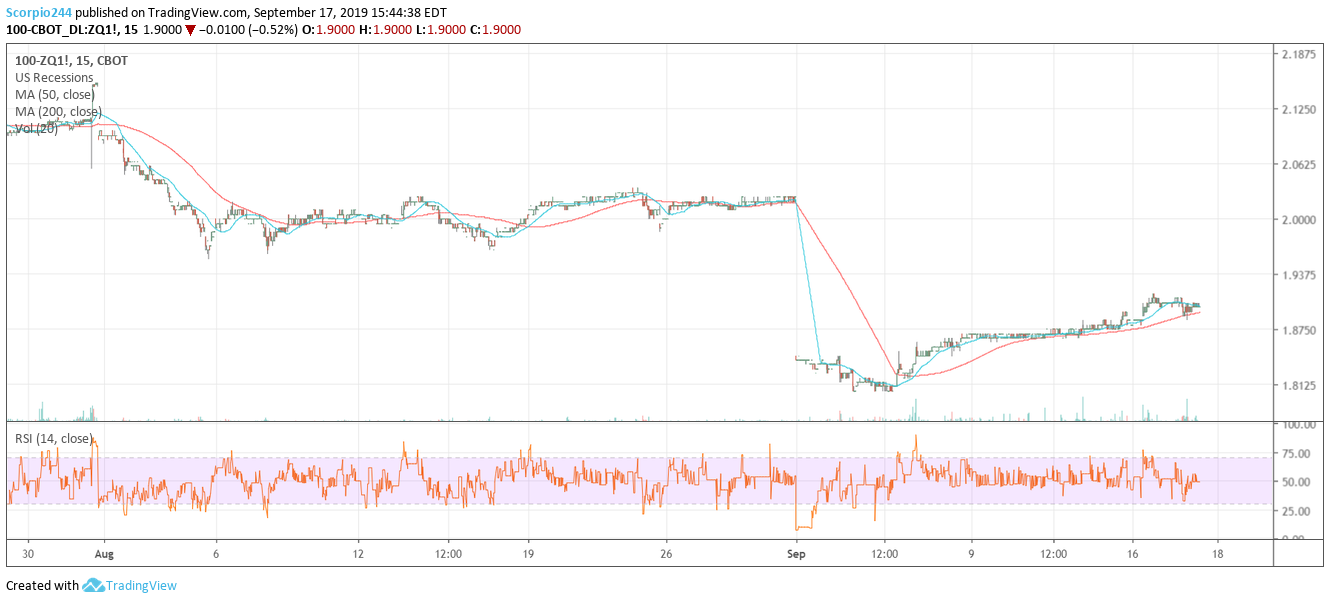

The CME Group is now showing a less than 50% of a chance rate cut. A pretty astonishing turn of events. The Fed Fund Futures continue to climb and are now around 1.9%.

Repo Rates- Yes, Repo Rates

Then we have the repo rates surging. The repo rate is what banks charge to lend to one another overnight. Hard to say there is something disastrous going in the overnight interbank lending market.

The big concern here is that some bank or institution may not have enough dollar. Some people are pointing to a dollar shortage in general in the market, or maybe do to tax payments. The theories are all over the place.

My natural intuition from living through 2008 is immediately to check LIBOR and eurodollar rates. To this point, we aren’t we seeing a significant spike in eurodollar future rates.

There can’t be that much stress in the system.

Even overnight libor rates from Monday only ticked up by two bps from 2.09% to 2.11%. So, I’m a bit confused by this. I will have to go and revisit my 2008 playbook to see what exciting things I can dig up. Maybe we can start talking about the TED spread again.

In all seriousness, I’m confused by all of this to some degree. I’m not sure that the economic data has improved all that much in one week to warrant the Fed, not cutting rates.

S&P 500 (SPY)

The S&P 500 rose when it was supposed today at the uptrend. So I guess we can all hold our breathe and see what today will bring.

Acadia (ACAD)

ACADIA (NASDAQ:ACAD) announced a secondary yesterday, another $250 million worth. It should be interesting to see how it prices and trades tomorrow, it will be very telling. I wonder if the Bakers will get to take a considerable part of the deal like they on the last secondary in November when they received 11.7 million shares of the 16.1 million shares when the stock was $17.

SNAP (SNAP)

Snap (NYSE:SNAP) rose sharply following the upgrade this morning. The stock managed to close above $16.70, which was the level I note on the mid-day update at lunchtime.

Shopify (SHOP)

Shopify (NYSE:SHOP) had a good day and bounced nicely after the secondary pricing at $317.50, managing to finish at $328. But the trend in the stock still appears to be lower, and the shares are still in a precarious spot.

Netflix (NFLX)

Netflix (NASDAQ:NFLX) had a nice day yesterday, and it appears it may be finally making that turn higher.

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) continued to act poorly, failing to rise above $31.40. The next day or so will be telling to see if the stock breaks out or not.