Last week saw some of the biggest trading upside moves in global market for over six years.

Energy had its biggest consecutive rally since 2009, with oil having its best weekly gain in over two years.

The S&P had its best week of 2015 and its best weekly gain since December 2014.

Zinc on Friday had its best intraday trading gain of 10.2% on the LME as Glencore (L:GLEN) announced it will be pulling 100,000 tonnes a year of supply out of the market as it looks to cut costs.

The ASX had its best week since January and has now added $92 billion in market value since the 29 September collapse.

This is the second strongest continuous rally on the ASX since the January/February rally towards 6000 points.

The CBOE VIX index had its longest losing streak since 2011 and fell to its lowest level since August 19.

The XVI VIX has fallen 27.8% in nine days and is at its lowest reading since 24 August.

There is a saying currently floating around trading floors that does make you think about the current environment which is: ‘If what goes up must come down, does what go down have to come up?’

My opinion last week has actually created more confusion rather than answers. Markets are not united in their views as seen by the bond market moves. The sell off during the winter was clearly overdone, the risk premiums being built into commodities particularly had gone past critical mass as China fears crossed over from being rational to being mass speculation and hysteria. Last week was a clear snap back as the downside risk was not only priced in, but was asking for a rather large premium.

Last week’s trade has created a theme that cannot be ignored now and that is rotational, both fundamentally and technically.

The fundamental change has been driven by what appears to be a ‘USD peak’. The unwinding of the premium pricing in the USD has seen risk currencies somewhat correcting, shown by the mass moves in the NZD and AUD last week, oil movements, and the fact that US trade balances are adding sustained downward pressure.

The only data supporting raising the Fed funds rate has been employment (which has begun to shrink in the last quarter), coupled with increased talks of the approaching debt ceiling negotiations, not to mention the 2016 Presidential elections, all means we are seeing signs of the lift-off being pushed back, as inflation remains nowhere to be seen. That macro change could see the 2014 theme of muted growth with a (continuing) lower for longer rate scenario and a stable (but subdued) emerging market environment flowing right into 2016.

The technicals back the fundamental theme; oil crossed over its 100-day moving average and several risk currencies have broken out to the upside of downward or wedge patterns. This would suggest the short-term bounce last week is likely to continue short term as momentum looks to have shifted.

However, the question remains, is this a fundamental conviction buying point or a short-term cyclical move where what goes down must come up – which leads straight into the next part of the cycle, in what goes up will come down (at some point).

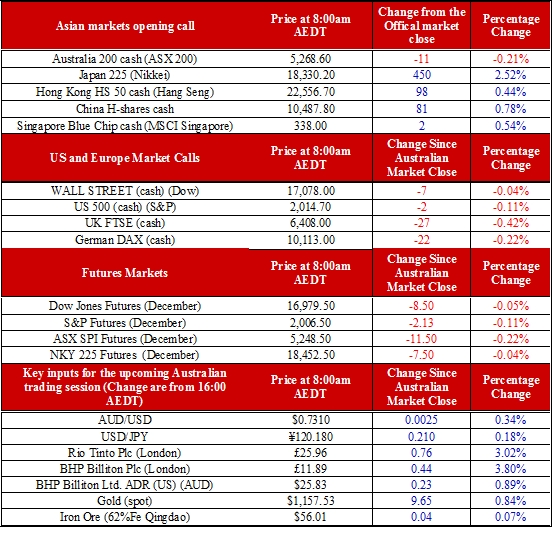

Ahead of the open, we are calling the ASX down 11 points to 5268.