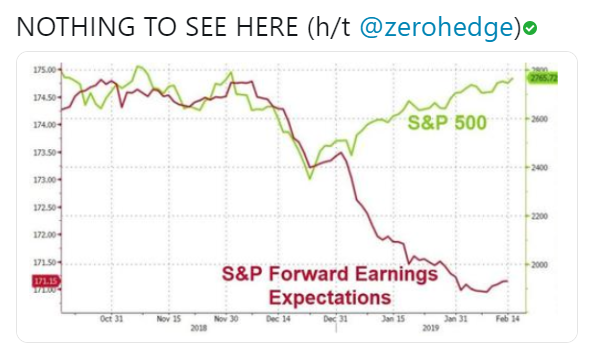

This chart got a lot of play on Twitter on Friday and Saturday morning and it tells an important story, but also stimulates a more important question (maybe): just how far out does the S&P 500 (the index) discount earnings data?

Here is the “4-week change” in the 2019 S&P 500 EPS estimate for the last 6 weeks:

- 2/15/19: -1.47%

- 2/8/19: -1.73%

- 2/1/19: -2.32%

- 1/25/19: -1.85%

- 1/18/19: -1.87%

- 1/11/19: -2.03%

The 12-week change and the y/y change is still deteriorating or becoming more negative.

S&P 500 Weekly Earnings Data:

- Fwd 4-qtr est: $168.65 vs $168.79 last week

- PE ratio: 16.5x

- PEG ratio: 4.55%

- S&P 500 earnings yield: 6.04% vs last week’s 6.23%

- Year-over-year growth of fwd est: +3.6% vs last week’s +3.8%

Summary / conclusion: My own expectation for S&P 500 earnings for 2019 was “low teens” (I was thinking more precisely 13%, versus last year’s “organic” growth rate – ex tax reform – of 14%) and that might be too high. But here’s the rub: in 2018, S&P 500 earnings grow mid-20% with tax reform, and the S&P 500 returned -4.35% in calendar ’18. It was a year of sharp P/E contraction to say the least. In 2017, the S&P 500 returned over 22% while S&P 500 earnings grew 12%.

So for what period can we reasonably expect the S&P 500 index to discount forward earnings?

Conventional wisdom says the U.S. stock market looks 9-12 months forward, so 2019’s early price action is currently discounting Q4 ’19 and potentially 2020 S&P 500 earnings growth.

The year-over-year drop in expected Q1 ’19 earnings seems well discounted in the benchmark already.

Financials got a nice pop this week after it was disclosed Berkshire Hathaway (NYSE:BRKa) was a buyer with the latest 13-F filings: JPMorgan Chase (NYSE:JPM), U.S. Bancorp (NYSE:USB), Bank of New York Mellon (NYSE:BK), Travelers Companies (NYSE:TRV), PNC Financial Services Group (NYSE:PNC), Bank of America (NYSE:BAC) were all mentioned as Financials where Berkshire had increased their stake in the names.

Financials continue to be an overweight sector in 2019 for clients, after a tough 2018. Schwab (NYSE:SCHW), JP Morgan, CME Group (NASDAQ:CME), the Financial Select Sector SPDR (NYSE:XLF), and the SPDR S&P Regional Banking (NYSE:KRE) are all top 10 positions for clients. The flatter yield curve is not helping the sector. One positive for the sector is that – despite deterioration in the S&P 500’s expected growth in 2019 – expected earnings growth for Financials for 2018 has been stable, at just above 9%, better than benchmark. That’s a plus.