- In a previous article we discussed a critical point concerning the bull run so far.

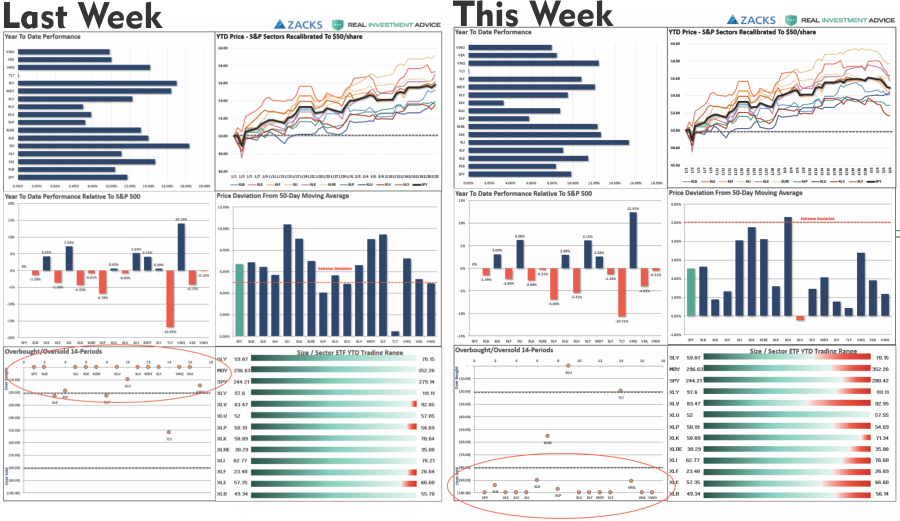

"You will note that with the exception of bond prices, every market and sector is more than 5% above its 50-day moving average and year-to-date performance is pushing more historic extremes both in price and in extreme overbought conditions...

On virtually every measure, markets are suggesting the fuel for an additional leg higher in assets prices is extremely limited.”

The chart below compares last weeks analysis to this week. You can see the sharp difference between the two periods as much of the overextension last week has now been reversed.

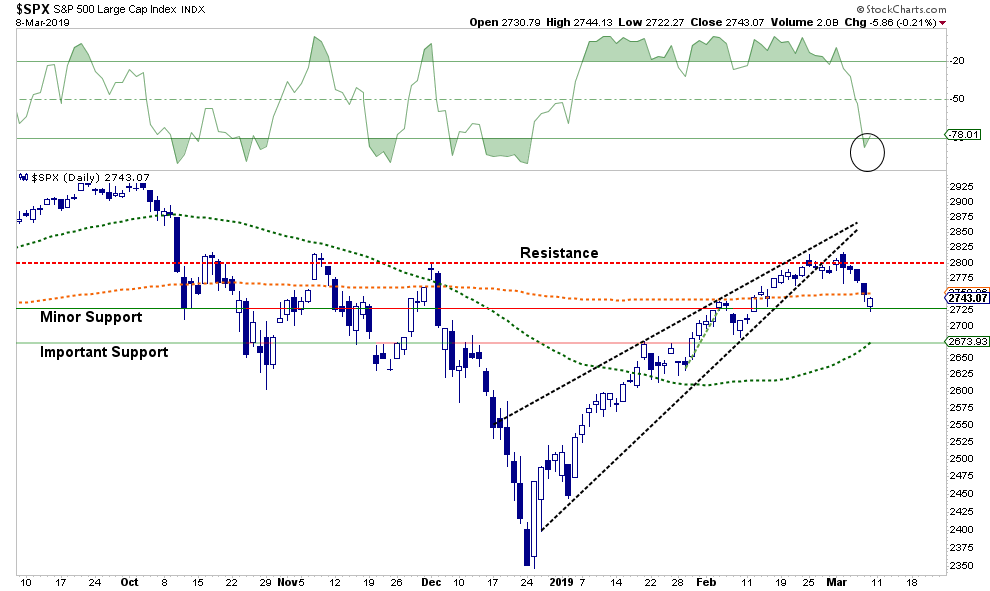

The chart below also shows the short-term reversal of the market as well as the test of minor support at the initial October lows.

This short-term oversold condition, and holding of minor support does set the market up for a bounce next week which could get the market back above the 200-DMA. The challenge, at least in the short-term remains the resistance level building at 2800.

However, the next two charts suggest there is a decent probability any bounce will fail in the short-term and should be used for rebalancing risk.

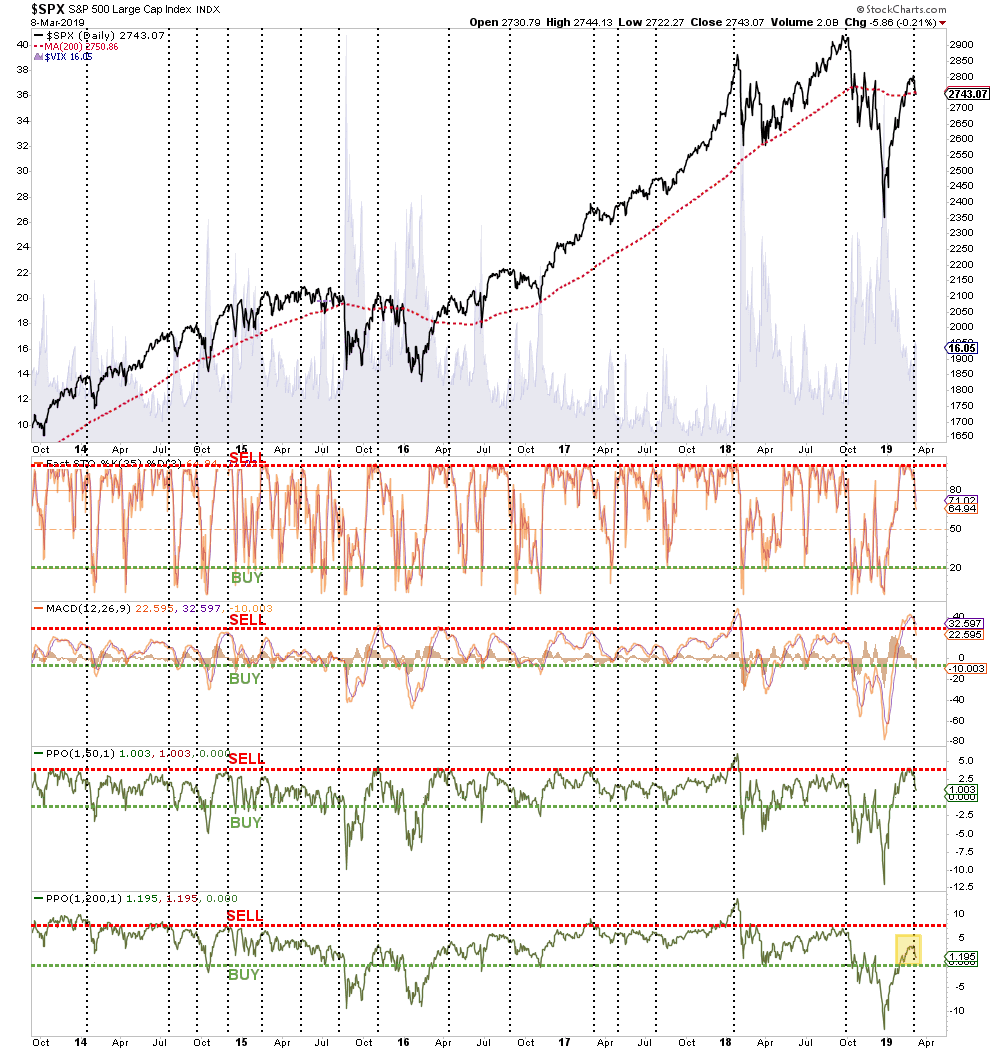

- The market has not reversed to levels which normally signals short-term bottoms. The red lines in the bottom four panels denote periods where taking profits and reducing risk, has been ideal. The green lines have been prime opportunities to increase exposure. As you will note, these indicators tend to swing from extremes and once a correction process has started it is usually not completed until the lower bound is reached.

Important Note: This does not mean the market will decline sharply in price. The current overbought conditions can also be resolved by continued consolidation within a range as we have seen over the last two weeks.

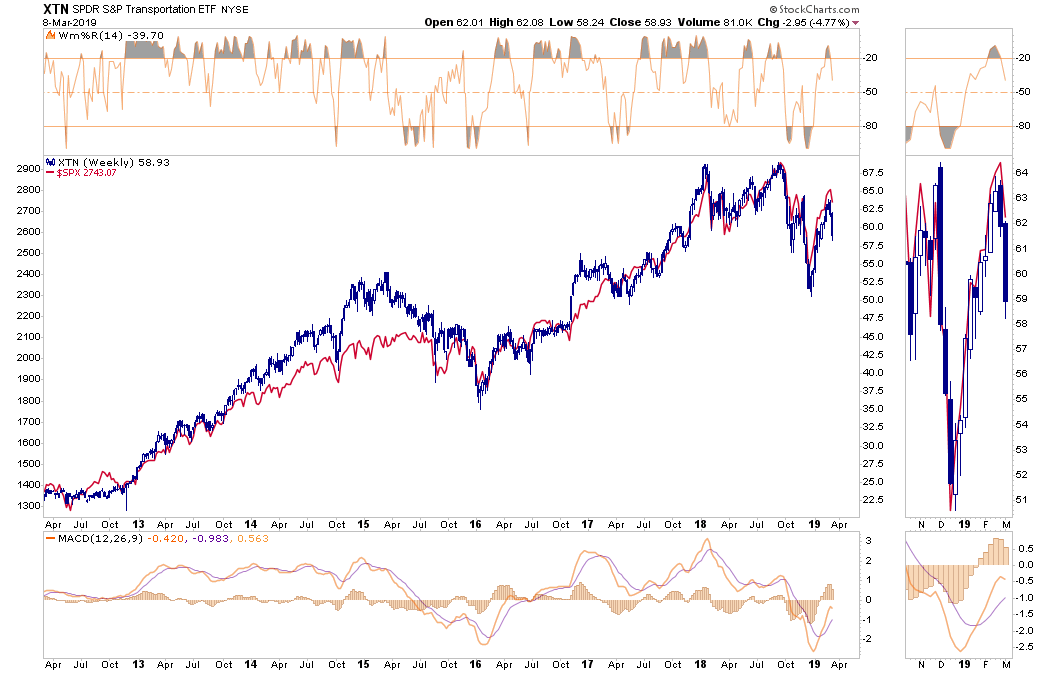

2) There is historically a very high correlation between what happens in the transportation sector (a view on the economy) and the market as a whole. Watch for a rally in the transportation sector to signal an all-clear for the markets.

The current set up suggests that the correction that started last week is not yet complete and any bounce will likely be a good opportunity to reposition portfolios in the short-term until a better entry point to increase exposure is achieved.

The problem with statements like these is that those of the “permanently bullish” mindset tend to extrapolate the analysis into the onset of the next major “bear market.” Such is certainly not the intent, nor is it a suggestion to sell everything and hide in cash.

What should be readily apparent is that paying attention to price can help alleviate our natural tendency to “buy high” and “sell low.” Managing a portfolio of investments is simply measuring risk and reward and placing bets when reward outweighs the potential risk. Tweaking exposure to “risk” overtime can pay big dividends over the long-term which is our goal of investing to begin with.

This is why every great investor throughout history has basic investing rules which all revolve around limiting losses to capital. Here are James Montier’s 7-Immutable Laws Of Investing:

- Always insist on a margin of safety

- This time is never different

- Be patient and wait for the fat pitch

- Be contrarian

- Risk is the permanent loss of capital, never a number

- Be leery of leverage

- Never invest in something you don’t understand

If these rules sound logical to you, and you are nodding your head in agreement, then how does a pitch to “buy and hold” and “ride out the market” make any sense?

During a bull market cycle, buying and holding good investments which pay a dividend is absolutely the right thing to do. However, at the end of the market cycle, not so much.

What Do Central Banks Know That You Don’t

As we noted why QE may not work this time, Central Bankers globally have jumped back into the “emergency measure” pool.

The Fed

- Has announced it will be “patient” with future rate hikes.

- The pace of QT, or balance sheet reduction, will not be on “autopilot” but instead driven by the current economic situation and tone of the financial markets.

- It is expected the Fed will announce in March that QT will end and the balance sheet will stabilize at a much higher level, and;

- QE is a tool that WILL BE employed when rate reductions are not enough to stimulate growth and calm jittery financial markets.

China has launched its version of “Quantitative Easing” to help prop up its economy which grew at the slowest pace in nearly 30-years.

- China has taken fiscal and monetary policy measures such as fast-tracking infrastructure projects

- Additional monetary support for the economy

- A cut in taxes, and;

- A Reduction banks’ reserve requirements

The ECB, after downgrading Eurozone growth, announced

- They will not raise rates in 2019, and;

- They will extend the TLTRO program, which is the Targeted Longer-Term Refinancing Operations scheme which gives cheap loans to struggling Eurozone banks, into 2021. (Currently, Italy, Spain, Greece, and Portugal all borrow more than they deposit and more than $800 billion from the previous TLTRO is set to mature over the next two years. Without the extension of the program, defaults could rise sharply.)

But there is nothing to worry about, right?

Maybe, but if there is nothing to worry about, then why the sudden pivot by Central Banks? What are they seeing that you don’t?

As we discussed in our analysis, the macro-environment in the U.S. is markedly different than it was in 2009. The Fed’s starting point to battle the next recessionary environment is far weaker than it was then when the Fed funds rate was twice as high and the balance sheet four-times smaller.

Here is the important point. We, as investors, have been trained over the last decade to “buy” whenever Central Banks are engaged in monetary interventions. So far it has worked in lifting asset prices higher. But therein lies the risk of complacency.

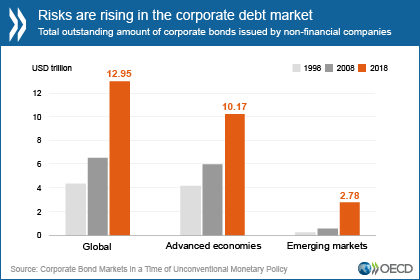

In 2009, most of the risk in the financial and credit markets had been wrung out from the decline. Today, the markets are more exposed than ever to leverage and credit risk throughout the global ecosystem.

My friend Doug Kass had a great note Friday related to this risk.

“Astonishingly I heard a ‘talking head’ on one of the business media platforms earlier this week who said that none of the excesses that existed in past recessionary periods are in place today.

To say excesses, systemic issues, and possible instability, don’t exist is borderline irresponsible.

As I see it, there are several measurable excesses and associated risks that represent this cycle’s new challenges that may be summarized into these five categories:

- An untenable level of global (private and public sector) debt

- Structural instability and growth threats in the form of rising deficits and demographic trends (i.e., slowing population growth)

- Lack of (sovereign) cooperation

- Unparalleled political instability and rising policy risks

- A dangerous shift in market structure

Debt

Debt that is not self-funding is future consumption brought forward.

Through years of unprecedented monetary ease, we have enjoyed unsustainable consumption and growth which cannot continue at its current pace in the future. Debt, then, is a drag on future growth, and the amount of debt the world now has will be a monster drag on that growth.

The fact is that the global economies are over-levered with debt in our private and public sectors that are excessive. As I chronicled in “Why Interest Rates Are the Bull Market’s Most Serious Threat,” in the fullness of time, the weight of debt will act as a governor to economic growth – it saps capital. To think otherwise is foolhardy.

Deficits and Demographic Threats

Under the weight of rising and uncontrolled deficits (supported by both parties) and slowing population growth, intermediate to longer-term economic and profit growth prospects are diminishing. Near term, domestic economic growth is already weakening (as supply side economics is being further discredited). At the same time Chinese growth is failing to stabilize and it appears that Europe is entering a deepening recession – underscoring the fragility of the global economic system that is still being propped up by low or negative interest rates.

China

It is my core expectation that U.S. and China will fail to agree on trade. (My baseline expectation is that investors will view a likely, superficial agreement as no agreement at all). We will find out shortly whether my view is accurate and that there will be no big deliverables with regard to IP theft and/or technology exchange. The consequences for the global economy are obvious – China accounts for only about 14% of world GDP but accounts for about one third of the delta in global economic growth.

Earnings & Risk

Most importantly, for investors, the consensus expectations for corporate profits, and economic growth expectations, remain far too optimistic.”

I will steal his last line as I agree that risks currently remain to the downside which explains our cautious outlook for 2019-2020.

If the message that Central Banks are sending comes to fruition, it will likely be a challenging backdrop for equities in the months ahead.

Currently, it certainly seems these concerns are outlandish and far fetched but the data is all too present and real. After a scorching run in the first two months of the year, it is hard to see anything as being bearish, but therein lies the risk.

As an investor, our job should be an honest evaluation of our portfolio allocations and our investment strategy with relation to the relevant market risks.

In other words, ask yourself this one simple question:

“What will happen to my money if something goes wrong?”

If that question raises no concerns for you, do nothing? But if you didn’t like the plunge last November and December, it may be time to re-evaluate things.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Is Behind The Sudden Pivot By The Central Banks?

Published 03/10/2019, 01:12 AM

Updated 02/15/2024, 03:10 AM

What Is Behind The Sudden Pivot By The Central Banks?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.