I received a fair amount of feedback to my recent post highlighting the weakness of commodity prices (see A tactical sell signal, but no signs of a major top). The key point raised is that since commodities are priced in US dollars, the recent strength in the greenback is going to pose a headwind for commodity prices. On the other hand, China has been the major marginal consumer of commodities and Chinese demand is going to have a major effect on pricing.

So what is more important to commodity prices, the China effect or the USD effect?

An inverse correlation to USD

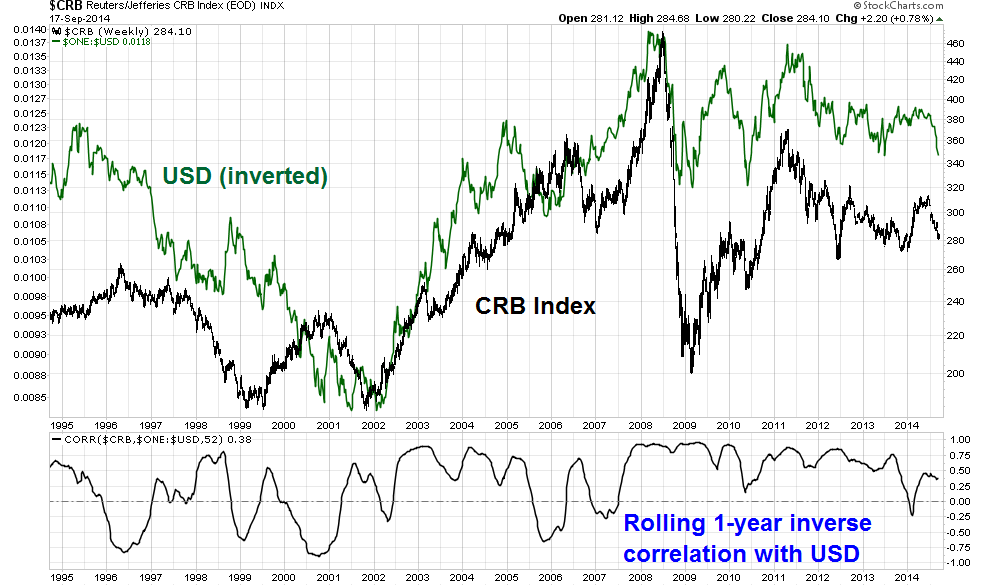

Let us consider each effect, one at a time. The chart below shows the CRB Index (black) and the USD Index (in green, inverted). The bottom panel shows the rolling correlation of the CRB with the USD. There is no question that there is a major inverse correlation between the CRB Index and the USD Index.

China effect equally important

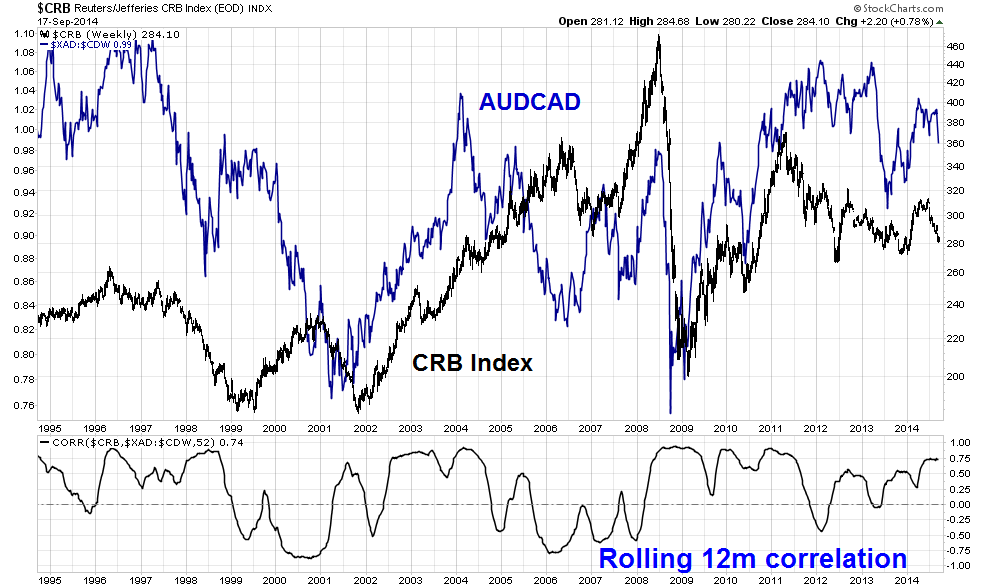

What about China? One way of distilling the China effect is to watch the AUD/CAD exchange rate. Both the Australian and Canadian economies are resource sensitive, with Australia more China-sensitive and Canada more US-sensitive. The chart below of the CRB Index (in black) and the AUD/CAD rate (in blue) shows a higher level of a high level of correlation as well.

Which is more important? My conclusion is that they are different, but important in their own way.

A possible commodity rebound?

Recently, commodity prices have been battered by the double whammy of a strengthening USD and Chinese slowdown, but those headwinds may be changing.

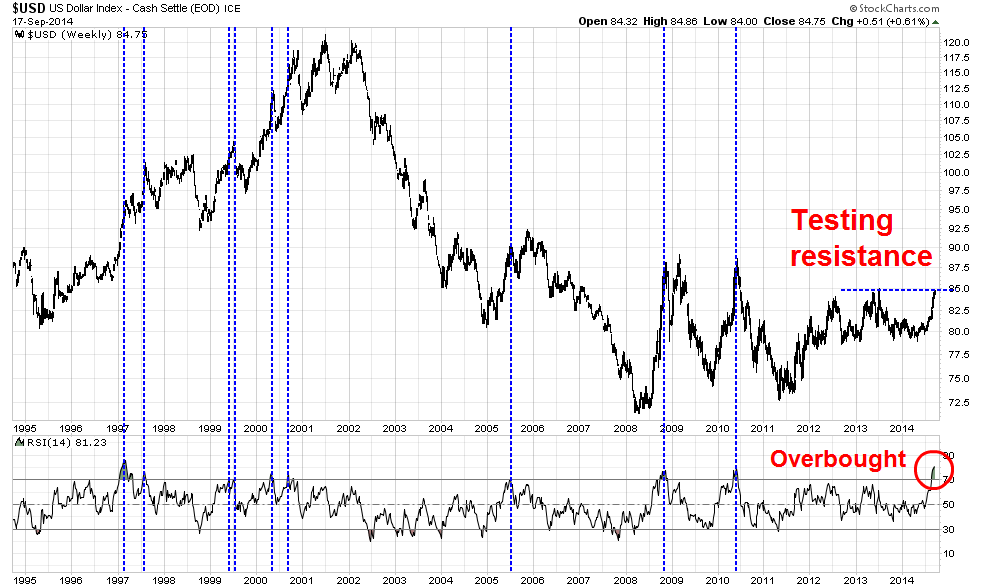

The chart below shows that the USD Index is testing a key technical resistance level. The 14 week RSI, shown in the lower panel, shows an extended and overbought condition. I have marked with dotted vertical lines previous instances when these overbought readings have occurred and these kinds of readings have marked an interim USD top on every occasion.

The outlook for commodity prices based on the China effect is more mixed. The recently announced stimulus program by the PBoC represents a Rorschach test for investors, according to this Bloomberg report:

As economists in China woke up to overnight news from website Sina.com that the People’s Bank of China was extending 500 billion yuan ($81 billion) of credit to the country’s five largest lenders, their interpretations of the step diverged. Without a PBOC statement to explain policy makers’ motive or intentions, there was little from officialdom to go on.

The PBOC’s maneuver drew attention to a mechanism called the standing lending facility, introduced last year as a collateralized provision of funds to meet large-scale demands for financial institutions’ long-term liquidity. The central bank has referred to it in official statements on steps to address fluctuations in money-market rates.

That's because investors are less certain about the intent of the PBoC's actions. Is this intended to be a stimulus like an RRR cut, or just a temporary liquidity injection for technical reasons? The Street is divided in its opinion:

Shen Jianguang, chief Asia economist at Mizuho in Hong Kong, wrote in a note that the measure was “stealthy easing” and “may help to support the economy, which faces rising risk of a hard landing.” Goldman analysts including Beijing-based Song Yu wrote that the injection marked “the first clear policy response to weak August data.”

By contrast, Chang Jian, chief China economist at Barclays Plc in Hong Kong, said it was “a normal liquidity operation,” in the title of her note on the news.

“We think the latest SLF is mainly aimed at providing liquidity to pre-empt potential liquidity shortages in the banking system in the coming weeks,” Chang wrote. Cash needs for the coming National Day holiday, along with initial public offerings of stock, are among the reasons she cites. Pressures for stimulus that stem from the deceleration in growth mean investors may interpret the news as a form of easing, she said.

Meanwhile, the initial AUD/CAD market reaction was positive initially but ended the day on a negative note. As the chart below shows, this cross rate fell below technical support from a well-defined trading range:

My personal opinion is that the jury is still out on the intent of the China "stimulus" and we won`t know the true effects of this new program for a few more days. Net of all effects, however, the medium term outlook for commodity prices has moved from highly negative (rising USD and slowing China) to mildly positive (possible downward USD retracement and neutral on China).

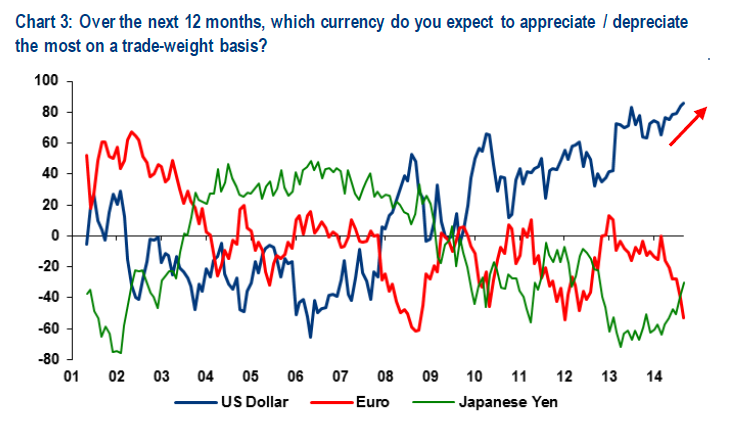

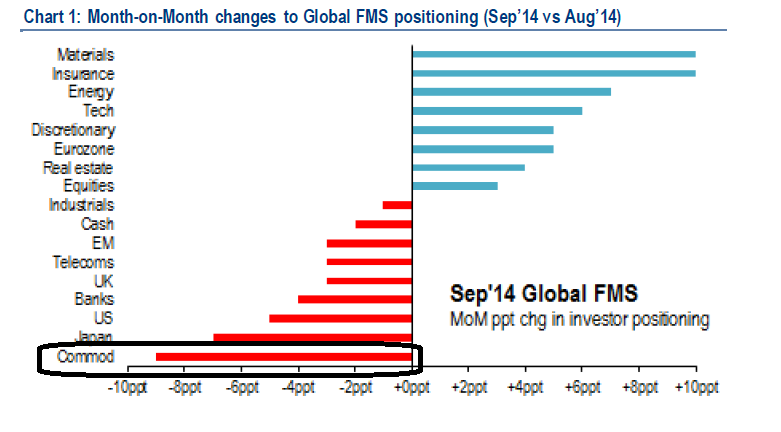

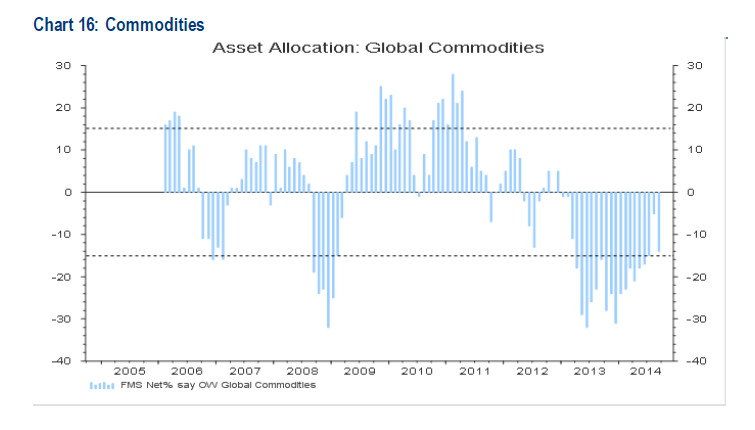

In addition, the BoAML Fund Manager Survey shows that managers were aggressive sellers of commodities in September, which is contrarian bullish:

Commodities testing support

Gold is starting to look washed out, as it tests a support level in the context of a downtrend. (Is Joe Wiesenthal's comment that gold looks like death contrarian bullish?)

The technical condition of silver, the poor precious metal cousin to gold, looks even weaker:

However, with more favorable macro conditions, I expect these key support levels to hold and the commodity complex to stage a robust rally in the near future.

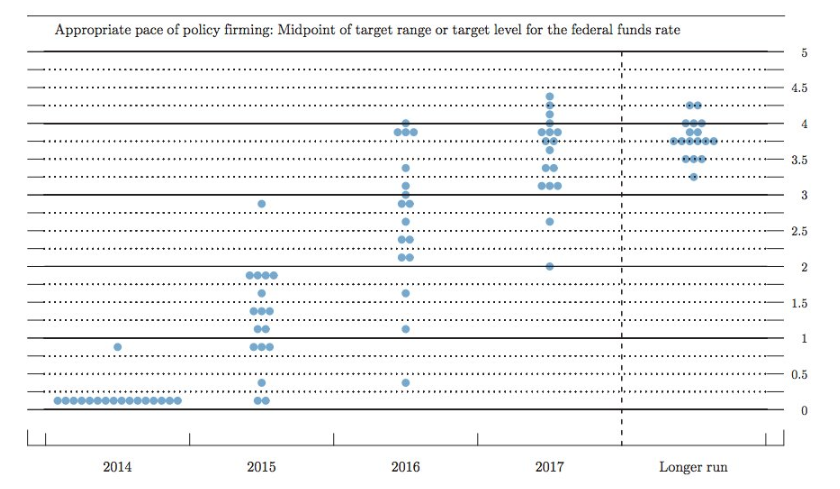

By implication, a hard asset price rebound has the potential to throw a scare into the equity market as rising inflationary expectations could create the impression that the Fed`s dot plot will rise faster than expected.

Key risk

The one key risk to this trade is that the USD could continue move higher in the short-term. An overbought USD doesn`t mean that it can`t get more overbought.

There are many reasons to be bullish on the greenback.The U.S. 10-Year Treasury currently yields 2.6% compared to 1.0% for Bunds. Notwithstanding the differential in monetary policy between the Fed and the ECB, that kind of rate spread between so-called "risk-free" instruments has the potential to attract funds into USD assets and push the EUR/USD rate lower. As well, stories touting a short JPY/USD position as the "trade of the decade" could see more hot momentum players piling and pushing the USD up further. Star bond manager Jeffrey Gundlach recently advocated this trade on CNBC:

Dollar-yen could double, according to Jeffrey Gundlach, noted bond guru and founder of DoubleLine Capital, who predicts we'll see the dollar strengthen to 200 yen in three to five years. That's an 87 percent move.

"I think this breakdown in the yen has pretty high momentum. I wouldn't be surprised to see the yen get substantially weaker," he told "Squawk on the Street" this week.

While I am bearish in the USD intermediate term, my crystal ball is too cloudy to call the exact top. I would therefore be inclined to either buy commodities with a tight stop or wait for the USD Index to turn before putting on a position.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.