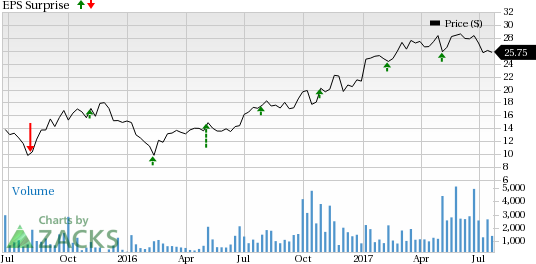

MINDBODY, Inc. (NASDAQ:MB) is scheduled to report second-quarter 2017 results on Jul 26. Last quarter, the company posted a narrower-than-expected loss, resulting in a positive surprise of 10%. Notably, the stock surpassed the Zacks Consensus Estimate over the trailing four quarters, with an average positive surprise of 13.6%.

Let us see how things are shaping up for this announcement.

Factors to Consider

MINDBODY develops cloud-based business management software and payments platform for the wellness services industry. The company provides its services to over 42,000 businesses in over 124 countries worldwide. With such a huge client base, it is anticipated to post impressive earnings numbers in the second quarter.

Furthermore, significant investments in growth areas for improving implementation timelines, particularly for the web and mobile applications products, will boost profitability. This is likely to be reflected in the to-be-reported quarterly results.

Nonetheless, the availability of various cheap alternatives such as Vagaro Pricing, iConnect360 Pricing and Zen Planner Pricing may adversely affect the second-quarter results. Moreover, an uncertain economic condition remains a concern.

Earnings Whispers

Our proven model does not conclusively show that MINDBODY will likely beat the Zacks Consensus Estimate in its upcoming release. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, this is not the case here as elaborated below.

Zacks ESP: The Earnings ESP for MINDBODY is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 11 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MINDBODY has a Zacks Rank #2. Though a Zacks Rank #1, 2 or 3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a couple of stocks, which you may consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming releases:

Cypress Semiconductor Corporation (NASDAQ:CY) , with an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Expedia, Inc. (NASDAQ:EXPE) , with an Earnings ESP of +16.67%, and a Zacks Rank #2.

PayPal Holdings, Inc. (NASDAQ:PYPL) , with an Earnings ESP of +3.13% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Expedia, Inc. (EXPE): Free Stock Analysis Report

MINDBODY, Inc. (MB): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Original post

Zacks Investment Research