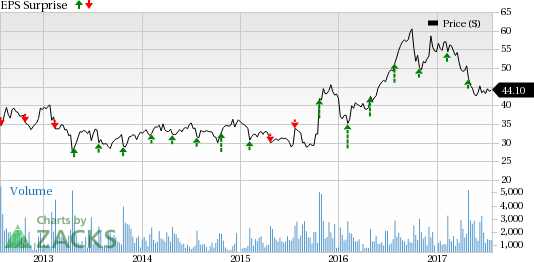

Netgear, Inc. (NASDAQ:NTGR) is slated to report second-quarter 2017 results on Jul 26. Last quarter, the company posted a positive earnings surprise of 5.77%. Additionally, it has an average positive earnings surprise of 12.72% in the trailing four quarters.

However, we note that shares of networking equipment maker Netgear have decreased 9.7% in the last year, underperforming the industry‘s advance of 4.4%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Netgear designs technologically advanced, branded networking products that address the specific needs of small businesses and home users. We expect the company’s strong product portfolio, comprising offerings like its Nighthawk WiFi routers and Arlo home security products, to boost the top line.

In particular, we are positive about the company‘s launch of the Arlo Baby Smart HD Monitoring Camera (ABC1000), in Jan 2017. Netgear’s Arlo segment revenues jumped 150% year over year, driven by Arlo Pro in first-quarter 2017.

We believe that Netgear’s strength of Arlo and Orbi sales in the retail channel will primarily drive results. Region-wise, North America continues to contribute the lion’s share (65% of 1Q17 net revenue).

However, the service provider business continues to pose challenges with the company streamlining the segment. In the first quarter, the company reported a $28.3 million year-over-year decline in sales to service providers.

For the second quarter, the company expects net revenue of $315–$330 million, with GAAP operating margin to be in the range of 5.3–6.3% and non-GAAP operating margin in the range of 8–9%.

Earnings Whispers

Our proven model does not conclusively show that Netgear is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below.

Zacks ESP: Netgear currently has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 44 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Netgear carries a Zacks Rank #3. Though a Zacks Rank #1, 2 or 3 increases the predictive power of ESP, the company’s ESP of 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions momentum.

Stocks to Consider

Here are some stocks that, as per our model, have the right combination of elements to post an earnings beat this quarter:

Cypress Semiconductor Corp. (NASDAQ:CY) has an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank Stocks here.

IPG Photonics Corp. (NASDAQ:IPGP) has an Earnings ESP of +3.07% and a Zacks Rank #1.

Lam Research Corp. (NASDAQ:LRCX) has an Earnings ESP of +1.33% and a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

NETGEAR, Inc. (NTGR): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research