Kimco Realty Corporation (NYSE:KIM) is slated to report second-quarter 2017 results on Jul 26, after the market closes. While its revenues are expected to grow year over year, funds from operations (“FFO”) per share might see a decline.

Last quarter, this New Hyde Park, NY-based retail real estate investment trust reported in-line results with respect to FFO per share. The company also recorded the strongest leasing volume in the past decade.

Over the trailing four quarters, Kimco beat estimates in one occasion and posted in-line results in the other three, recording an average beat of 30.9%. The graph below depicts this surprise history:

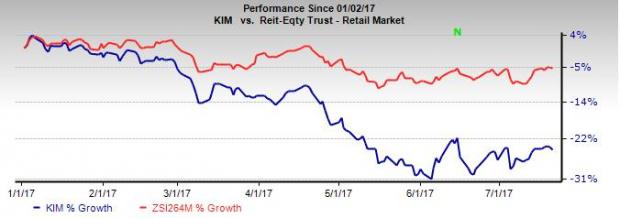

However, the stock has lost 24.9% year to date, underperforming the 5.4% decline of the industry it belongs to.

Factors to Influence Q2 Results

Kimco is continuing with its strategic 2020 Vision. The company has been purchasing premium assets in key U.S. markets, carrying out joint-venture buyouts and making progress in its simplification efforts. Specifically, it has also been lowering the number of joint ventures.

In fact, during the second quarter, Kimco made stake dispositions in nine shopping centers, aggregating 892,000 square feet of space, as well as two land parcels, for a gross price of $155.8 million.

However, mall traffic continues to suffer amid a rapid shift in customers’ shopping preferences and patterns, with online purchases growing by leaps and bounds. These have made retailers reconsider their footprint and eventually opt for store closures. Also, retailers not able to cope with competition are filing bankruptcies. This has emerged as a pressing concern for retail REITs, like Kimco.

Management anticipates same-site NOI growth to be in the range of 2–3% for full-year 2017. This estimate includes the negative impact from the Sports Authority bankruptcy of approximately 225 basis points in the second quarter.

In addition, Kimco’s activities during the quarter could not gain adequate analyst confidence. Consequently, the Zacks Consensus Estimate for funds from operations for the second quarter remained unchanged at 38 cents over the last 30 days.

Earnings Whispers

Our proven model does not conclusively show that Kimco will likely beat estimates this season. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here as you will see below.

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

Zacks ESP: The Earnings ESP for Kimco is 0.00%. This is because the Most Accurate estimate of 38 cents matches the Zacks Consensus Estimate.

Zacks Rank: Kimco currently has a Zacks Rank #4, which actually reduces the predictive power of ESP.

Stocks That Warrant a Look

Here are a few stocks in the REIT space that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this time around:

Liberty Property Trust (NYSE:LPT) , expected to release earnings on Jul 25, has an Earnings ESP of +1.61% and a Zacks Rank #2.

Regency Centres Corporation (NYSE:REG) , expected to release second-quarter results on Aug 3, has an Earnings ESP of +1.12% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here..

CyrusOne Inc (NASDAQ:CONE) , likely to release earnings on Aug 2, has an Earnings ESP of +2.70% and a Zacks Rank #2.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Kimco Realty Corporation (KIM): Free Stock Analysis Report

Regency Centers Corporation (REG): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Liberty Property Trust (LPT): Free Stock Analysis Report

Original post

Zacks Investment Research