Defense giant, Northrop Grumman Corporation (NYSE:NOC) is scheduled to release second-quarter 2017 results on Jul 26, before the opening bell. Being one of the largest U.S. defense contractors, it enjoys a strong presence in the U.S. Air Force, Space and Cyber Security programs.

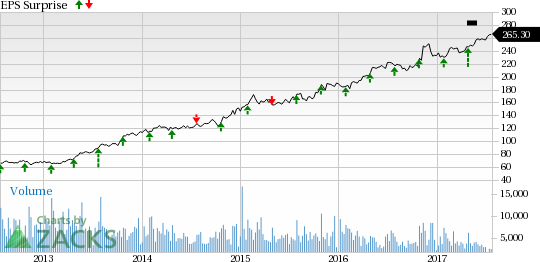

In the prior quarter, the company reported a positive earnings surprise of 25.17%. It is worth noting that Northrop Grumman has outperformed the Zacks Consensus Estimate in all the trailing four quarters, the average positive surprise being 10.87%.

Let’s see how things are shaping up for the company prior to this announcement.

Factors to Consider

Northrop Grumman’s better-than-expected first-quarter results demonstrated improved segment operating income, supported by strong sales growth and solid program performance. Similar outperformance can be expected in the soon-to-be-reported second quarter’s results as well.

The company consistently follows a stable capital deployment strategy. In line with this, during the second quarter, Northrop Grumman hiked its quarterly dividend by 11%, bringing the annualized payout to $4 per share. This reflected the strong balance sheet and steady cash flow position that the company boasts. This, in turn, offers it substantial financial flexibility to invest in business and scope for incremental dividends.

Further, the company won a handful of notable contracts in the second quarter. These include the $303.9 million modification deal for procurement of three low-rate initial production of second lot’s MQ-4C Triton unmanned aircraft, the $243.9 million contract for providing 72 Active Electronically Scanned Array (AESA) radars and spares, and the foreign military sales (FMS) deal worth $179 million for providing hardware for large aircraft infrared counter measures (LAIRCM) and necessary support related to it. Such contracts will surely get reflected in terms of Northrop Grumman’s solid revenue growth in the second quarter and beyond.

Moreover, the company identified a growing list of domestic and international opportunities across its businesses. This comprises the Ground Based Strategic Deterrent program,MQ-25 unmanned aerial system, new Space programs and a variety of international opportunities for Autonomous Systems as well as upgrading Lockheed Martin’s F-16 jets with its SABR Radar. It also includes additional international opportunities pursued by its Technology Services segment in the Middle East and Australia. Further updates on these opportunities can be expected once Northrop Grumman reports its second-quarter results.

On the flip side, the company continues to witness lower sales volume for its KC-10 program, which dragged down its revenue from Technology Services in the first quarter. With no improvement anticipated soon in this issue, we expect the second-quarter results to reflect a similar sales decline for the segment.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at $2.84 per share, up 9.32% year over year, while the revenue estimate of $6.21 billion implies a 3.57% year-over-year improvement.

Earnings Whispers

Our proven model does not conclusively show that Northrop Grumman is likely to beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Zacks ESP: Northrop Grumman has an Earnings ESP of -1.06%. This is because the Most Accurate estimate is pegged at $2.81, lower than the Zacks Consensus Estimate of $2.84. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Northrop Grumman carries a Zacks Rank #2 (Buy), which increases the predictive power of ESP. But the company’s -1.06% ESP makes surprise prediction difficult.

Meanwhile, we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks that Warrant a Look

Here are some defense companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Huntington Ingalls Industries, Inc. (NYSE:HII) is expected to report second-quarter 2017 results on Aug 3. The company has an Earnings ESP of +4.96% and a Zacks Rank #2.

Raytheon Company (NYSE:RTN) is expected to report second-quarter 2017 results on Jul 27. The company has an Earnings ESP of +0.58% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

General Dynamics Corp. (NYSE:GD) is expected to report second-quarter 2017 results on Jul 26. The company has an Earnings ESP of +0.41% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research