BlackBerry Limited (NASDAQ:BBRY) based in Waterloo, Canada, is slated to release first-quarter fiscal 2018 results on Jun 23, before the market opens.

In the last quarter, the company delivered a positive earnings surprise of 75%. In fact, it has an impressive earnings history. Notably, BlackBerry beat the Zacks Consensus Estimate in each of the last four quarters with an average beat of 75%.

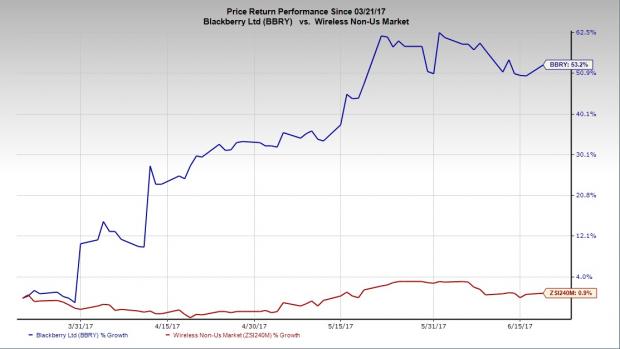

Shares of BlackBerry rallied 53.21% in the last three months, significantly outperforming the Zacks categorized Wireless Non-US industry’s advance of a mere 0.91%, in the same period.

Let’s see how things shape up for this announcement.

Factors Likely at Play

The company is expected to perform impressively in the first quarter of fiscal 2018, driven by its decision to end all internal hardware development and focus exclusively on software business, which seems to pay off.

BlackBerry expects its software business to either outperform or at least perform on par with the overall market in first-quarter fiscal 2018. In fact, the company anticipates profitability (on an adjusted basis) and also presumes to generate free cash flow in the quarter.

The dispute settlement with Qualcomm (NASDAQ:QCOM) marks a big victory for BlackBerry which concentrates on expanding its software development and licensing businesses. The company expects this monetary addition to be free from taxes.

However, the company’s struggles on the top line front raise concerns for the quarter. With increasing global exposure, BlackBerry does face the risk of adverse foreign exchange fluctuations.

Additionally, Brexit and macroeconomic pressures have increased volatility in currency markets with possibility to leave a negative impact on BlackBerry’s operations. This in turn may also affect the company’s results in first-quarter fiscal 2018.

BlackBerry’s licensing contract with T-Mobile (NASDAQ:TMUS) was not renewed after its expiry. Losing a carrier partner like T-Mobile doesn’t really bode well for a company with expanded network. Hence, this could eventually impact BlackBerry’s sales as well as hurt the top line in first quarter.

Earnings Whispers

Our quantitative model does not show conclusively that BlackBerry is likely to beat earnings in the fiscal first quarter. Per our proven model, a company needs the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better – to increase the odds of an earnings surprise. However, that is not the case as highlighted below.

Zacks ESP: The Earnings ESP for BlackBerry is 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 2 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: BlackBerry carries a Zacks Rank #3 which increases the predictive power of ESP. However, the company’s 0.00% ESP complicates our surprise prediction.

Please note that Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Stock to Consider

Investors interested in the broader computer and technology space may consider Apple Inc. (NASDAQ:AAPL) , as our model shows that the stocks possesses the right combination of elements to post an earnings beat in its next release.

Apple has an Earnings ESP of +1.91% and a Zacks Rank #3. The company beat the Zacks Consensus Estimate in each of the last four quarters with an average beat of 2.77%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

BlackBerry Limited (BBRY): Free Stock Analysis Report

Original post

Zacks Investment Research