Portfolio construction and the game Whack-a-Mole seem to have something in common: Key assets have been looking for a place to hide.

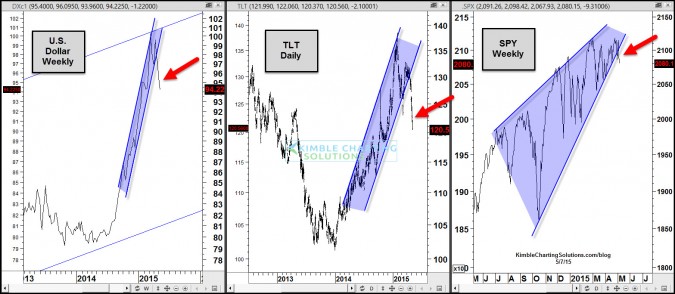

The 3-pack below shows that the US dollar and Government Bond ETF (ARCA:TLT) have broken below steep rising channels. At the same time, the S&P 500 may be slipping below a steep rising support line.

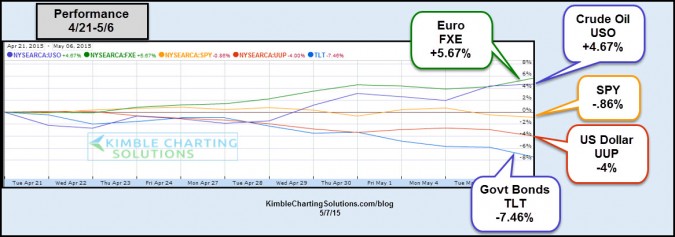

If you've been looking for a place to hide the past couple of weeks, it might surprise that the Euro ETF (NYSE:FXE) has done pretty darn well, with crude oil not far behind. TLT, which had a stellar performance last year, has had a rough go of it lately.

The declines in bonds and the US$ are near extremes for such a short period of time. It wouldn’t surprise me to see a move in the opposite direction (for a few days) for the assets that are at both extremes.

Three weeks ago the Power of the Pattern said that the stage was set for a strong rally in crude and advised the following pair trade:

- Long (ARCA:XLE)

- Short SPY

Bottom line…Lately It has paid to buy low and sell high in these key assets.