Westlake Chemical Corporation (NYSE:WLK) announced a regular dividend of 21 cents per share. The figure represents a 10% hike from 19.06 cents in the second quarter of 2017. Notably, this is the 52nd successive quarterly dividend announced by the company since the completion of its IPO in August, 2004. The dividend will be paid on Sep 18 to stockholders of record as of Sep 1.

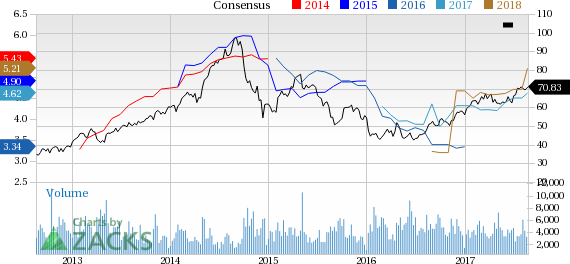

Shares of Westlake Chemical have moved up 12.4% in last three months, significantly outperforming the industry’s 2.7% growth.

Westlake Chemical recorded a net income of $152.8 million or $1.17 per share in the second quarter of 2017, up roughly 37.5% from $111.1 million or 85 cents logged a year ago. Net earnings improved mainly due to earnings contribution of Axiall, lower effective tax rate, higher sales price of major products and lower costs associated with turnarounds and unplanned outages.

Barring one-time items, earnings for the reported quarter were $1.21 per share, which topped the Zacks Consensus Estimate of $1.19.

Westlake Chemicals, in second-quarter earnings call, declared that the results benefited from strong global demand of its key products and increasing prices in Vinyls segment. The company is making notable progress in integrating, improving activities and achieving the expected synergies associated with the acquisition of Axiall business. Westlake Chemical believes that continued investment and acquisition will help to fully leverage the improving Vinyls market.

Westlake Chemical currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , POSCO (NYSE:PKX) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos has expected long-term earnings growth rate of 5%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research