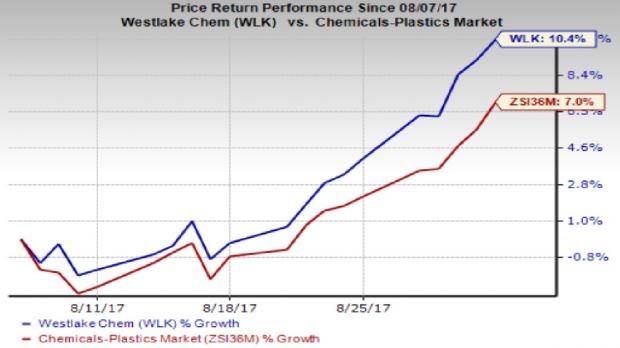

Shares of Westlake Chemical Corporation (NYSE:WLK) have gained around 10% over the past month. The company has also outperformed its industry’s gain of 7% to over the same time frame.

Westlake Chemical, which has a market cap of roughly $10 billion, is a vertically integrated manufacturer and supplier of petrochemicals, polymers and fabricated products. The company has a VGM Score of B and long-term earnings per share growth rate of 10.1%

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock of late.

Driving Factors

Westlake Chemical’s shares are hitting new highs following the company’s strong second-quarter earnings release. The company’s profits (as reported) shot up around 38% year over year to $152.8 million or $1.17 per share in the quarter.

The bottom line was boosted by earnings contribution of Axiall acquisition, lower effective tax rate, higher sales price of major products and lower costs associated with turnarounds and unplanned outages. Adjusted earnings for the quarter were $1.21 per share, topping the Zacks Consensus Estimate of $1.19.

Westlake Chemical also saw a roughly 82% jump in its net sales to $1,979.2 million. Sales in the quarter benefited from higher sales contributed from Axiall and increased selling prices for major products.

Westlake Chemical, in its second-quarter earnings call, said that its results benefited from strong global demand of its key products and increasing prices in the Vinyls segment. The company sees increased ethylene availability with the start-up of new ethylene plants and completion of capacity expansions.

The company is making notable progress in integrating and achieving the expected synergies associated with the acquisition of Axiall business. Westlake Chemical believes that continued investment and acquisition will help to fully leverage the improving Vinyls market.

The Axiall acquisition has diversified the company’s product portfolio and geographical operations, creating a North American leader in Olefins and Vinyls. The company is on track to realize around $120 million in synergies and cost savings related to the acquisition in 2017.

Westlake Chemical’s shares also got a boost following its recent dividend hike announcement. The company declared a 10% increase in its quarterly dividend to 21 cents per share. Notably, this is the 52nd consecutive quarterly dividend announced by Westlake Chemical since the completion of its IPO in August 2004.

Stocks to Consider

Stocks in the basic materials space worth considering include The Chemours Company (NYSE:CC) , Kronos Worldwide Inc (NYSE:KRO) and Kraton Corporation (NYSE:KRA) . All three sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has expected long-term earnings growth rate of 5%.

Kraton has expected earnings growth of 7.2% for the current year.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Kraton Corporation (KRA): Free Stock Analysis Report

Original post

Zacks Investment Research