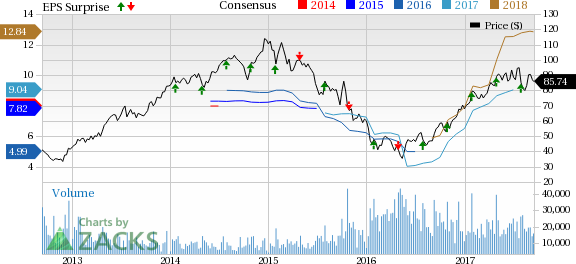

Shares of Western Digital Corporation (NASDAQ:WDC) fell 3.41% to close at $85.75 on Sep 13. The decline followed after Toshiba announced that it is now favoring the Bain Capital-led consortium over Western Digital and Foxconn for its prized NAND flash memory unit.

Toshiba stated that it has signed a non-binding memorandum of understanding (MOU) with the Bain-led consortium that includes South Korean chipmaker SK Hynix as well as Innovation Network Corp of Japan (INCJ) and the Development Bank of Japan (DBJ).

According to The Wall Street Journal, Apple Inc (NASDAQ:AAPL) and Dell technologies are also part of the consortium. Apple is anticipated to invest 400 billion yen in the consortium.

Toshiba is in dire need to raise capital (by the end of March 2018) to remain as a listed entity. The company expects to complete the divestiture by the end of this month.

Reportedly, Bain’s offer of $22 billion (2.4 trillion yen) not only surpasses its expectation of 2 trillion yen but is also better than what respective consortiums led by Western Digital and Foxconn are willing to pay. Per Reuters, Bain will also invest another 200 billion yen on infrastructure development.

Western Digital Fumes over the Decision

Western Digital promptly protested over the decision and issued a statement that it will continue with the arbitration process against Toshiba. Notably, Western Digital’s division SanDisk and Toshiba jointly run the flash memory operations in Japan.

The Japanese conglomerate retaliated immediately (per Reuters) stating that Western Digital had been “persistently” overstating its rights over the memory chip unit.

Western Digital and Toshiba had been at loggerheads over the divestiture from the beginning of the auction. Based on the joint-venture (“JV”) agreement, the U.S.-based company had been insisting on its rights to approve or disapprove any transaction involving the partnership, which Toshiba had refused to entertain.

Both are now fighting legal suites in the United States as well as Japan. As per the directive of a California court, Toshiba has to officially notify Western Digital two weeks prior to the closing of the divestiture transaction.

Lack of Trust, Apple Warning Hurt Western Digital

The relationship between Toshiba and Western Digital somewhat mended in August and early September, when Western Digital’s Chief Executive Officer (CEO) visited Japan for negotiations related to the disputed unit. Per Reuters, Steve Milligan also apologized to Toshiba’s CEO, Satoshi Tsunakawa, for strained ties.

However, negotiation between the companies failed primarily due to lack of trust. Reportedly, Toshiba feared that Western Digital will eventually seek ways to gain a majority stake at the chip business. The company sought to limit the U.S. storage device provider’s future position in the unit that dragged down the deal.

Moreover, threat from Apple to not to use Toshiba’s product also hurt the prospects of the deal with Western Digital. The iPhone-maker argued that it would lose pricing power if Western Digital gains control over the chip-unit.

What’s Next for Western Digital?

Toshiba has kept options open for negotiation with other bidders, which still gives a slim chance to Western Digital. We do expect a last-minute counter-deal from the U.S.-based company, given the significance of the memory unit to its growth prospects.

Notably, Toshiba is the second largest NAND flash memory maker, a technology that is now preferred over legacy hard-drive storage systems due to speed and reliability. Western Digital was keen on acquiring the unit as it would have improved its competitive position against the likes of Micron technology Inc. (NASDAQ:MU) , SK Hynix and Intel Corporation (NASDAQ:INTC) .

However, if a counter deal fails, we expect Western Digital to become more aggressive legally. This may eventually help it to gain more concessions at the JV.

Currently, Western Digital has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Western Digital Corporation (WDC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post