The recent disclosures by the Wells Fargo & Company (NYSE:WFC) has raised skepticism over the mega bank’s existence. It revealed to have identified an additional 1.4 million fake accounts apart from the 2.1 million accounts disclosed last September.

After being pressured by the legislators for expanding the review period from the beginning of 2009 instead of 2011, the new discovery was made. Investigation of about 165 million deposit and credit-card accounts found that the employees had been conducting illegal sales practices for an even longer period.

Wells Fargo stated that of the total unauthorized accounts that were opened, about 190,000 had incurred fees and other charges compared with 130,000 disclosed earlier. The bank is now expected to pay $10.7 million in compensation to its customers, which includes refunds of about $7 million, up from $3.3 million previously.

It has been almost a year since the news of Wells Fargo’s involvement in unfair sales practices had spread in the market. Apart from being penalized by the regulators with a fine of about $185 million, Wells Fargo had to go through a lot of restructuring. Its executives faced pay cuts and about 5000 employees were fired.

Further, the repercussions of this new disclosure keep us anxious.

The review also revealed issues with the online bill pay service that the bank provides to its customers. It was uncovered that about 528,000 unauthorized online bill-pay enrollments were made without customers’ knowledge. The reviewers found those accounts to have only one transaction of a nominal amount. The bank has promised to refund $910,000 to the affected customers.

Currently, Wells Fargo is caught in a horde of litigations over several malpractices which have come into the spotlight. It is going to be a long and expensive journey for the bank till it gets all the dust settled.

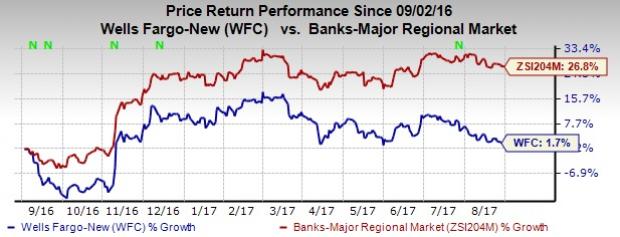

The bank’s performance over the past year reflects investors’ disappointment. Shares of Wells Fargo have gained 1.7%, significantly underperforming the industry’s rally of 26.8%.

Currently, the stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the same space are State Street Corporation (NYSE:STT) , Washington Federal, Inc. (NASDAQ:WAFD) and FB Financial Corporation (NYSE:FBK) . All these stocks carry a Zacks Rank #2 (Buy).

State Street’s Zacks Consensus Estimate for current-year earnings was revised 3.7% upward for 2017, in the past 60 days. Also, its share price has increased 31% in the past 12 months.

Washington’s current-year earnings estimates were revised nearly 1% upward, over the past 60 days. Further, the company’s shares have jumped 17.2% in a year.

FB Financial’s Zacks Consensus Estimate for current-year earnings was revised 3.2% upward, over the last 30 days. Moreover, in the past year, its shares have gained 67.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

State Street Corporation (STT): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Washington Federal, Inc. (WAFD): Free Stock Analysis Report

FB Financial Corporation (FBK): Free Stock Analysis Report

Original post