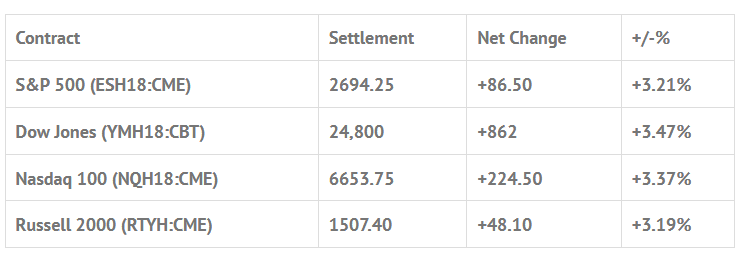

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -1.81%, Hang Seng -0.89%, Nikkei +0.16%

- In Europe 12 out of 12 markets are trading higher: CAC +0.57%, DAX +0.76%, FTSE +1.06%

- Fair Value: S&P -1.54, NASDAQ +3.17, Dow -48.85

- Total Volume: 4.7mil ESH & 2.9k SPH traded in the pit

Today’s Economic Calendar:

Robert Kaplan Speaks 6:00 AM ET, MBA Mortgage Applications 7:00 AM ET, William Dudley Speaks 8:30 AM ET, EIA Petroleum Status Report 10:30 AM ET, Charles Evans Speaks 11:15 AM ET, Consumer Credit 3:00 PM ET, and John Williams Speaks 5:20 PM ET.

S&P 500 Futures: #ES 170.75 Handle Rally in 17 Hours And Highest Volume Since The Credit Crisis

After the Dow fell a record 1,500 points the major US indices short covered and then fell sharply into Mondays close. Things looked bad but took a turn of the worst during Monday night’s overnight Globex session when the S&P 500 futures traded all the way down to 2529.00, down 349.50 handles or down almost 12% from its 2877.50 2018 contract high. After Japan’s Nikkei opened down 1,000 points Monday night the ES hit the skids as ‘hundreds’ of sell programs hit the futures.Then the Stoxx Europe 600 fell 2.4%, posting its largest one-day decline since June 2016, After making the night time low the ES rallied all the way up to 2644.50, a 115.50 handle rally before selling back down to the 2600 area heading into the cash open.

On the 8:30 am cst RTH open the ES printed 2601.75 down just 4.75 handles on the session, up 72.75 handles from the globex low and down 42.75 handles from the overnight high. After making an early 2589.00 low in the opening moments of the session and then proceded to rally up to 2680.75 then up 72.75 handles on the day just after 9:00 am cst before then being hit with waves of selling down to 2623.75 just after 1:00 pm and as the market-on-close orders began to mount strongly on the sell side, the S&P futures firmed up and began to rally into the close.

In the final hour the MiM was showing as much as $4 billion to sell before the MOC imbalance came out $2.2 billion to sell as the ESH18 pushed to a new high at 2699.75, up 170 handles from the overnight low and settled the day at 2689.75, up 82.00 handles on the day or 3.10% on the day.

The VIX printed above the 50.00 level making a high of 50.30 up about 40% before closing the day in the red at 29.98 down 20% on the session. Gold futures traded lower much of the day before closing at 1326.90 down $15.50 or 1.25% and crude oil closed up .49 at $63.92 up .70%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.