This week’s economic calendar includes some key data on the housing market and few other major reports. The debate about the strength of the U.S. economy continues. The housing market is an important contributor to the economy. As we enter the key season for real estate many will be asking:

Is it Springtime for housing?

Prior Theme Recap

In my last WTWA, I predicted that there would be special attention to the mixed message of economic reports, contrasting the relative strength of employment with other data. That was a major theme. Some insisted that the employment was overstated. Others said it was a lagging indicator. A few mentioned that GDP was probably understated. Friday’s relatively strong data continued the mixed message. I also suggested that the political sideshow would grab attention, but that was obvious.

Once again the early strength faded at the end of the week. Doug Short captures the story of the decline, the third straight) with his excellent weekly chart. (With the ever-increasing effects from foreign markets, you should also add Doug’s World Markets Weekend Update to your reading list).

The entire post adds more analysis on the major themes as well as a multi-year context.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

The economic calendar has mostly secondary reports again this week. Friday’s stronger economic data only intensified the debate, as the market reacted negatively. This week features three important housing reports and two of lesser significance. Since springtime brings higher expectations for this sector, I expect more attention than usual. The punditry will be asking:

Is it Springtime for Housing?

Background

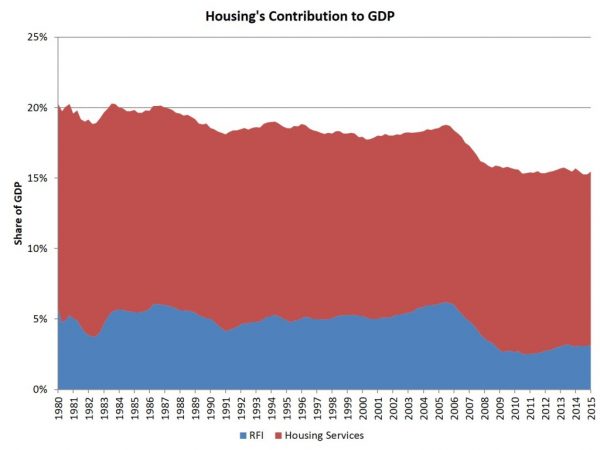

Attention focuses on housing with some frequency since it is important to the economy. Wells Fargo notes that residential investment rose 14.8% in the past year, contributing 0.5% to the Q1 GDP growth (which coincidentally was 0.5%). Last year the National Association of Homebuilders calculated that housing was over 15% of GDP. The impact is not just home sales, but also remodeling.

Viewpoints

The basic themes, moving from bearish to bullish on stocks are as follows:

- The real estate market is about to crash (Ron Insana);

- 0% down has returned. Didn’t we learn anything?

- Increasing housing prices strain the affordability for new buyers (prices are too high);

- Millennials do not have adequate credit;

- Homes held in foreclosure proceedings or by speculators provide low-priced competition; (Whoops. That one changed).

- Home sales are low because there is insufficient supply (the new version).

- Interest rates remain at historically low levels, helping affordability;

- We can expect increasing purchases from young people;

- Increased home prices enable more people to sell – trading up or even sideways to take new jobs.

It is easy to find disciples for each viewpoint.

As always, I have my own opinion in the conclusion. Make your own choice, and feel free to make your case in the comments.

But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good news.

- “Framing” lumber prices are higher. One of the many reasons to follow Calculated Risk is finding data no one else mentions.

- The “shallow industrial recession” seems to be over. New Deal Democrat provides both data and analysis.

- Retail sales were much stronger than expected, up 1.3% versus expectations of 0.9%. The retail earnings reports varied widely, with high-end names doing poorly. Online sales were excellent and gas station sales moved higher. (Remember that gas prices have been part of the recent retail weakness). Auto sales remain strong.

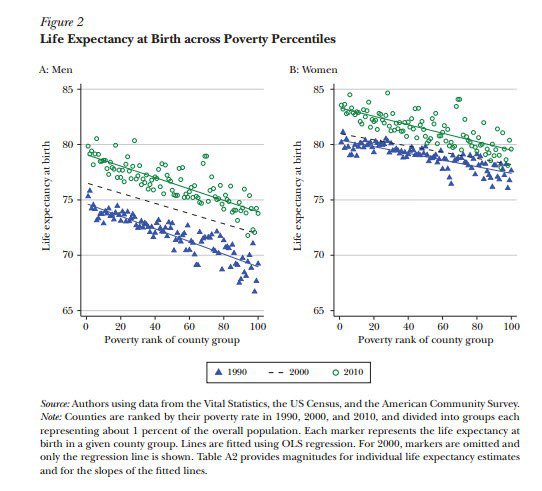

- Life expectancy is higher – and health inequality is lower. Alex Tabarrok of the Foundation For Economic Education presents the data, including the chart below. There is still a downward slope in the data, but the entire line has shifted.

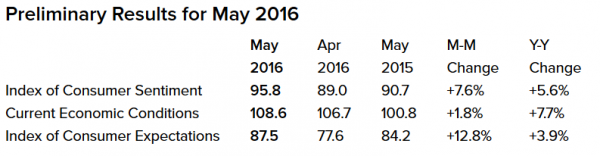

- The Michigan sentiment index beat both last month and also expectations by a wide margin – 95.8 versus about 90. This survey gets timely information about job creation and spending that we do not see elsewhere. As always, I recommend looking at the best chart (and also great discussion) from Doug Short. This month I also recommend checking out the Michigan site. You can find long-term charts and a great explanation of the method. Here is the summary of the key forward-looking data:

- The job market improved, as indicated by the JOLTs report. I often describe this as the most misunderstood data release. Too many people try to use it to analyze net job growth, something better done with various other sources. The ECRI has a new indicator (something about purple animals) subtracting actual hires from job openings, and somehow inferring weakness if this difference increases. They seem to be on a mission to find something negative in the data. Here is their key chart:

Let’s keep this simple.

- Job openings are good – the more the better.

- The quit rate shows voluntary departures from jobs, a strong signal of confidence about finding an alternative.

The Atlantic has an article that is geared toward non-economists, but explains the key points. The article notes that quits are highest in low-paying jobs and lowest among financial services workers and government employees.

Doug Short illustrates the strength of the voluntary quit rate versus layoffs.

The Bad

Some of the news was negative.

- Energy bankruptcies increased, despite rising oil prices. Terry Wade at Reuters suggests that recent oil price increase might be too little, too late for many companies.

- Rail traffic continues to worsen. Steven Hansen reports the 10.6% y-o-y decline, adding a variety of interesting comparisons.

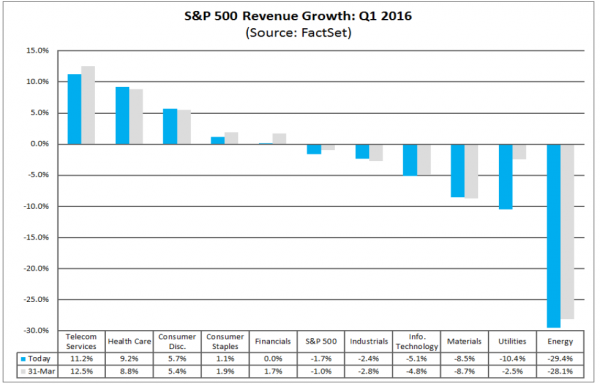

- Earnings season continued with mixed data. FactSet has a nice weekly analysis with interesting charts and also a focused discussion on key sectors. Here are some of the main themes:

- The 71% earnings “beat rate” is higher than usual, but everyone knows the expectations have been lowered.

- Earnings declined for the fourth consecutive quarter.

- The sales beat rate was below normal.

- Many companies cited the strong dollar as a source of weakness, so they expect better future results.

- Autos and internet sales showed the most strength.

- A forgiving market did not punish “misses” as much as usual – at least on average!

- Jobless claims edged higher. 294,000 was the highest reading in more than a year. (Jeffry Bartash, MarketWatch) Employment is important and we should watch in closely – both job creation (which this does not measure) and job loss (which it does).

- Business inventories rose more than expected. The inventory data is easy to spin and difficult to interpret accurately. Does it reflect unsold goods or business confidence in future sales? Steven Hansen (GEI) sees the bullish side.

- Puerto Rico defaulted on a $400 billion debt payment. The Council on Foreign Relations explains the significance.

The Ugly

The TSA. Airport security lines have grown much longer. People are missing planes and some airlines are even delaying flights. Baggage is sitting outside because of inspection delays. There are no immediate plans for more TSA resources, so it is a matter allocating what is available. Here is a good story in The Guardian (via a tweet from Real Clear Markets). A video of the lines at Chicago’s Midway airport now has over two million views.

The comments from Guardian readers suggest that the situation is having an impact on potential international travelers.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week. Nominations are welcome. I see plenty of opportunities!

Quant Corner

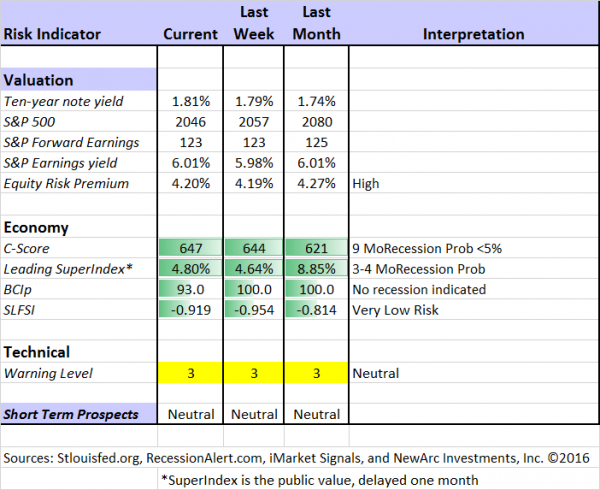

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. I recently made some changes in our regular table, separating three different ways of considering risk. For valuation I report the equity risk premium. This is the difference between what we expect stocks to earn in the next twelve months and the return from the ten-year Treasury note. I have found this approach to be an effective method for measuring market perception of stock risk. This is now easier to monitor because of the excellent work of Brian Gilmartin, whose analysis of the Thomson-Reuters data is our principal source for forward earnings.

Our economic risk indicators have not changed.

In our monitoring of market technical risk, I am now using our new model, “Holmes”. Holmes is a friendly watchdog in the same tradition as Oscar and Felix, but with a stronger emphasis on asset protection. We have found that the overall market indication is very helpful for those investing or trading individual stocks. The score ranges from 1 to 5, with 5 representing a high warning level. The 2-4 range is acceptable for stock trading, with various levels of caution.

The new approach improves trading results by taking some profits during good times and getting out of the market when technical risk is high. This is not market timing as we normally think of it. It is not an effort to pick tops and bottoms and it does not go short.

Interested readers can get the program description as part of our new package of free reports, including information on risk control and value investing. (Send requests to info at newarc dot com).

In my continuing effort to provide an effective investor summary of the most important economic data I have added Georg Vrba’s Business Cycle Index, which we have frequently cited in this space. In contrast to the ECRI “black box” approach, Georg provides a full description of the model and the components.

For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI’s business cycle analysis, as his associate Jill Mislinski does in this week’s update. She respectfully cites their most recent article. In my view it uses tortured logic to reach a negative conclusion of the JOLTs report (discussed further above). The Doug Short analysis of this report is much, much stronger. The ongoing review of the ECRI is comprehensive and provides an interesting comparison with Recession Alert, one of our featured sources. Chart lovers will love this regularly updated article.

Doug’s Big Four update is the single best visual review of the indicators used in official recession dating. You can see each element and the aggregate, along with a table of the data. Doug’s updates cover both the individual elements and a chart-packed summary helping to see what it all means.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.” His view of where we are in the business cycle differs sharply from that of the ECRI. His approach has been more accurate over a long period and especially in the last decade. I am overdue for an update comparing the recession methods. (So many great topics to consider, so little time).

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

Georg Vrba: provides an array of interesting systems. Check out his site for the full story. We especially like his Business Cycle Indicator, updated weekly and now featured in our table. Georg also has an unemployment rate recession indicator. This has long confirmed that there is no recession signal. What would it take to change the prognosis? In this interesting post he suggests that an increase of 0.3% in unemployment would warn of a recession.

The Week Ahead

We have a modest week for economic data. While I highlight the most important items, you can get an excellent comprehensive listing at Investing.com. You can filter for country, type of report, and other factors.

The “A List” includes the following:

- Housing starts and building permits (T). Most are looking for a rebound.

- Existing home sales (F). Less GDP impact than new construction, but a good read on the market.

- FOMC minutes (W). Expect pundit efforts to make something out of nothing!

- Leading indicators (Th). A controversial but popular measure of economic trends.

- Industrial production (T). An important but volatile series. Signs of improvement in a lagging sector?

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B List” includes the following:

- Philly Fed index (Th). I have promoted this indicator in importance after an academic study of it. First May data.

- Business inventories (F). March data, but relevant for Q1 GDP.

- CPI (T). Inflation by any measure remains of secondary importance until we get a few hot months. Then the story will change significantly.

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

There is a little FedSpeak. The Supreme Court will announce some decisions, perhaps including Obama actions on immigration and Puerto Rico. Political news will continue, and some are indeed attributing market weakness to the probable candidates. There are still a few important earnings reports.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

WTWA often suggests a different course of action depending upon your objectives and time frames.

Insight for Traders

We continue our neutral market forecast. Felix is still 100% invested, but with less aggressive sectors. REITs and utilities have moved near the top of the list. The more cautious Holmes is also fully invested. Holmes uses a universe of nearly 1000 stocks, selected mostly by liquidity. Even when the overall market is neutral, there will often be some strong candidates. Holmes holds a maximum of 16 positions at one time. For more information about Felix, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix and Oscar’s weekly ratings updates via email to etf at newarc dot com. They appear almost every day at Scutify (follow here). I am trying to figure out a method to share some additional updates from Holmes, our new portfolio watchdog. (You learn more about Holmes by writing to info at newarc dot com.

Dr. Brett offers innovative ideas for traders, and he does it week after week. Are you a perfectionist? Then prepare to be frustrated in your trading.

So what is our trader’s need? It’s the need to trade, the need to make money. If the market isn’t making sense, there’s no trade to put on and no money to be made. If the setup isn’t there, the trade isn’t there and neither are the profits. If a bad trade is placed, the fruits of a good trade are erased and there go profits. That same dynamic can also make it difficult to step away from screens, even though the trader recognizes in real time the signs of frustration. It’s not OK to miss opportunity.

Holmes is barking agreement. Felix would also agree if he were here instead of at a blackjack table in Vegas (emailing daily results). I hope Felix doesn’t get caught count counting cards like some of those other models.

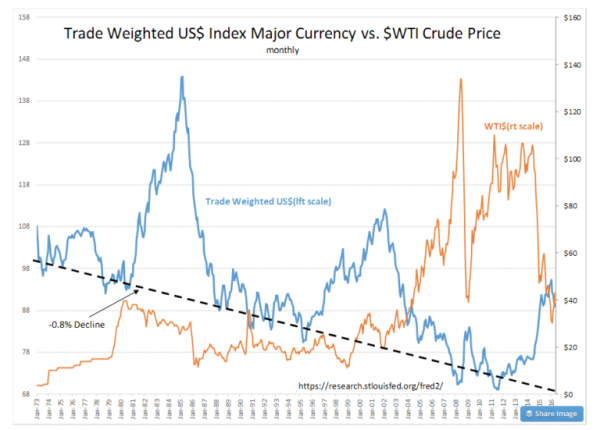

Todd Sullivan provides us with another valuable insight from “Davidson.” This quotation shows what traders should really be watching, if they want to catch short-term moves:

Today’s pools of capital are seeking gains within the day-by-day trading frenzy. The least little shift is taken as the possibility of a new trend and capital shifts in anticipation.

And later…

Most of the discussion today centers on whether it is oil or the USD which is driving the correlation. This is like a discussion of which comes first, the ‘Chicken’ or the ‘Egg’. My perception is that the main driver in changing global trade balances. Even if one could unravel all the inputs we have on global trade, the data itself is incomplete with a number of nations treating global trade figures as state secrets. Global trade balances impact prices and currencies long term to produce the correlations seen in the chart from Jan 1973.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking. Pick a topic and give it a try. Feel free to suggest new topics if your own “fear” is not on the list.

Some readers expressed concern about the overall market valuation. I discussed this last week. If you are worried about all of those valuation indicators (which supposed worked for centuries, but not in the last couple of decades) I urge you to read, Is the Market Cheap? Three things you need to know about valuation, but don’t.

Many individual investors will also appreciate our two new free reports on Managing Risk and Value Investing. (Write to info at newarc dot com).

Other Advice

Here is our collection of great investor advice for this week. If I had to pick a single most important source for investors to read, it would be David Merkel’s post, You Can Get Too Pessimistic. He notes the low probability of real disaster scenarios. In the context of a thoughtful analysis, he provides the following advice:

If you give into fears like these, you can become prey to a variety of investment “experts” who counsel radical strategies that will only succeed with very low probability. Examples:

- Strategies that neglect investing in risk assets at all, or pursue shorting them. (Even with hedge funds you have to be careful, we passed the limits to arbitrage back in the late ’90s, and since then aggregate returns have been poor. A few niche hedge funds make sense, but they limit their size.)

- Gold, odd commodities — trend following CTAs can sometimes make sense as a diversifier, but finding one with skill is tough.

- Anything that smacks of being part of a “secret club.” There are no secrets in investing. THERE ARE NO SECRETS IN INVESTING!!! If you think that con men in investing is not a problem, read On Avoiding Con Men. I spend lots of time trying to take apart investment pitches that are bogus, and yet I feel that I am barely scraping the surface.

Stock Ideas

Chuck Carnevale has an interesting recommendation for retired investors – Cisco Systems (NASDAQ:CSCO). As usual he does a thorough analysis, using his first-rate methods. See the whole story for illustrative charts and the key points.

Barron’s has a cover story on Regeneron (NASDAQ:REGN), which it calls the best of the biotechs. I see many attractive names in this beaten-down sector. The article does a good job of explaining why Regeneron is special.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. There are several great choices worth reading, but my favorite is from Josh Brown. He explains that many investors have a “toxic combination” of reducing financial literacy and increasing confidence. It is nothing personal, but a general consequence of aging.

Outlook on China

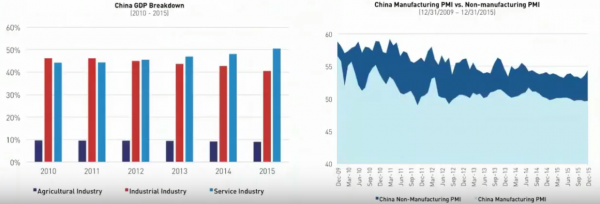

There has been a lot of very negative commentary about China in recent weeks. Some of this comes from outspoken hedge fund managers who have significant short positions. To balance this, investors need information from those who study and invest in China. One such source is KraneShares, which provided an excellent briefing for financial advisors last week. While there were many key points, her are two worth extra emphasis:

And also, most observers focus on manufacturing, ignoring the planned shift to a service-driven consumer economy.

My conclusion is that investing in China is not a matter of if, but when and how. The financial press emphasizes data points like the “flash PMI” which have little relevance to the key issues. (Full disclosure: KraneShares offers KWEB. We own it in our aggressive program, and I am considering expanding it to more investors who need more international exposure).

Market Fairness

Some individual investors are missing opportunities because of the perceived unfairness of the system. If you are trading in modest size, high frequency trading may actually have slashed your trading costs and increased your potential gains.

Watch out for….

Onecoin. This cryptocurrency seems to include elements of multi-level marketing, Ponzi schemes, and a lack of liquidity. There is always a great temptation to make money fast, but recent economic conditions may have increased the appetite. Before “investing” I urge you to do some careful research. Here is an opinion from a crypto currency site and also one from a CPA who has a great quotation from the Association of Certified Fraud Examiners:

- The investment opportunity promises “guaranteed” returns.

- The opportunity is described as “once-in-a-lifetime,” or pressures you to buy immediately “before it is too late.”

- The deal sounds too good to be true. Compare any promised return with the returns on well-known stock indexes.

- The investment offer was unsolicited.

- You are unable to find any public information about the investment opportunity. Often, this is explained away as the investment being “by invitation only” and a “secret that is best kept, lest too many people get involved.”

- The opportunities or people touting them are located outside of the United States. This particular point gives the scam an exotic feel and includes the idea (real or implied) that profits can be squirreled away offshore and away from the taxing authorities.

- You do not know the person who is contacting you, or they are just an acquaintance.

Check out the full post to see the comparison to the Onecoin marketing materials.

Final Thoughts

Last week I offered a strong opinion about resolving the tension between various economic data sources. I make most of WTWA a balanced summary of what is happening, with an emphasis on a current theme. It is in the conclusion where I do my editorializing. As I noted last week, when I do not have a solid answer to the weekly theme question, I am not afraid to say so. If only more observers would do the same! Readers sometimes complain that I do not give a specific answer to my own question. That misses the point. The weekly question is my prediction for the market theme – what you will see in the media. I cannot control that, and it would be dishonest to claim an answer that I do not really have.

With respect to housing, I expect growing strength. It might not show up this month, since we are still following Bill McBride’s “long bottom.” I plan to watch Calculated Risk stories this week for the best interpretation of the data. He writes this week:

Housing starts are up 13% from March 2014 to March 2016.

New home sales are up 25% over the two years.

Existing home sales are up 13%.

House prices are up 9.7% (Case-Shiller National Index February 2014 to February 2016).

Some day I’ll be bearish again on housing. But not in 2014 – and not now.

My own reasons for longer-term optimism include the following:

- Supply. Not that long ago many were predicting a “shadow supply” of foreclosed homes. That was gradually absorbed. Now the same sources are discussing a lack of inventory!

- Demand. When I first wrote about “shadow demand” it generated a lot of skepticism from readers (something that I embrace). We still have plenty of people living with parents when they would prefer their own home. Many magazine feature writers try to make this into a new preference of Millennials. I doubt it. Mostly this is the result of the lag in employment growth.

- Demographic and social trends. These are also demand factors, of course, but as people enter the labor force, we get more household formation. Immigration policy has been a negative in recent years, and it remains a wild card.

- Improving home prices. Many homeowners were making their payments, but were underwater on their mortgages. Higher prices have resolved some of that. They are now abler to move more readily, either to follow the jobs or to upgrade.

Trading and Investment Implications

Traders must continue to work the trading range, guessing daily reaction to Fed speculation, the moves in the dollar, and the shifts in oil prices. On Friday, stronger economic data sent the market lower. For the short term the message is that “good news is bad news”.

Investors should take the opposite perspective. The worry about the economic message from oil prices and interest rates is overdone. A good investor looks for good value. There is a method for this:

Find sectors and stocks that are currently unloved.

While I have been cautious about adding to our underweight energy positions (not just unloved, but hated) I do like and own homebuilders and regional banks.