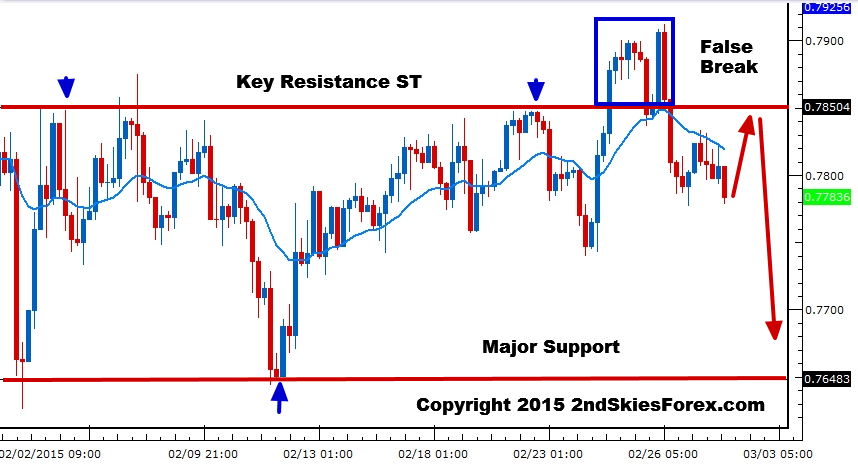

EUR/USD – Range Break, Looking to Sell

After dumping heavy to end the week and breaking below the key range support and role reversal level at 1.1260, I’m looking to sell on a weak rally. We may venture towards the yearly lows and support near 1.11 before a bounce, but either way, I’m looking to sell at this level.

Downside targets will remain 1.11, 1.1054 and 1.0920. Only a daily close above 1.1350 negates the ST & MT bearish momentum.

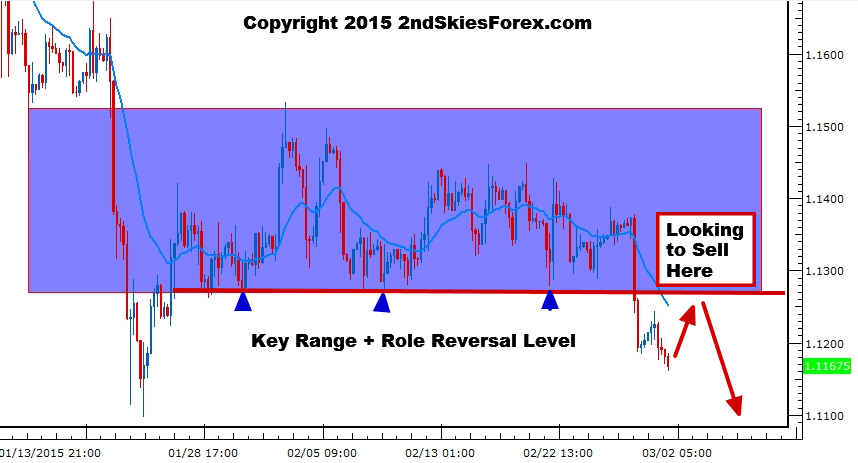

AUD/USD – False Break Above Key Resistance

After attempting to clear through the offers above the key resistance at 7850/60 we’ve been talking about, the pair formed a double top with some impulsive selling to close the week. This heavy selling resulted in a break back below 7850 forming a false break setup.

For now short term, the pair is bearish below this level and the double top at 7900. Any weak corrective pullbacks into these levels may attract offers back into the market for another attack on 7700 and 7650. Only some heavy buying and clearing above 7900 re-ignites the bullish mood.