There is no central bank meeting scheduled for this week, but we will get to hear from several ECB and Fed policymakers, from whom we may get more hints and clues as to how they intend to move forward in terms of monetary policy.

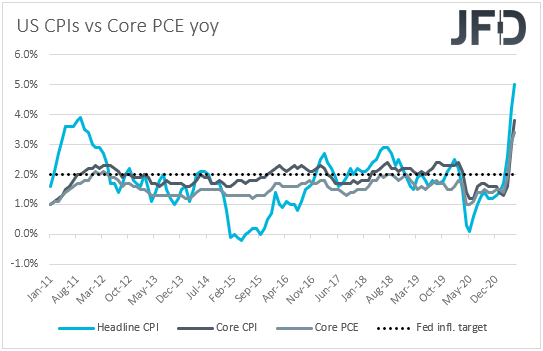

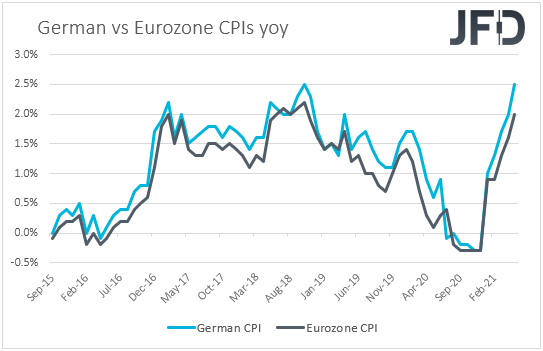

As for the data, Eurozone’s CPIs are likely to support the notion that surge in the bloc’s inflation is likely to prove to be temporary, but Friday’s NFPs are likely to paint a different picture for the US.

On Monday, there are no top-tier data releases on the financial agenda and thus, market participants are likely to pay attention to the scheduled speakers. According to the economic calendar, we have three ECB, two Fed, and one BoE officials scheduled to speak today.

From the ECB, we will get to hear from Vice President Luis de Guindos, Executive Board member Fabio Panetta and Governing Council member Jens Weidmann. Despite headline inflation in the Eurozone rising to 2%, President Christine Lagarde and Chief Economist Philip Lane have repeatedly been against the inflation-is-back narrative, supporting that it’s not time to consider withdrawing monetary policy support yet.

With that in mind, it would be interesting to see whether other members of the Bank hold the same view. In our view, with underlying inflation still staying at +0.9% yoy, we believe that they will agree with Lagarde and Lane, which may allow investors of European equities to increase somewhat their exposure.

At the same time, the euro may come under some additional selling pressure. Now, in case a member holds a different view, suggesting that they may have to consider scaling back stimulus at an earlier point in time, we may have the opposite market reaction, meaning a higher euro and a pullback in EU stocks.

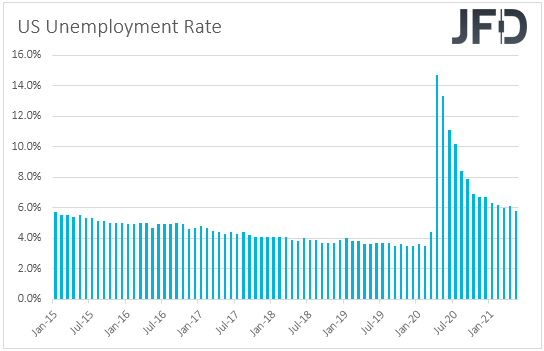

From the Fed, we have New York President John Williams and Board Governor Randal Quarles. We’ve already heard from Williams and we know that he is against withdrawing monetary policy support too soon. He said that data and conditions have not progressed enough for the FOMC to shift its monetary policy stance, adding that a discussion about raising interest rates is still “way off in the future.”

Although Fed Chief Jerome Powell shares a similar view, some other members, like Dallas President Kaplan, St. Louis President Bullard, and Atlanta President Bostic, believe that interest rates will need to start rising as soon as next year. Therefore, we are eager to find out in which camp does Governor Quarles belongs.

More support that the Committee should start scaling back QE soon and that interest rates may need to start rising as early as next year, could result in another setback in equities and another rebound in the US dollar.

As for BoE Chief Economist Andy Haldane, we know that, last week, he was the only one to support scaling back QE, but this was his last monetary policy meeting, so whatever he says today may have a limited market impact as it cannot affect the decision of his former colleagues.

On Tuesday, during the Asian session, we get Japan’s jobs data for May. The unemployment rate is expected to have ticked up to 2.9% from 2.8%, while the jobs-to-applications ratio is forecast to have ticked down to 1.08from 1.09.

Later in the day, Germany’s preliminary CPIs for June are due to be released. Both the CPI and HICP rates are forecast to have declined to +2.3% yoy and +2.1% yoy from +2.5% and +2.4% respectively, something that may raise speculation that Eurozone’s headline inflation, due out on Wednesday, may slow down as well.

From the US, we get the Conference Board consumer confidence index for the same month, which is expected to rise to 119.0 from 117.2.

On Wednesday, the main item on the agenda may be Eurozone’s preliminary CPIs for June. The headline CPI rate is expected to have ticked down to +1.9% yoy from +2.0% yoy, while the HICP excluding energy and food one is forecast to have held steady at +0.9% yoy. A small decline in the headline rate, and an underlying print still well below 2%, may add more credence to the view that ECB officials are unlikely to start considering withdrawing monetary policy support any time soon.

As for the rest of Wednesday’s data, Asian time, Japan’s preliminary industrial production for May and China’s official PMIs for June are coming out. Japan’s IP is expected to have shrunk 2.4% mom after improving 2.9% in April, while with regards to the Chinese PMIs, we only have a forecast for the manufacturing index, which is expected to have declined fractionally, to 50.8 from 51.0.

During the EU session, besides the EZ CPIs, we have the UK’s final GDP for Q1, and the German unemployment rate for June. The final UK GDP is just expected to confirm its preliminary estimate of -1.5% qoq, while Germany’s unemployment rate is forecast to have ticked down to 5.9% from 6.0%.

Later in the day, from the US, we get the ADP employment report for June and the pending home sales for May. The ADP report is expected to show that the private sector has gained 600k jobs in June, less than the 978k added in May. This could raise some speculation that the NFPs, due out on Friday, may come near their one forecast of 675k.

However, we will not rely much on the ADP report, as it’s been far from a reliable predictor of the NFPs. Even last month, when the ADP revealed a 978k job gain, the NFPs came in at 559k. It seems that market participants agree with us, and this is evident by how insignificant market reactions have been to the ADP number in the last years.

Pending home sales are expected to have slid 1.0% mom in May after tumbling 4.4% in April.

From Canada, we get the monthly GDP for April, which is expected to reveal a contraction of 0.9% mom after expanding 1.1% in March. However, we don’t believe that any potential slide in the loonie due to that will be large and long-lasting. We believe that CAD-traders may pay more attention to the OPEC+ meeting scheduled for Thursday.

As we just noted, Thursday’s main event is likely to be the OPEC+ decision, which may decide the faith of oil prices, and also affect oil-linked currencies, the likes of CAD and NOK. Media chatter suggests that producers are likely to agree on another 500k bpd output increase, starting from August, as the latest surge in oil prices gives them ample reasons to believe that the market can absorb this kind of an increase.

Now, in terms of market reaction, we believe that a 500k bpd increase is unlikely to impact much the broader path of oil prices, as this is what is already telegraphed and market participants are doubtful to get surprised. For oil prices to pull back, we think that a number well above 500k may be needed.

As for the rest of Thursday’s events, during the Asian trading, we get Japan’s Tankan survey for Q2, Australia’s trade balance for May, and China’s Caixin manufacturing PMI for June.

In Japan, both the large manufacturers and large non-manufacturers’ indices are expected to have increased to +18 and +3 from +4 and -1, while Australia’s trade surplus is anticipated to have increased to AUD 10.0bn from AUD 8.03bn. China’s Caixin manufacturing index is forecast to have slid to 51.8 from 52.0.

Later in the day, we have the final Markit manufacturing PMIs for June from the Eurozone, the UK and the US, as well as the ISM manufacturing index for the month. As it is always the case, the final Markit prints are expected to confirm their preliminary estimates, while the ISM index is expected to have declined fractionally, to 61.0 from 61.2.

Finally, on Friday, the spotlight is likely to turn to the US employment report for June. Nonfarm payrolls are expected to have increased by 675k, more than May’s 559k, while the unemployment rate is anticipated to have ticked down to 5.7% from 5.8%. Average hourly earnings are anticipated to slow somewhat in monthly terms, but the yoy rate is forecast to have surged to +3.6% from +2.0%, adding to fears that inflation may continue to fly well beyond the Fed’s objective of 2.0%.

In our view, such a report is likely to add to speculation that the Fed may indeed have to raise interest rates sooner than previously anticipated, something that may support the US dollar. Oddly enough, although this means further progress for the world’s largest economy, it could hurt equities, as higher rates mean more expensive borrowing and lower present values for companies.

Having said all that though, the main driver behind the broader market sentiment is likely to stay the signals and opinions from various Fed officials in our view, as this paints a more direct picture with regards to what could happen next in terms of monetary policy.

As for the rest of Friday’s releases, we have Germany’s retail sales, Canada’s trade balance, and the US factory orders, all for May. Germany’s data is anticipated to show decent improvement, while Canada’s trade surplus is forecast to have declined somewhat. US factory orders are expected to have rebounded after sliding in April.