Following last week’s ECB decision, this week, the central bank torch will be passed to the FOMC, with market participants eager to find out when officials are planning to start scaling back their QE purchases, and perhaps when they are planning to start raising interest rates.

As for the data, the most important ones may be Australia’s, Canada’s, and Eurozone’s CPIs, which may shape expectations around the future plans of those nations’ respective central banks.

Monday is a relatively light day, with the only release worth mentioning being Germany’s Ifo survey for July. The current assessment index is expected to have risen to 101.6 from 99.6, but the expectations one is anticipated to have slid to 103.3 from 104.0. That said, this is likely to take the business climate index fractionally higher, to 102.1 from 101.8.

An event that may attract even more attention than the Ifo survey may be a speech by BoE MPC member Gertjan Vlieghe. A couple of weeks ago, MPC member Michael Saunders said that economic activity had recovered a bit faster than forecast in May and that it may become appropriate fairly soon to withdraw some stimulus.

However, BoE MPC member Jonathan Haskel said last Monday, that reducing stimulus is not the right option for the foreseeable future. This suggests that the views within the BoE are varying and thus, it would be interesting to hear where Vlieghe stands. If he also believes that some stimulus should be withdrawn soon, the pound is likely to strengthen, while the opposite may be true if his view is closer to Haskel’s.

Tuesday’s agenda is also light. We only get the US durable goods orders for June and the Conference Board consumer confidence index for July. Headline orders are forecast to slow to +2.1% mom from +2.3%, but the core rate is anticipated to have increased to +0.8% mom from +0.3%. The CB index is anticipated to have declined somewhat, to 124.1 from 127.3.

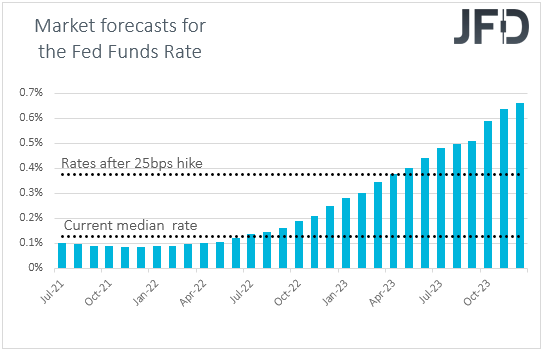

On Wednesday, the spotlight is likely to fall on the FOMC interest rate decision. At its latest meeting, the Committee kept its policy unchanged, but signaled that interest rates are likely to start rising in 2023. Since then, we’ve heard the individual views of several policymakers, with some of them supporting that interest rates should even start rising during 2022, and others arguing against withdrawing monetary policy support too soon.

The divided Fed was also reflected in the minutes of the gathering, with various participants feeling that the conditions for reducing their asset purchases would be “met somewhat earlier than they had anticipated,” while others saw a less clear signal from incoming data and suggested a “patient” approach to any policy change.

Overall though, they generally agreed that it is important to be well positioned to reduce the pace of asset purchases in case there is faster-than-anticipated progress towards the Committee’s goals.

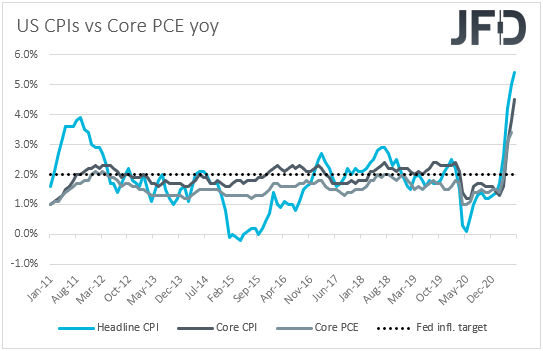

What’s more, both the headline and core CPIs for June accelerated by more than anticipated with the headline rate rising to a 13-year high and the core one hitting its highest level since November 1991. This may have added to concerns that the inflation spike may eventually not be due to transitory factors.

Even Fed Chair Powell, who said that the economy is “still ways off” from desired levels, failed to convince market participants that it will take long before they start normalizing their monetary policy.

According to the Fed funds futures, investors are now fully pricing in the first rate increase to happen in April 2023, and thereby they may be interested to see whether their bets are correct. They may also be eager to find out when officials are planning to start scaling back their QE purchases.

A hawkish message, suggesting that a rate hike may be on the cards for the first months of 2023, and hints pointing to QE tapering in the next few months, may allow the US dollar to trade higher, and equities to correct lower. However, with Wall Street hitting fresh records on Friday, it seems that equity investors are not concerned that much about higher interest rates. Or they may be rushing into benefiting from cheap borrowing costs before a hike takes place.

Anyhow, this week, stock traders may focus more on earnings by giant firms, like Google (NASDAQ:GOOGL), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Facebook (NASDAQ:FB), and Tesla (NASDAQ:TSLA), where stellar results may encourage buying any possible dip triggered by a hawkish Fed.

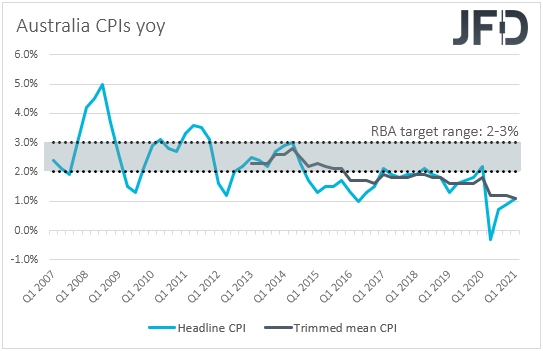

As for Wednesday’s economic data releases, during the Asian session, we have Australia’s CPIs for Q2. The headline rate is forecast to jump to +3.8% yoy from +1.1%, above the upper end of the RBA’s 2-3% target range.

However, the trimmed mean rate, although also expected to rise, is forecast to have stayed below the lower bound of that range. Specifically, the trimmed mean rate is anticipated to have risen to +1.7% yoy from +1.3%. Therefore, with underlying inflation staying below the RBA’s objective, we doubt that aussie-traders will start betting on earlier tightening by this Bank.

At this month’s gathering, officials announced that they will proceed with more bond purchases, beyond September, and also said that they are planning to keep rates at current levels until 2024. With that in mind, even if market sentiment continues to improve, we believe that the aussie is likely to perform poorer than its other risk-linked counterparts, especially the kiwi, the central bank of which is expected to push the hike button very soon, perhaps as early as next month.

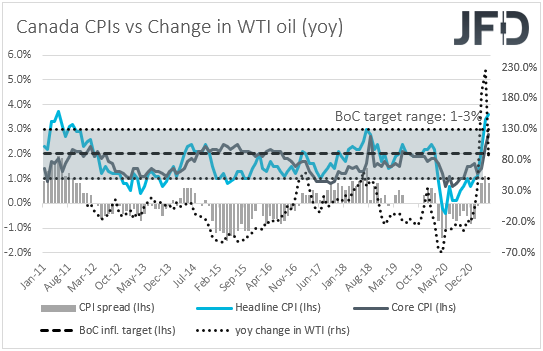

Later in the day, we get more CPI data, this time from Canada and for the month of June. Here, both the headline and core rates are forecast to have declined to +3.2% yoy and +2.4% yoy, from +3.6% and +2.8% respectively.

At its latest meeting, the BoC appeared less hawkish than expected, saying that they continue to see the output gap closing in H2 2022, which suggests that their expectations over when they may start raising interest rates have not come forth.

With that in mind, slowing inflation is likely to add credence to the view that the prior surge was due to transitory factors, and may prompt CAD-traders to reduce their hike-bets even further. This is likely to keep the loonie under selling interest, especially against the greenback in case the Fed sounds hawkish on Wednesday.

On Thursday, during the Asian morning, we have New Zealand’s ANZ business confidence index for July, but no forecast is currently available.

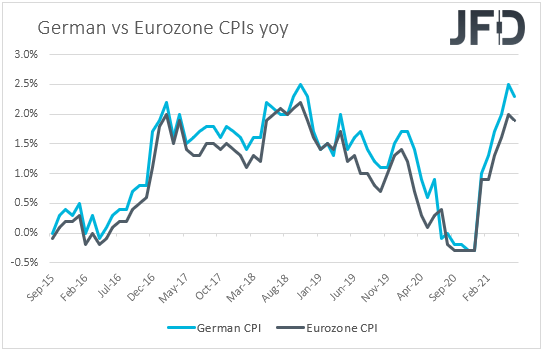

Later in the day, we get Germany’s preliminary inflation data for the same month, with both the CPI and HICP yoy rates expected to have surged to +3.2% yoy and +3.0% yoy, from +2.3% from +2.1% respectively. This is likely to raise bets that Eurozone’s headline inflation print, due out on Friday, may also accelerate notably.

The 1st estimate of the US GDP for Q2 is also coming out, and the forecast points to a rising growth rate, to +8.6% qoq SAAR from +6.4%. Conditional upon hawkish hints by the Fed on Wednesday, this is likely to encourage participants to bring forth their bets over when they expect the Committee to push the hike button.

Finally, on Friday, the main items on the agenda may be Eurozone’s preliminary CPIs for July, and the first estimate of the bloc’s GDP for Q2. Eurozone’s headline CPI is forecast to have ticked up to +2.0% yoy from +1.9%, while the HICP excluding energy and food rate is anticipated to have slid to +0.7% yoy from +0.9%.

This comes in contrast with Germany’s forecasts, which point to a strong acceleration. If indeed, the bloc’s numbers are as soft as expected, they will confirm the ECB’s dovish stance last week, and may keep the euro under selling interest.

Remember that the Bank changed its forward guidance, saying that it will keep interest rates at present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon, which may also imply a period during which inflation moderately overshoots that objective. In our view, this translates into willingness to hold rates low for much longer than the previous guidance suggested. As for the GDP, no forecast is currently available.

As for the rest of Friday’s data, during the Asian session, Japan’s employment report, preliminary industrial production, and retail sales, all for June are coming out. The unemployment rate is forecast to have held steady at 3.0%, while the jobs-to-applications ratio is anticipated to have ticked up to 1.10 from 1.09. Industrial production is forecast to have rebounded 5.0% mom after sliding 6.5%, but retail sales are expected to have slowed to +0.2% yoy from +8.3%.

Later in the day, from the US, we get personal income and spending for June, alongside the core PCE index for the month. Personal income is expected to have declined again, but at a slower pace than the previous month, while spending is forecast to have slowed somewhat.

The final UoM consumer sentiment index for July is also due to be released and it is just expected to confirm its preliminary estimate of 80.8.

From Canada, we have the monthly GDP for May, with expectations pointing to a 0.3% mom contraction, the same as in April.