We have a very busy week ahead of us, with four central banks deciding on monetary policy: the BoJ, the SNB, the Norges Bank and the BoE. Only the BoE is nearly certain to proceed with changes, with officials expected to expand their QE purchases as the current target is set to be reached in the beginning of July. On top of that, Fed Chair Powell is scheduled to testify on monetary policy before Congress on Tuesday and Wednesday. However, we don’t expect any fireworks, as we got to hear from him last week, after the FOMC policy decision.

Monday

On Monday, we have already had China’s retail sales, industrial production, and fixed asset investment, all for May. Retail sales and fixed asset investment slid by more than anticipated, while industrial production rose by less than the forecast suggested.

As for the rest of today’s events, from the Eurozone, we have the trade balance for April, for which no forecast is available, while from the US, we get the New York Empire State manufacturing index for June. This index is expected to have risen, but to have stayed within the negative territory. Specifically, it is expected to have risen to -27.50 from -48.50.

Tuesday

On Tuesday, the BoJ will announce its decision on monetary policy. The previous meeting of this Bank, on May 22nd, was an emergency one. Officials kept interest rates and the target of their long-term government bond yields unchanged, but announced the start of a new small business lending program. Policymakers are not expected to proceed with any changes to their main policy tools this time either, but it would be interesting to see whether they will expand further some of their emergency lending programs.

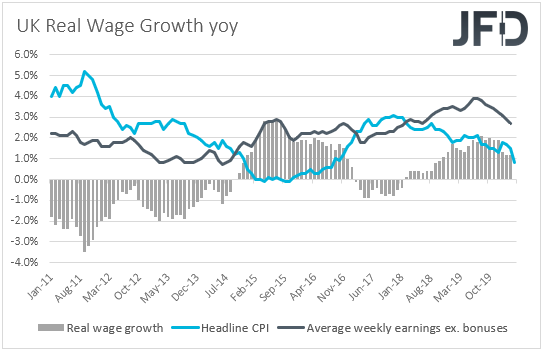

During the European day, we get UK employment data for April. The unemployment rate is expected to have risen to 4.5%, while the net change in employment is expected to show that the economy has lost 65k jobs in the three months to April after gaining 211k in the three months to March. Average earnings including bonuses are forecast to have slowed to +1.4% yoy from +2.4%, while the excluding-bonuses rate is anticipated to have declined to +1.9% yoy from +2.7%.

According to the KPMG and REC UK Report on Jobs, permanent staff appointments and temporary billings fell at the sharpest rates in the survey’s history, while the availability of candidates rose for the first time since April 2013, with the rate of expansion being the steepest since November 2009. This supports the notion with regards to an increase in the unemployment rate. What’s more, the weaker demand for staff also drove renewed declines in starting salaries, which enhances the case for a notable slowdown in earnings. Germany’s final CPIs for May and the nation’s ZEW survey for June is also due to be released. The final inflation prints are expected to confirm the preliminary ones, while the ZEW survey is expected to reveal improvement in both the current conditions and sentiment indices. Eurozone wages and the labor cost index for Q1 are also on the agenda.

Powell testifies to Congress

In the US, Fed Chair Jerome Powell will testify on the FOMC’s semi-annual monetary policy report before Congress. He will testify via a video conference before the Senate Banking Committee on Tuesday, while on Wednesday, he will present the same testimony before the House Financial Services Committee. Although investors are likely to be on the lookout for his view on the economic outlook and the future steps of the Fed, we don’t expect those events to result in any fireworks. After all, we heard his view just last week after the FOMC decision, when we also got updated economic projections. Thus, market participants are already aware of the Fed’s view on how the economy may perform from now onwards.

As for US data, we have retail sales, industrial and manufacturing production, all for May. They are all expected to have rebounded after tumbling in April.

Wednesday

New Zealand’s current account balance for Q1 and Japan’s trade balance for May are coming out. New Zealand’s current account deficit of NZD 2.66bn is forecast to have turned into a surplus of NZD 1.48bn, while Japan’s trade deficit is expected to have narrowed to JPY 560bn from 931.9bn.

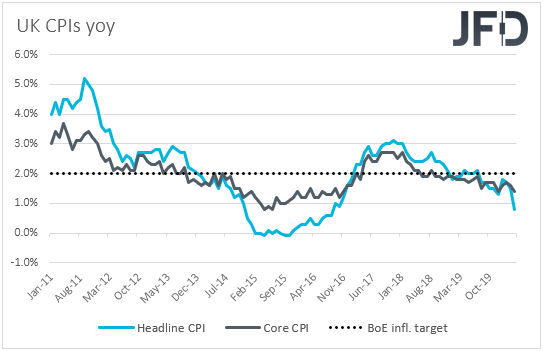

We will also get UK CPI for May. Both the headline and core CPI rates are expected to have declined to +0.5% yoy and +1.2% yoy from +0.8% and +1.4% respectively. Coming on top of a potentially soft employment report, slowing inflation, further below the BoE’s objective of 2%, may increase speculation that on Thursday, policymakers will discuss the option of negative interest rates and thus, the pound may come under selling interest. Eurozone’s final CPI for the month are also coming out, but as it is always the case, they are expected to confirm their initial estimates.

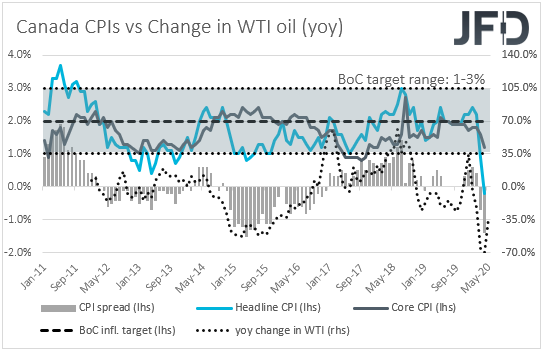

Later in the day, we get more inflation data for May, this time from Canada. The headline rate is expected to have ticked up, but to have stayed in negative territory. Specifically, it is expected to have risen to -0.1% yoy from -0.2%, while no forecast is currently available for the core rate. At the prior BoC gathering, policymakers kept interest rates unchanged and said that given the improvement in short-term funding conditions, the Bank reduced the frequency of its term repo operations and its program to purchase bankers’ acceptances. They also said the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report and that the economy is expected to resume growth in the third quarter. With inflation also near the Bank’s estimates, all this suggests that as long as coronavirus-related restrictions are lifted, and as long as data continues to suggest that the worse is behind us, Canadian policymakers are likely to stay sidelined for a while more. US building permits and housing starts for May are also coming out.

Thursday

On Thursday, we have three more central banks deciding on interest rates and those are the SNB, the Norges Bank and the BoE.

Kicking off with the SNB, no policy changes are expected. The last meeting of this bank was back in March 19th, with officials refraining from touching the already low interest rate of -0.75%. However, they strengthened their intervention language in light of the fast spreading of the coronavirus, noting that they will intervene more strongly in the FX market. They also added that the franc was even more highly valued. With governments around the globe easing their lockdown measures and economic data suggesting that the deep economic wounds from the coronavirus may be behind us, we don’t expect this Bank to proceed with any policy changes. After all they haven’t done so in March, when every other central bank was expanding its stimulus efforts to fight the economic fallout from the coronavirus. That said, bearing in mind that now the franc is stronger than it was when officials last met, we believe that they will stay ready to intervene in the FX market if things fall out of orbit.

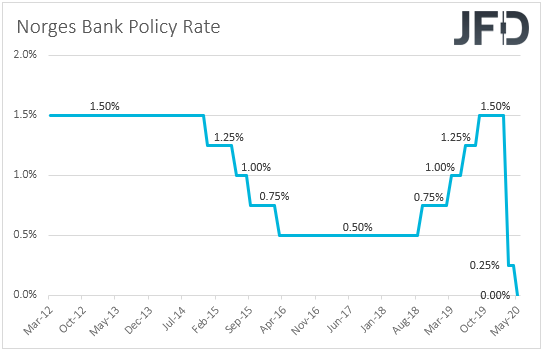

Passing the ball to the Norges Bank, we don’t expect any changes to policy either. At its latest meeting, the Norges Bank cut its benchmark policy rate to 0.0%, with officials saying that it will most likely stay at that level for some time ahead. “We do not envisage making further policy rate cuts”, Governor Olsen said in the accompanying statement. Last week, data showed that both headline and core inflation accelerated more than anticipated, something that allows policymakers to sit more comfortably on the sidelines, in our view.

BoE meets

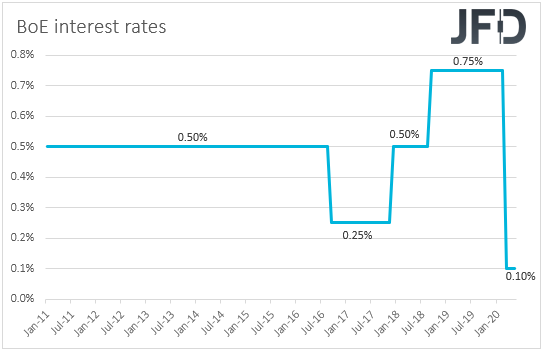

Last but not least, we have the BoE. At their last meeting, policymakers of this Bank kept monetary policy unchanged. Via a unanimous vote, they kept interest rates on hold, while with regards to their QE program the vote was 7-2 in favor of keeping the amount of purchases unchanged. The two dissenters, Saunders and Haskel, preferred to increase the target for the stock of asset purchases by an additional GBP 100bn. With officials noting that the current QE is set to reach its target at the beginning of July, we see it nearly certain that they will expand their purchases at this gathering, perhaps by another GBP 100bn as the dissenters suggested at the prior gathering.

However, bearing in mind that such a decision may be largely expected, we don’t expect it to shake the pound. We think that GBP-traders will focus more on the language around interest rates. Remember that in the aftermath of the prior gathering, BoE Governor Andrew Bailey and Chief Economist Andy Haldane said that the Bank is looking more urgently at negative interest rates. Thus, although they may not cut rates at this gathering, it would be interesting to see how ready they are to do so in the months to come.

If there is intense talk with regards to the examination of negative interest rates, the pound is likely to come under selling interest, but the currency’s traders may also keep an eye on developments and headlines surrounding Brexit.

EU summit kicks off

On Thursday and Friday, an EU leaders’ summit is scheduled to take place and we will look for clues as to how far away the EU and the UK are in finding common ground. That said, ahead of the summit, on Monday, UK PM Johnson will meet with EU Commission President Von der Leyen and thus, we may get an early taste from headlines over that event. EU leaders are also expected to discuss the proposed coronavirus recovery fund. Most members support the plan, but Netherlands, Austria, Denmark, and Sweden are still skeptical. For the plan to take flesh, it must be accepted by all members and any conflict may result in a decent retreat in the euro.

As for Thursday’s data, during the Asian session, New Zealand’s GDP for Q1 and Australia’s employment report for May are coming out. New Zealand’s GDP is expected to have contracted 0.9% qoq after expanding 0.5% in the last three months of 2019, something that will drag the yoy rate down to +0.3% from +1.8%. Australia’s unemployment rate is expected to have risen to 7.0% in May from 6.2%, while the net change in employment is forecast to show that the economy has lost 125.0k jobs after losing 594.3k in April.

Friday

Finally, on Friday, Japan’s national May CPI for May are due to be released. No forecast is available for the headline rate, while the core one is expected to have ticked up to -0.1% yoy from -0.2%.

Later in the day, we get retail sales data from the UK and Canada. The UK headline rate is forecast to have rebounded to +5.8% mom in May from -18.1%, while the core one is expected to have inched up to +4.6% mom from -15.2%. With regards to the Canadian numbers, headline sales are expected to have fallen 15.1% mom in April, after sliding 10.0% in March, while the core rate is expected to have tumbled to -12.8% mom from -0.4%.