Market Summary

Asia

Asian markets kicked off last week on strong footing, gaining in response to gains from Wall Street, and on investor optimism over the U.S. tax reform legislation. The exception to that was South Korea’s Kospi, which remained depressed throughout most of the week. By Wednesday the optimism over tax reform had faded, in a case of buy the rumor and sell the news. The passage of the tax act through both the House and Senate in the U.S. had little positive impact on Asian markets. They did end the week on a high note however, with broad based gains across the region Friday. Overall Hong Kong’s Hang Seng was the strongest performer, gaining 2.5% on the week. Japan’s Nikkei also posted a 1.6% gain, but most of that was from Monday. In Australia the S&P/ASX 200 was 1.2% higher, again with the bulk of gains coming at the beginning of the week. The worst performance came from South Korea’s Kospi, which ended with a 1.7% weekly loss. Markets in Hong Kong and Australia will be closed Monday for Christmas and Tuesday for Boxing Day.

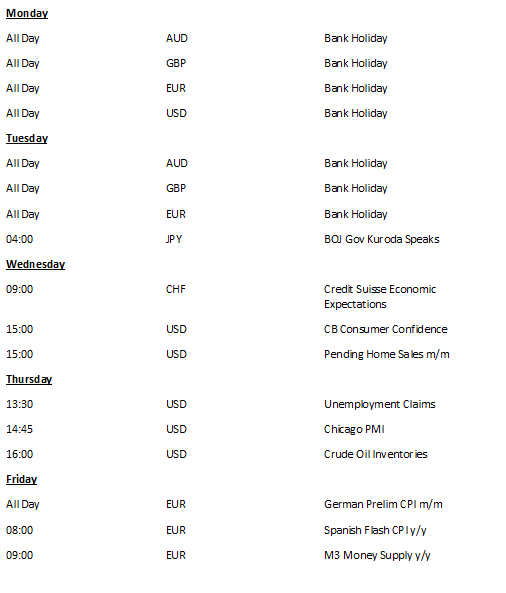

Next week is expected to be fairly quiet across the Asian region, and although most markets in Asia don’t close for Christmas, the lack of trade volume from Europe and the U.S. is almost certain to keep results muted. We will hear from Bank of Japan governor Haruhiko Kuroda on Tuesday, and this could impact the Japanese markets. Australia and Hong Kong are likely to remain quiet due to the three day trading week, followed by another long holiday weekend, which will likely have many traders away from the markets all week.

Europe

European markets also got off to a strong start last week on optimism over U.S. tax reform, but that quickly faded. Tuesday and Wednesday saw markets suffering broad based and sharp losses. There was a recovery on Thursday, but then news of the separatist movement winning parliamentary elections in Spain’s Catalan region sent equities skidding again Friday as investors worried about a flare-up in tensions. Even with all that the Stoxx Europe 600 managed a gain of 0.6%, and the CAC 40 in France was 0.2% higher on a weekly basis. Germany’s DAX didn’t fare as well as it retreated by 0.2% for the week. London’s FTSE avoided the sharp Tuesday and Wednesday losses, while still rallying strongly on Monday and Thursday. This gave the benchmark British index a weekly gain of 1.4% to easily lead in the European arena.

European equity markets are likely to be even quieter than their Asian counterparts in the coming week. Most markets across the region will be closed both Monday and Tuesday, leaving a three day trading week. And that going into a three day holiday extended weekend for New Years. There is also little in the way of data due during the week, with the exception of CPI data due Friday that likely won’t move markets much as there simply won’t be many traders at their desks by Friday.

US

U.S. markets got off to a great start as well, but then saw mixed results throughout the week, with modest losses in three of five sessions, and modest gains on Thursday. Still, at the close of the week the S&P500, Dow Industrials, and Nasdaq were all higher by 0.3% on a weekly basis, thanks to the Monday gains. It was also the fifth consecutive weekly gains for the S&P500 and Dow Industrials. The passage of the highly anticipated tax reform bill did little to help markets late in the week, as they limped into the holiday extended weekend. Exchanges in the U.S. will remain closed on Monday for the Christmas holiday.

Next week promises to be quiet, but perhaps not as quiet as Asia and Europe, with U.S. investors getting in a four session trading week. Still, it is sandwiched between the Christmas and New Years’ holidays, and many investors simply won’t be trading during the week, off instead on family getaways before 2018 begins.

Cryptocurrencies

It was another volatile week in the cryptocurrency space, with the coins other than Bitcoin spending the week rising to new all-time-highs, while Bitcoin floundered and slid steadily lower. The week ended with a massive selloff in the cryptocurrency space, with Bitcoin falling 30% Friday morning, and most other coins falling anywhere from 30-50%. Markets rebounded however, and most coins ended the day down by just 10% or less. Major coins were the hardest hit, with Bitcoin down roughly 25% on a weekly basis, and Litecoin falling 15% from its weekly highs. IOTA also suffered and finished flat for the week. Ethereum and Ripple were the big winners for the week, with Ethereum up some 30%, while Ripple gained roughly 40% as it surprisingly surged through the $1 level.

Given the nature of cryptocurrency markets the coming week will likely feature more volatility. While there is no sign of a recovery for Bitcoin yet, we all know that prices can flip instantly, making it possible we could see Bitcoin trading back near $20,000 by the end of the week. Conversely, we could also see it testing the Friday lows of $10,400. The closure of traditional markets should have little impact on this space, and the cryptocurrency markets will be some of the only financial exchanges seeing trading action on Christmas day.

Upcoming Events