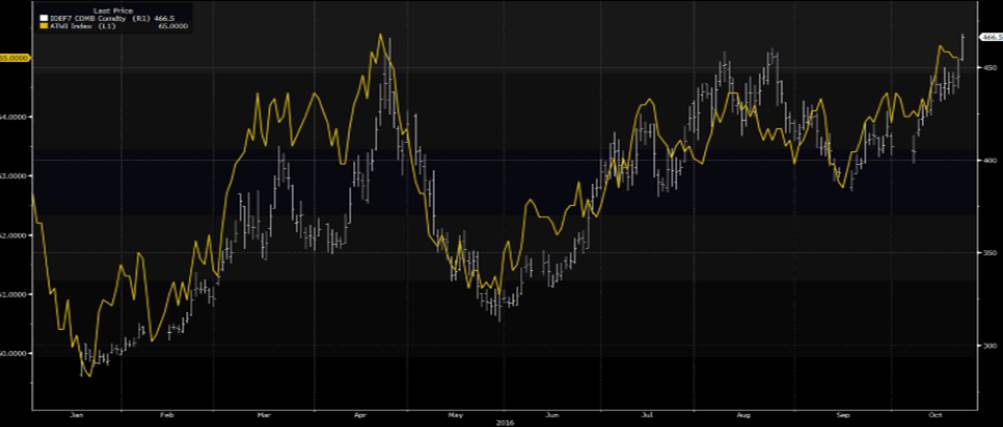

We face a sizeable amount of event risk this week, but it seems the bulls are getting the upper hand in a number of equity indices. China is well worth putting back on the radar, with the CSI 300 and China A50 cash indices eyeing a break of the 15 August highs (see chart below) and the market trending progressively higher. The Hang Seng has been in a range of 24,000 to 23,000 since September and could test the top of that range soon with earnings season firmly underway there.

We can focus on Europe where the German DAX has broken the August downtrend and is threatening a close above the August pivot high itself, while the Spanish IBEX is now at the highest levels since April. Both these markets are getting a tailwind from the weakening EUR, although Spain has seen some unease about its political situation clearing. Had you told fixed income traders in the halcyon days of the European debt crisis that the market would demand the same risk premium to hold Spanish debt as UK gilts, most people would think you were nuts! Still, to push these markets higher from here we may need to see a further fall in EUR/USD, although I wouldn’t be surprised to see a bit of a retracement in the currency pair. However, with the trend firmly lower rallies should be sold.

The S&P 500 is creeping higher (the index closed up +0.5%), but still needs a break of 2180 before I turn bullish on this market. Good buying has been seen in the technology and staples sectors and tech will play a big role in price action for the remainder of the week, with Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL) out with numbers. Caterpillar (NYSE:CAT) report in US trade tonight with the market looking for Q3 adjusted earnings of 76c, on revenue of $9.88b. They should provide a 2017 outlook, with the street looking for $39.62b, but specifically the macro community will be eyeing views around the demand seen from emerging markets and China.

In Australia, we should see some modest buying on open, specifically in the financial space with (AX:CBA)’s adr (American Depository Receipt) looking quite firm. BHP (NYSE:BHP) should open on a modestly weaker footing given US crude is a touch lower on the session, although for the seventh time since 5 October found buyers easy to come by on a test of $50 – $50 seems to be the line in the sand. As we saw yesterday, with Aussie financials rallying 0.8% off the opening low and subsequently dragging the broader index with it, there seems little concern about buying banks ahead of 2H 2016 earnings. The earnings release start on Thursday with NAB, with the financials having gained 2.3% thus far in October, just lagging behind the staples sector.

It’s worth highlighting that iron ore futures exploded to the upside with a 4.8% gain (the biggest percentage gain since 8 March 2016). Steel (rebar) futures are driving the show with a 2.5% gain. With this in mind it’s interesting to see the correlation between iron ore futures and the trade-weighted AUD moving in such a tight correlation. The correlation specifically with AUD/USD is not huge, but the pair is likely finding some support from the firmer terms of trade and lower implied market volatility (the US volatility index is now below 13). However, price action shows a divided market with the intra-day ranges contradicting and traders wanting to see the details of tomorrow's Q3 CPI and Fridays Q3 US GDP before committing themselves. AUD/USD traded in a range of $0.7591 to $0.7641.

China A50 cash index – Short-term moving averages headed higher. Watch for the break of the August highs.