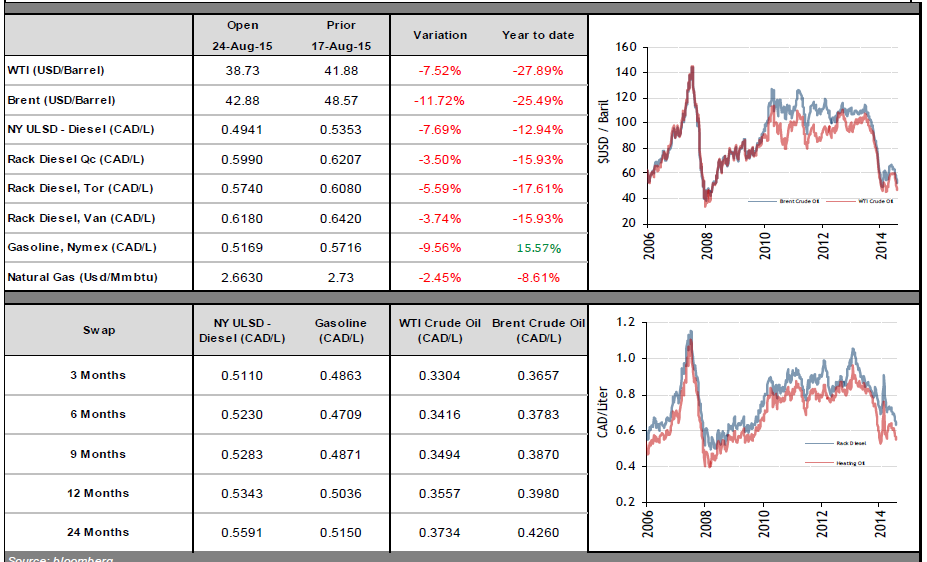

Last week, for the first time since 2009 the price of WTI crude fell below US$40/barrel, marking another week of negative returns on energy prices. WTI, Brent and diesel, priced in U.S. dollars, fell by -4%, -9.3% and -6% on the week.

The main factors explaining the sharp drop in energy prices were the massive production of black gold in the U.S., Saudi Arabia’s obstinate stance over producing at full capacity, and serious fears over the health of China’s economy.

Last week’s wave of panic was not only felt in energy prices; the S&P 500, the leading index south of the border, fell by no less than 6% in 5 days!

It should be noted that diesel prices in CAD/litre are at the lowest levels seen in close to five years. Companies that have not yet hedged their diesel supplies should take this market correction as a good opportunity to secure their long-term supply and lock in costs. But if you already have hedges in place, we recommend that you wait to see which way energy prices are heading before taking any new positions in the market.