As I noted last Friday, the recently approved budget was an anathema to any fiscally conservative policy. As the Committee for a Responsible Federal Budget stated:

“Republicans in Congress laid out two visions in two budgets for our fiscal future, and today, they choose the path of gimmicks, debt, and absolutely zero fiscal restraint over the one of responsibility and balance.

While the original House budget balanced on paper and offered some real savings, the Senate’s version accepted today by the House fails to reach balance, enacts a pathetic $1 billion in spending cuts out of a possible $47 trillion, and allows for $1.5 trillion to be added to the national debt.

Make no mistake – this is a defining moment for the Republican party. After years of passing balanced budgets and calling for fiscal responsibility, the GOP is now on-the-record as supporting trillions in new debt for the sake of tax cuts over tax reform and failing to act on the pressing need to reform our largest entitlement programs.”

Passing fiscally irresponsible budgets just for the sake of passing “tax cuts,” is, well, irresponsible. Once again, elected leaders have not listened to, or learned, what their constituents are asking for which is simply adherence to the Constitution and fiscal restraint.

As the CFRB concludes:

“Tax cuts do not pay for themselves; they can create growth, but in the amount of tenths of percentage points, not whole percentage points. And they certainly cannot fill in trillions in lost revenue. Relying on growth projections that no independent forecaster says will happen isn’t the way to do tax reform.”

That is absolutely correct.

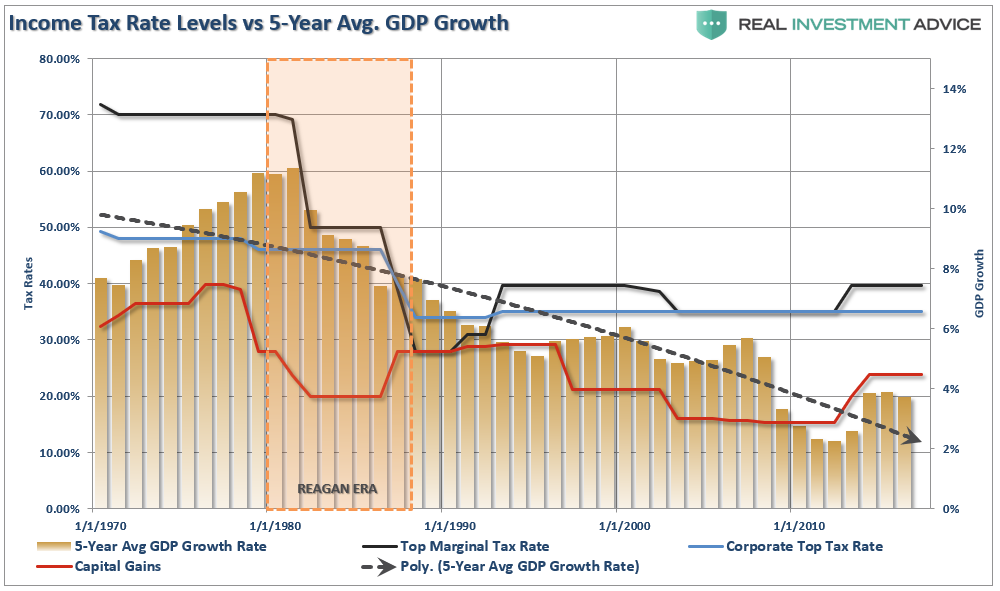

As the chart below shows there is ZERO evidence that tax cuts lead to stronger sustained rates of economic growth. The chart compares the highest tax rate levels to 5-year average GDP growth. Since Reagan passed tax reform, average economic growth rates have only gone in one direction.

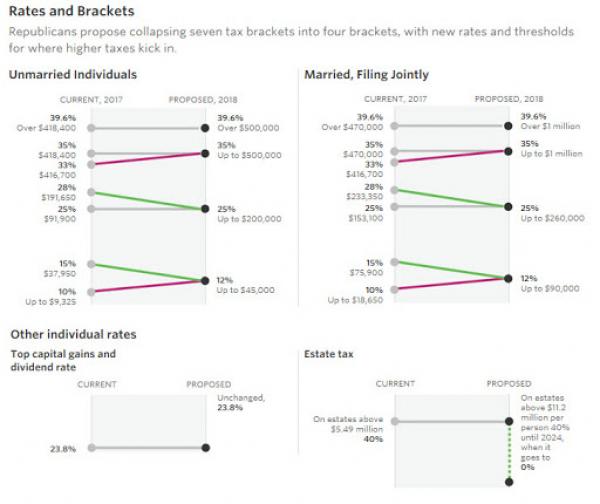

However, the most likely unintended consequence of the proposed tax “cut” bill is that it will likely translate into a “hike” on middle class Americans. Take a look at the proposed tax bracket chart below.

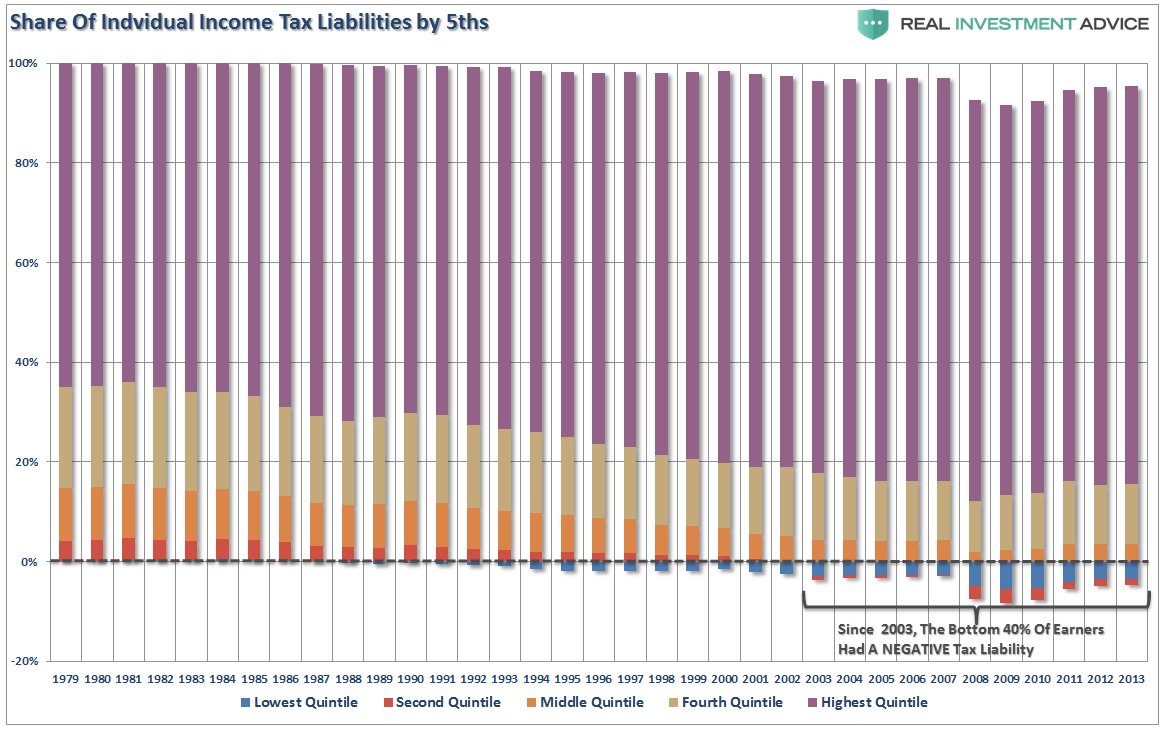

Now, compare that with the actual breakdown of “who pays taxes.”

“The bottom 80% currently pay only about 18% of individual taxes with top 20% paying the rest. Furthermore, the bottom 40% currently have a NEGATIVE tax liability, and with the new tax plan cutting many of the deductions currently available for those in the bottom 40%, it could be the difference between a tax refund and actually paying taxes. “

“Of course, those in the top 20% of income earners are likely already consuming at a level with which they are satisfied. Therefore, a tax cut which delivers a few extra dollars to their bottom line, will likely have a negligible impact on their current levels of consumption.”

Given the newly designed tax brackets compresses individuals into fewer groups, it is quite likely a large chunk of the bottom 80% will likely experience either a hike or an inconsequential change. With the bottom 80% already consuming at max capacity, as discussed yesterday, a tax increase will hit the economy right where it hurts the most – in consumption expenditures.

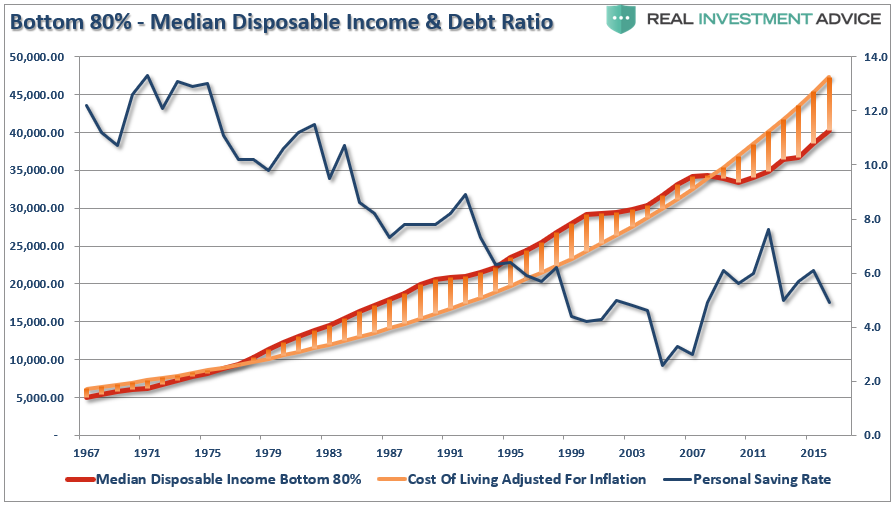

“As the chart below shows, while savings spiked during the financial crisis, the rising cost of living for the bottom 80% has outpaced the median level of ‘disposable income’ for that same group. As a consequence, the inability to ‘save’ has continued.”

But while Congressional members were campaigning yesterday the “tax plan” would give an $1182 tax cut to most Americans, it should not be forgotten that since they failed to “repeal and replace” the Affordable Care Act, any tax cut will only be diverted to offset a substantial rise in health care premiums in 2018.

Regardless, the proposed tax bill is just the first step.

Let the “horse trading” begin.