by Pinchas Cohen

The Week That Was

SPX: First Weekly Decline in 2 Months

Global stocks posted fresh records, but backed off slightly ahead of the Friday close. The S&P 500 ended 8 straight weeks of gains, forming a High-Wave candle.

The pattern expresses more than just investor confusion. It indicates that fear and a lack of leadership are back and often develops before reversals.

When Bullish Sentiment Is Also a Bearish Signal

According to Investors Intelligence, 64 percent of newsletter writers are bullish on the markets, while only 14 percent are bearish. This is the sixth week during which this particular sharp contrast between the two views remains in effect.

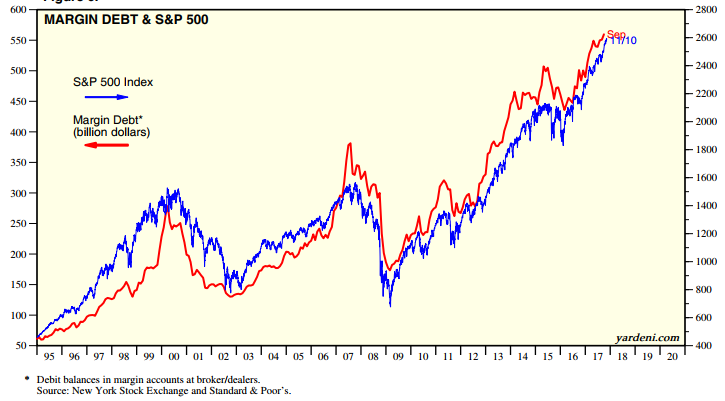

Chart courtesy Ed Yardeni

As well, margin debt—wherein very bullish investors are highly leveraged in stock investments—grew from 14 percent at the beginning of the year to 64 percent at the end of the third quarter. This is another sign of strong faith that stocks will continue to rise.

Tax Plan At Last (But Which One)

Both the House and the Senate unveiled their tax bills. The US House Ways and Means Committee amended its original tax bill, and the Senate Finance Committee introduced its own plan for the first time on Thursday. Among the many disparities between the two plans is one critical major incongruity that will need to be reconciled relatively quickly: when will it go into effect?

While the House's bill is supposed to take effect in the upcoming year, the Senate's bill would only become operational in 2019. Republican leaders are under increasing pressure to pass something before the year is out.

Off-year elections this past week didn't play out so well for GOP candidates, and mid-term elections are now less than a year away. If Republicans continue to be unable to enact a single major initiative, as has been the case since Donald Trump took office, they might find themselves out of jobs. This won’t help the President’s abysmal approval ratings either, which are already lower than those of any other president in the course of seven decades of polling. What happened to candidate Trump's claim that he was the all-time greatest deal maker?

Regulation Rollback, Maybe

While the tax plan has been the major focus over the last few months, investors might yet get a different gift they’ve also been waiting for since the Trump electoral victory, regulation rollback. This past week, newly appointed Fed vice chair for bank supervision Randal Quarles spoke publicly for the first time, indicating that he believes the Fed should take a fresh look at post-financial crisis banking regulations.

New Trade Deal and Other China Developments

The White House has been boasting of a $250 billion overall trade deal, the result of Trump's just completed visit to Beijing. Some have scoffed however, asserting the majority of the points within the deal were already previously set up. So far, China has renewed the free passage of US beef, after blocking it since 2003 on the mad cow disease scare.

PBOC governor Zhou Xiaochuan repeated his warning that China’s financial system is rapidly becoming vulnerably due to risky financial transactions. Intentionally or not, Zhou has become a force for reform as he encourages his country to open up markets, relax capital controls and reduce restrictions on non-Chinese financial institutions to counter the risk to Chinese assets.

Oil At 2.5 Year High: US Production Offers Risk Downside

While oil analysts continue to say that the Saudi Arabian anti-corruption purge drama isn't having an effect on the price of oil, the commodity gained ground amid last week's events and the uncertainty in Venezuela. Crude climbed to $57.20 from $54.60 last week.

Whether the Saudi crackdown on corruption contributed to the rise in the price of oil or not, it reached a 2.5 year high. The trend has been pushing higher at ever steeper angles, not offering a reasonable entry point from a risk perspective. It would be preferable to wait for a dip to one of the uptrend lines before entering. The three lines in the chart above represent three levels of risk. The steeper the line the higher the risk.

Even as the crackdown continues, it appears that Saudi Arabia also removed and is detaining Lebanon's Prime Minister Saad al-Hariri, which may mean that Iran will assume effective control of Hariri's home country.

Israel may not take too kindly to that. Seems geopolitics continues to roil the Middle East, which could support oil.

The renewal of old tensions in the Middle East alongside Venezuelan debt default risk appear to have been behind the multi-year push. However, US production is always another factor just around the corner, leaving risk to the downside, rather than the upside.

Sterling Can’t Catch a Break

Forty UK Conservative lawmakers are ready to oust Prime Minister Theresa May. She has been pursuing a hard Brexit line, while promising UK lawmakers and voters that this is best for the future of the country. She's also promised she'll get the job done on the best terms for the UK and within a reasonable timeline. Unfortunately she's has been bogged down by a series of political scandals. Both her Defense Minister and Secretary of State for International Development were forced to resign. Concurrently, the EU has been taking a harder negotiating line.

The Week Ahead

All times are in EST

Monday

12:45: Japan – BOJ Governor Kuroda Speaks

The yen has managed to keep the dollar locked within a range since March, even as the dollar strengthened on the possibility of tax reform, as well as risk-on returning to markets via continuous new record highs. This, even after Japan's central bank governor Kuroda clarified that accommodation is here to stay.

Japan’s economy is set to show seven straight quarters of growth, the longest expansion since the eight-quarter streak that lasted from April-June 1999 to January-March 2001, according to Reuters. Might any of this change the BOJ boss’s tone on accommodation?

If so, it's likely to provide a strong boost to the yen, which already pushed the dollar back into its range.

The USDJPY's Bearish Engulfing pattern, at the range-top, suggests the pair is likely to return toward the 108 range bottom.

Tuesday

2:00: Germany – GDP (Q3, flash): forecast to rise to 2.2% from 2.1% YoY, and remain at 0.6% MoM.

4:30: UK – CPI (October): prices expected to grow 0.2% MoM and 3.2% YoY, from 0.3% and 3.2% respectively. Core CPI to rise 2.8% YoY from 2.7%.

Inflation, along with monthly unemployment information and retail sales results will paint a picture of the state of the UK economy as a result of last year’s Brexit vote, during a time when PM Theresa May is being challenged and the EU is taking a harder Brexit line.

Investors will also try to figure out whether the recent first rate hike by the BOE in more than a decade was an anomaly or whether it might become part of faster path to higher rates.

Last week’s GBP/USD price action erased two weeks' worth of losses. The fact that it happened atop the 1.3000 line compounds confidence that the GBP should gain strength. However, political instability is likely to turn that around. The 1.3000 level will be key.

5:00: Eurozone – GDP (Q3, 2nd estimate): growth expected to be 0.6% QoQ and 2.5% YoY.

5:00: Germany – ZEW Sentiment (November): economic sentiment forecast to rise to 19.2 from 17.6.

8:30: US – PPI (October): prices expected to rise 0.1% MoM from 0.4%.

18:50: Japan – GDP (Q3, preliminary reading): forecast to be 2.6% YoY from 2.5%, and 0.3% from 0.6% QoQ.

Wednesday

4:30: UK – Employment Data: Claimant Count expected to rise to 8.9K in October, from 1.7K in September, while the September Unemployment Rate remains at 4.3% and Average Earnings rose 2.1% from 2.2%.

8:30: US – CPI, Retail Sales (October): CPI expected to be 2% YoY and 0.1% MoM, from 2.2% and 0.5% respectively. Retail sales forecast to rise 0.1% MoM from 1.6%.

While investors were disappointed with Jay Powell, considered a dovish pick for the Fed’s next Chair, the central bank's new vice chair of supervision, Randal Quarles, has suggested that regulation rollbacks could be ahead by indicating thye US might need to revisit its post-crash view. Rising inflation would support a path to higher interest rates.

As for the Dollar Index, an H&S bottom neckline supported the currency's move, suggesting from here on out the price should rise.

10:30: US – EIA Crude Inventories (w/e 10 November): stockpiles rose by 2.2 million barrels last week.

19:30: Australia – Employment Data (October): 23,800 jobs expected to have been created, from 19,800, while the unemployment rate is forecast to rise to 5.6% from 5.5%.

Thursday

4:30: UK – Retail Sales (October): forecast to fall 0.1% from -0.8% MoM, and fall 0.8% from 1.2% YoY.

5:00: Eurozone – Inflation (October): expected to rise 0.1% MoM from 0.4%, well below the ECB target. This would support the ECB slower path to withdraw monetary stimulus slowly, which disappointed euro investors so much.

The EURUSD's H&S top’s neckline has been resisting the return move, in a mirror image of the DXY, suggesting from here on out, the pair should trade downward within the dotted projected channel.

8:30: US – Initial Jobless Claims (w/e 11 November): forecast to fall to 236K from 239K.

Friday

8:30: Canada – CPI (October): prices expected to rise 0.1% MoM and 1.6% YoY, from 0.2% and 1.6% respectively.

Last month the Bank of Canada, disappointed investors when it left its interest rates unchanged. It also said it will remain cautious regarding any future rate hikes, due to the economy’s risks.

The recent USD/CAD weakness is considered a correction, a dip back to the uptrend line, suggesting the pair should rise to retest the 1.29, former peak from November.

8:30: US – Housing Starts and Building Permits (October): building permits rose fell 3.7% in September, while housing starts fell 4.7%.