The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday lower.

- ES pivot 1878.92. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- YM Futures Trader: still long at 16,434.

Recap

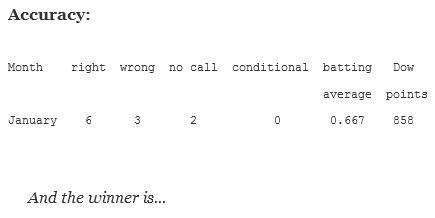

After calling Tuesday higher I was pleased to see the Dow pop right out the gate as opposed to so many days this year when it took an immediate dump instead. But then I began to worry as it spent most of the rest of the day just falling lower again as the bears reasserted themselves. It looked like my call for a higher close was going down the drain until it was saved at the last minute by a late afternoon rally to finish with a 28 point gain. Meager as it is, I'll take it. So having dodged that bullet let's move ahead to Wednesday and see where that will be going.

The technicals

The Dow: On Tuesday the Dow formed a textbook perfect long-legged doji star near the lower end of last Friday's big dump. This small game was nonetheless good to finally lift the indicators off of oversold as they continue to drift slowly higher. The stochastic is now threaded out at oversold and has no predictive power. So what we're left with is a reversal warning but considering the way things have been going all this year so far I will require some confirmation first.

The VIX: Last night I said the VIX looked likely to go lower on Tuesday and that's exactly what it did, dropping 3.59% back down to a still relatively elevated 26.05 on a green inverted hammer. However that was enough to send all the indicators finally on their way off of overbought levels towards oversold. And also what looked like an incipient bullish stochastic crossover from a high level was cancelled and now it's looking more like a bearish crossover. The overall impression is that there still room to run lower here; however that's far from a given considering the craziness we've seen all year so far. So I'm just going to defer on this chart tonight.

Market index futures: Tonight, all three futures are sharply lower at 12:19 AM EST with ES down a massive 1.47%. On Tuesday ES put in a lopsided long-legged doji star nearly retracing both last Friday's highs and lows at one point intraday. The net result was little change and the indicators are now wondering about just off of oversold. The stochastic, which looked like it was forming a bullish crossover, has now threaded out and thus has no predictive power. In addition, OBV continues to fall as it has for the last four days now hitting -5 million. This is the sort of reversal warning that requires confirmation and at least with ES we can get that in the overnight. But right now there is no confirmation as ES is just continuing lower once again. It now appears intent on retesting for the third time the September lows. If that fails, it will move on to the August lows around 1857. However with this chart more oversold than overbought, I question whether there is much more downside available here. Nevertheless right now this chart is not looking very healthy at all.

12:15 AM update: ES has now broken down through August daily closing support at 1857, disconfirming the doji. All that remains is the August intraday low at 1824.25 and we're not that far from that. If that goes, we're in uncharted territory - that's the lowest level this contract has hit since it began trading.

ES daily pivot: Tonight the ES daily pivot dips from 1881.75 to 1878.92. That still leaves ES well below its new pivot, so this indicator flips right back to bearish.

Dollar index: Last night the dollar looked too tough for me to call despite something of a fat hammer candle. It did try to rally on Tuesday with a nice early gap up, however it spent the rest of the day retracing that before finishing virtually unchanged for a tall red candle. That left all the indicators quite overbought with the stochastic starting to narrow around for a bearish crossover. This is just about a dark cloud cover so the overall impression here is negative for Wednesday.

Euro: Last night I thought the euro might go lower on Tuesday but instead it did manage a small advance to close back up to 1.0839. However it did it on a narrow hanging man at the upper end of the last week's trading. But that was enough to send the indicators moving higher again, though they have not yet reached overbought. The overall action here looks fairly nervous and the new overnight isn't really going anywhere either, so tonight I am not going to touch this chart. Sorry.

Transportation: Like the Dow, the trans continued lower on Tuesday in a bit of barish divergence losing another 0.48%. That now makes it three reversal warnings in a row, this one on a classic red spinning top. But these sorts of candles seem to mean very little these days. Oddly enough all the indicators continue rising from their oversold levels of a week ago with the one exception of OBV which continues fall and having now reached crazy low level of -10 million. The pace of the decline does seems to be slackening but it is still impossible to call a reversal on this chart. The selling has to end sooner or later but at this point I'm just not sure when that might be. Moving all the way out to the monthly chart shows absolutely no support here all the way down until the 6186 level which was set all the way back in the middle of 2013! That is not very encouraging. The trans are following the same path as the Dow and at the current month-long rate of change, are due to hit zero in mid-April of this year. That's right, in three months we can all pack up and go home.

Tonight it's just looking like more of the same old same old - oil and China, China and oil with no end in sight. This one unfortunately is pretty clear: Wednesday lower.

YM Futures Trader

No change tonight.