The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher.

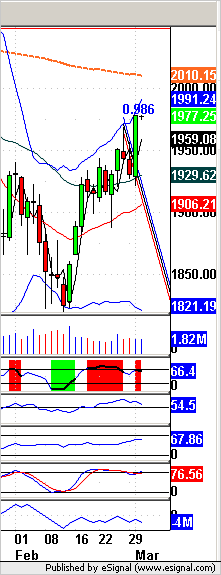

- ES pivot 1959.08. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- YM futures trader: no trade.

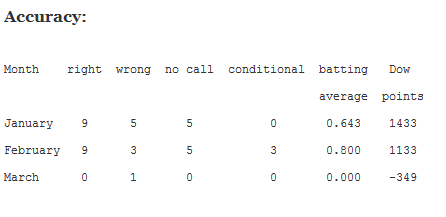

Foo. I sure picked yet another bad day to be wrong some good economic news totally torpedoed the technicals resulting in the market having its best day in a month. Oh well - as Fred Astaire said in Swing Time, you "just pick yourself up, dust yourself off, and start all over again". I always hate starting off the month with a loser but we will endeavor to get back in step and pick Wednesday right.

The technicals

The Dow: On Tuesday the Dow jumped 2.11% on a tall green marubozu that was stopped only by its upper BB. And even that wasn't enough to send the indicators overbought. That leaves the Dow in a funny sawtooth rising pattern. And the last two times we've hit the upper BB, the next day was lower. Hmmm...

The VIX: Last night I was equivocating over the VIX. Turns out the reversal candle was confirmed as it fell a big 13.87% to come crashing down through its 200 day MA, giving up the 20 handle for17.70. With a tall red marubozu and the lower BB not til 16.87, there's nothing bullish about this chart tonight.

Market index futures: Tonight, all three futures are higher at 12:20 AM EST with ES up 0.13%. On Tuesday ES had a fantastic day, busting out of a new descending RTC with a jolly green giant marubozu and also ending right on its own upper BB at 1978. That sent the indicators back to just overbought. The candle itself isn't bearish but lately ES has been taking a break after big one day rallies so that's what I'd expect there on Wednesday.

ES daily pivot: Tonight the ES daily pivot rises from 1937.42 to 1959.08. ES remains well above its new pivot so this indicator flips back to bullish.

Dollar index: On Tuesday the dollar totally disconfirmed Monday's wanna-be evening star, instead gaining 0.15% on a lopsided green spinning top. That sent the indicators to extreme overbought but this is a reversal sign that requires confirmation.

Euro: Well at least I got the euro right on Tuesday. It indeed fell some more to close down to 1.08695 after exactly touching its lower BB and bouncing back a bit. That still leaves indicators quite oversold but with the lower BB hit and no further deterioration in the overnight, I think a reversal may be at hand here.

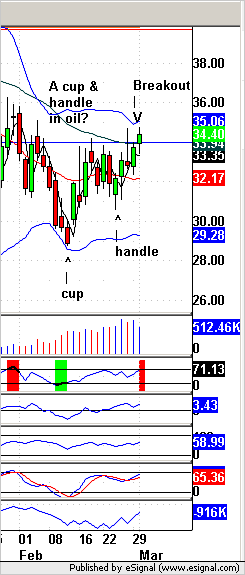

Oil: Remember the cup and handle I showed here last night? Well oil gained some more on Tuesday. If this holds, it would constitute a breakout and confirmation of the cup and handle. This is generally a very good bullish pattern.

What a difference a day makes. Tonight there are suddenly essentially no bearish signs on the charts and the futures are holding onto Tuesday's gains. I know I'm going to run the risk of getting whipsawed, but I just can't see how I'd make a bearish case here, so I'm just going to have to call Wednesday higher..

YM Futures Trader

No trade tonight.