The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher, low confidence..

- ES pivot 2051.00. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

The sell-off continued Tuesday with the Dow 30 down big time again right out the gate until Mr. Market figured out that maybe the world wasn't coming to an end after all. We then spent the rest of the day slowly slogging uphill to finish still down but only by 51 points. The chart implications are interesting so let's get right to them.

The technicals

The Dow: On Tuesday the Dow drew a textbook perfect classic hammer candle iif ever I saw one. Thing is though, it was also a bearish RTC trigger along with a completed bearish stochastic crossover and indicators only just now off overbought. So who ya gonna believe/ Hmmm... Moving on...

The VIX: THis is perhaps the best chart of the day. ON Tuesday the VIX began with a huge gap up, only to spend the rest of the day sagging lower. The end result was still a 4.79% gain but on a tall red marubozu, evening star-style. This trade was entirely above the upper BB® and as I always say, the VIX never likes to spend much time at those altitudes. So my best guess is we're looking for lower here on Wednesday. That's supported by VVIX which is quite overbought and put in a big gap-up doji on Tuesday for 2/3 of an evening star.

Market index futures: Tonight, all three futures are lower at 12:15 AM EST with ES down 0.09%. On Tuesday ES, like everything else, put in a very tall hammer that came close to its lower BB and caused RSI to bottom before hitting oversold. This is an excellent reversal sign. I'd be happier though if we were seeing some positive pin action in the overnight.

ES daily pivot: Tonight the ES daily pivot drops from 2063.58 to 2051.00. That was more than enough to put us back above the new pivot despite a sag in the overnight so this indicator turns bullish.

Dollar index: Last night I wrote about the dollar index, "this one looks lower on Tuesday." And indeed it was as the bearish engulfing pattern asserted itself. Another gap-down hammer here makes a good case that we could see a move higher on Wednesday.

Euro: And of course as the dollar weakened the euro gained on Tuesday, though not with an inverted hammer. But it did just barely manage to squeak out a bullish RTC setup and with a rising stochastic and indicators just off oversold, I'd say there's more upside potential than downside risk here on Wednesday.

Transportation: And finally on Tuesday the Trans put in an even bigger hammer than the Dow did. A gap-down hammer like this that punches through the lower BB is quite unusual and an excellent reversal sign. Enough that I'm calling this one higher on Wednesday even though we've yet to hit oversold.

Whew - we've got a boiler factory-worth of hammers on the charts tonight! More than I think I've ever seen. That's quite a powerful reversal sign. In addition, the SPX Hi-Lo index is now down to 66 - not screamingly low but still lower than the last reversal we saw on December 1st. And the NYSE A/D line has stopped putting in lower lows and lower highs, so that's always a good sign. The only real problems I've got tonight are that 1, I'd prefer seeing ES moving higher rather than even a bit lower and 2. while we have a lot of reversal candles, they're not supported by the indicators which have yet to hit oversold.

I guess I'm just going to have to close my eyes, shinny waaay out on the limb and nervously call Wednesday higher. I could be wrong. Lord knows I am often enough.

ES Fantasy Trader

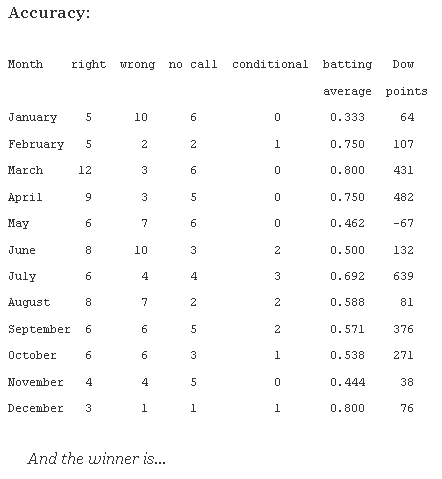

Portfolio stats: the account now stands at $110,500 after ten trades in 2014, starting with $100,000. We are now 7 for 10 total, 5 for 5 long, 2 for 4 short, and one push. Tonight we stand aside.