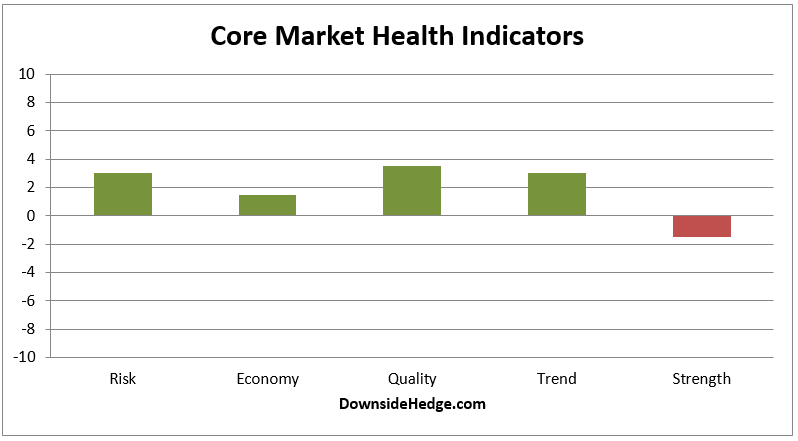

Over the past week, most of my core market health indicators fell. Most notably, my measures of market strength went negative. This changes the core portfolio allocations (below). Another thing that was interesting this week is that the fear everyone is talking about isn’t showing up in my Market Risk Indicator yet. The most sensitive components of that indicator think the saber rattling this week is a non-event event. That’s not to say a negative risk reaction won’t materialize, but until it does we have to operate under the assumption that this event will quickly fade as a market moving issue.

The new portfolio allocations are as follows:

Long / Short Hedged portfolio: 90% long high beta stocks and 10% short the S&P 500 Index (or use the ETF with symbol SH)

Long / Cash portfolio: 80% long and 20% cash

Volatility Hedged portfolio: 100% long (Since 11/11/2016)

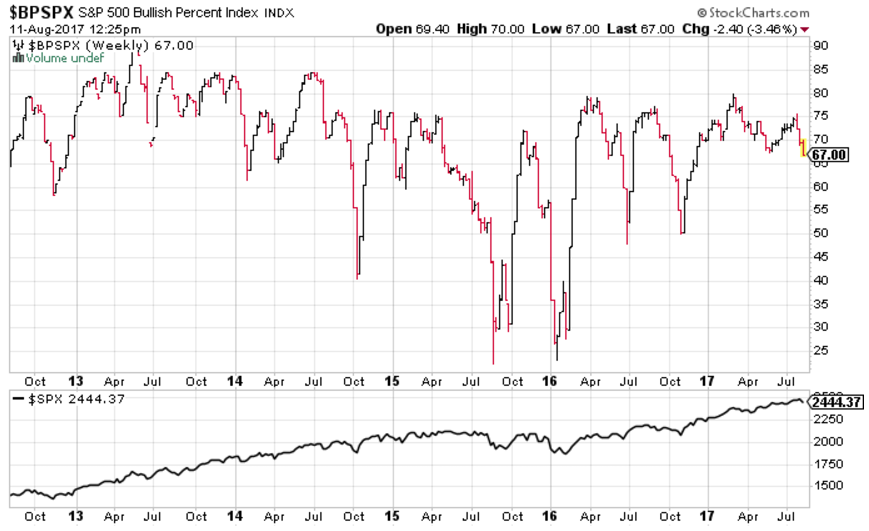

One thing you can keep an eye on is the bullish percent index (BPSPX). It is still a good distance above my threshold of 60%. However, if it falls below that level then the odds of a large market decline increase dramatically.

Conclusion

Core market indicators are weakening, but risk isn’t rising substantially… yet. It’s time to start paying attention, but not panic.