Wayfair Inc. (NYSE:W) recently announced plans of offering $400 million of convertible senior notes in a private placement.

The interest rate, conversion rate and certain other terms of the notes are yet to be determined.

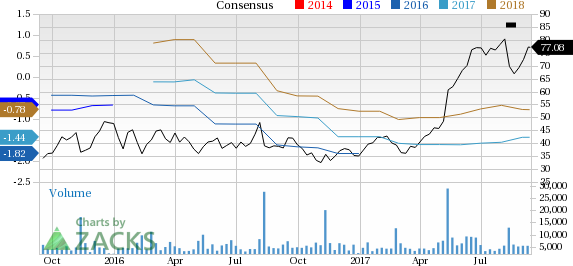

Over the last one year, shares of Wayfair have been steadily treading higher. The stock returned 105.7% compared with the industry’s gain of 39.0%.

More Into the Headlines

The notes will be offered to qualified institutional buyers only, and in accordance with Rule 144A under the Securities Act of 1933, as amended. The company will also give the initial purchasers of the notes an option to buy up to an additional $45 million aggregate principal amount of the notes to cover any over allotment. This option will be exercisable for 13 days.

Interest on the notes will be paid semi-annually and will mature on Sep 1, 2022.

In connection with the pricing of the notes, Wayfair expects to enter into more convertible note hedge transactions with the initial purchasers or their affiliates if required.

The company also expects to use certain portion of the proceeds to pay the cost of the capped call transactions. The remaining net proceeds will be used for working capital and general corporate purposes.

Wayfair’s Cash Position

As of Jun 30, 2017, the company had cash equivalents and marketable securities balance of almost $255.9 million, down from $276.7 million in the prior quarter. Also, the company generated $18.1 billion of cash from operations, spending $33.6 billion on capex and $11.7 million on site and software development. Principal repayments of capital lease obligations were $82.7 million in the second quarter.

We believe that the company has a strong balance sheet, which will help it in capitalizing on investment opportunities and pursuing strategic acquisitions, further improving its growth prospects. Moreover, the senior notes offering will bring down the company’s cost of capital, thus strengthening its balance sheet and supporting growth.

Bottom Line

Wayfair is well positioned in the home furnishing retail market. We remain positive about the company’s market position, product selection and expanding customer base.

Also, its high revenues and strong metrics growth is a big positive. We believe that the company is being driven by logistic and international expansion.

Zacks Rank and Stocks to Consider

Currently, Wayfair has a Zacks Rank #3 (Hold). A few better-ranked stocks in the same space are Lam Research Corporation (NASDAQ:LRCX) , Applied Materials (NASDAQ:AMAT) and Stamps.com Inc. (NASDAQ:STMP) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Applied Materials delivered a positive earnings surprise of 2.66%, on average, in the trailing four quarters.

Stamps.com Inc. delivered a positive earnings surprise of 30.64%, on average, in the last four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Stamps.com Inc. (STMP): Free Stock Analysis Report

Wayfair Inc. (W): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research