During all the trading mayhem, I did a Slope PLUS Post (you know, for the people who actually FINANCIALLY SUPPORT all my hard work………..) about shorting the NYSE:XLU. Here’s the post. In it, I said it was time to short XLU. I’ve put an arrow where, I kid you not, is the exactly minute bar where the post went out.

For me, it was a really weird day. The strangest thing is the combination of these two facts:

- I came into the day completely and aggressively short

- There was a portion of the day when I actually had a LOSS for the day!!!

What a pisser, huh?!?!!?

Well, Tim, how on earth could you manage that? How did you manage to be in the red on a day when the Dow was down so hard? Do you seriously suck that bad?

No, no. Truth to tell, i wound up the day with a GREAT profit. The obstacle for me was that my positions are heavily interest-sensitive, and with interest rates plunging, it kicked my portfolio in the balls. I spent most of the day massively underperforming, but by the end, things turned out fantastic.

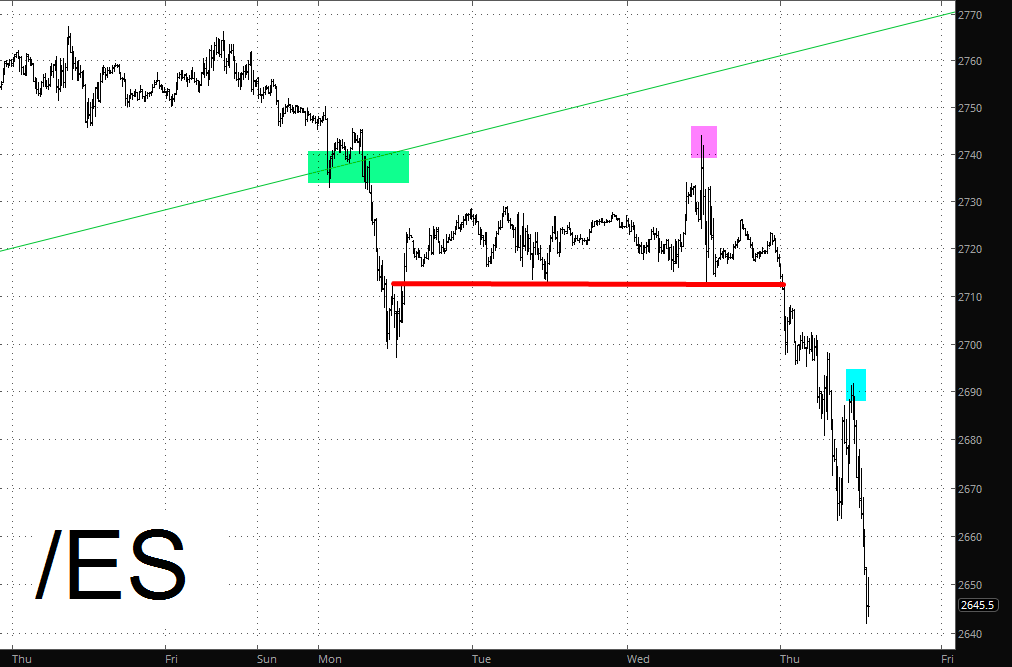

Let’s review recent ES activity:

The GREEN tint marks the point that I’d be yammering on about for so long, since so many trendlines were dependent on this level. The failure there on Sunday night/Monday morning marks the beginning of the end.

The MAGENTA tint was the extremely brief “golly, only 3 more rate hikes this year!” rally, which made me very, very, very sad. But those emotions are a memory now.

The TEAL tint was the time today when I actually had a loss on my portfolio. That also made me sad. But we don’t want me to be sad, do we? Of course not. So the market swooned lower, and for whatever reason, all the real estate stuff that had been causing me so much trouble earlier in the day decided to cooperate and start falling too.

At the moment, I have 64 short positions, and every single one is in the green. It’s so weird, because you never can tell when a day like today is going to take place. Just spectacular.