The euro's rally in recent weeks has reached an area of possible reversal. Here, we examine the prospects for a resumed decline in the Invesco CurrencyShares® Euro Currency Trust (NYSE:FXE).

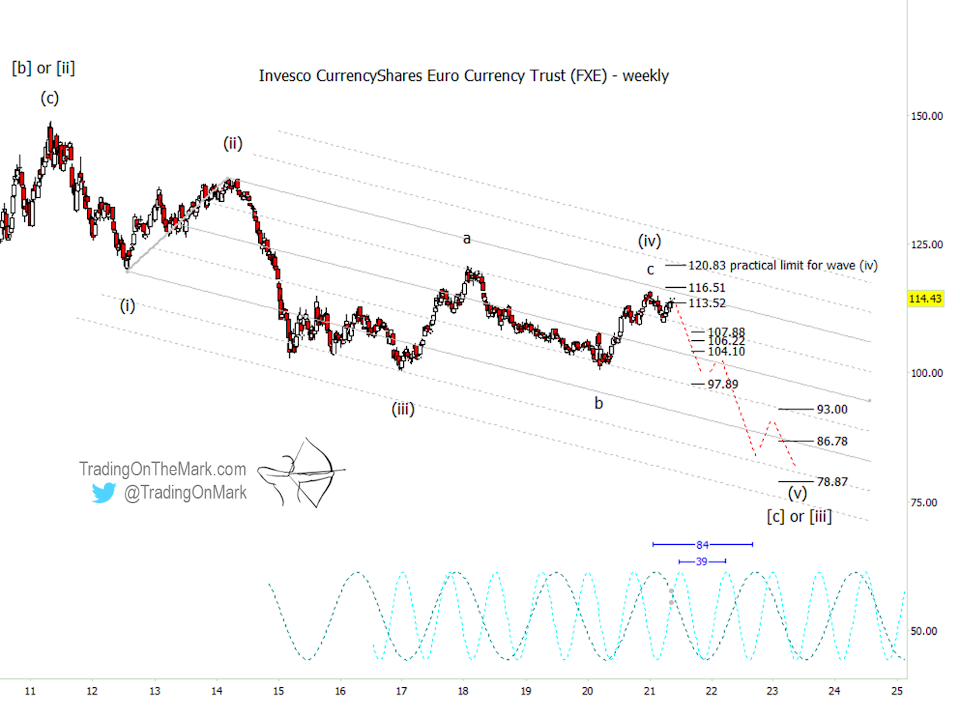

As we track the progress of an Elliott wave count for FXE, the biggest question is whether the corrective structure of the past four years is complete yet.

We are treating the up-down-up structure that began in January 2017 as wave (iv) in what should be a five-wave (i)-(ii)-(iii)-(iv)-(v) downward sequence. Price has shown some initial response to resistance near 116.51, but a test of the higher 1x1 resistance level at 120.83 is still possible. The structure can be considered valid as a fourth wave as long as it doesn't push above the 122.30 area.

If euro bears succeed in producing a minor lower high near the current area, then supports to watch during the remainder of 2021 would include 107.88, 106.22 and 104.10. Even 97.89 could be a stretch target this year, perhaps coinciding with the low points in the 39-week and 84-week dominant cycles shown on the chart.

Eventually, we expect price to break beneath the 2020 low. Fibonacci multiples of wave (i) suggest downward targets for wave (v) at 93.00, 86.78 or 78.87.

When the five-wave decline is eventually complete, it could mark a very long-term low for the euro. That event might be in store sometime in 2023 or later, and there will be bearish and bullish trade opportunities until then.

Keep in mind, it's not yet confirmed that the small upward move of recent weeks is truly a retrace forming a lower high. Euro bears hope to see some acceleration downward from the 113.52 area to serve as confirmation.

Trading On The Mark provides detailed, nuanced analysis for a wide range of markets including crude oil, the S&P 500, currencies, gold, and treasuries.