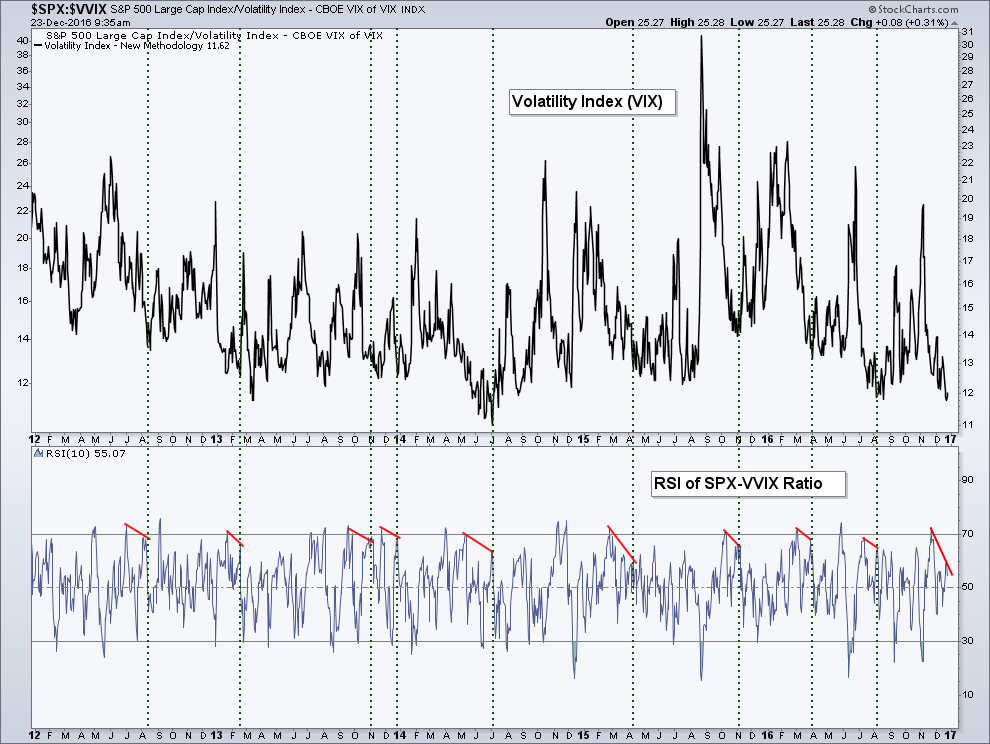

One of the great things about being a technician is the ability to constantly explore new charts and look at markets from all angles. The Volatility Index (VIX) has gotten a lot of attention lately as it gets to historically low levels. Charlie Bilello, CMT pointed out that the VIX earlier this month was down 48% in the prior 5 weeks, marking the 2nd largest five-week decline in history. Today I want to look at what I believe to be a unique ratio chart -- the S&P 500 and the Volatility of the VIX.

This ratio compares the relative performance of the S&P 500 equity market to the Volatility of the Volatility Index. What I’m most interested in is how momentum of this ratio acts and the timing of moves for the VIX itself. And that’s exactly what I’m looking for in this ratio chart below. When the two-week Relative Strength Index (RSI) for the S&P 500-VVIX ratio -- shown in the bottom panel -- moves above 70 (becoming ‘overbought’) and then declines as the VIX itself declines, it has marked some interesting turning points for the Volatility Index and has often marked the eventual low (or close to it) for the VIX.

This is a setup that’s taking place right now as the VIX drops under 12. It’s possible we see the VIX go higher from here, but over what time frame, we do not know. As of this post, the VIX is up and we’ll see if that continues as we finish out the year.

Merry Christmas.