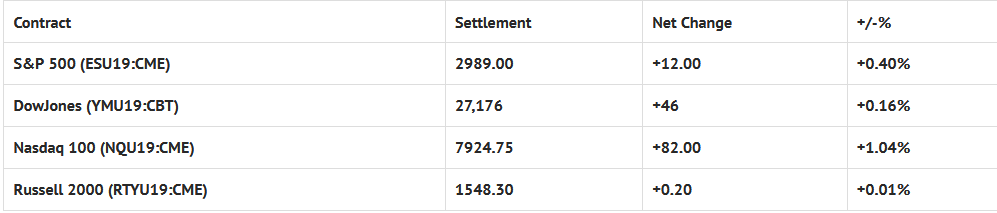

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.45%, Hang Seng +0.34%, Nikkei +0.95%

- In Europe 13 out of 13 markets are trading higher: CAC +0.94%, DAX +1.72%, FTSE +0.63%

- Fair Value: S&P +2.17, NASDAQ +15.40, Dow -16.00

- Total Volume: 1.1 million ESU & 33 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Redbook 8:55 AM ET, FHFA House Price Index 9:00 AM ET, Existing Home Sales 10:00 AM ET, and the Richmond Fed Manufacturing Index 10:00 AM ET.

S&P 500 Futures: Buy Nasdaq / Sell Russell 2000

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +8 as markets proved it can hold the prior breakout area (2975ish) as Washington kicks the can further down the road.

The S&P 500 futures (ESU19:CME) made a 2972.50 low on Globex Sunday night, 2 handles below Friday’s low, and then rallied 16 handles to print a high at 2988.25.

On the 8:30 futures open, the ES traded 2984.50, and then sold off down to 2981.50. After the early low, the futures rallied up to 2989.00 at 9:00, sold back off down to a higher low at 2982.00, then had one last blast up to a lower high at 2986.75, before selling off down to a new daily low 2978.50.

The futures bounced back up to the vwap, and then sold off down to 2978.75, one tick above the previous low. The next move was up to 2985.75, then back down to a 2981.50 double bottom, and then up to 2989.25.

After a little ‘back and fill’ at the 2987.50 level, the ES made a new daily high by 1 tick at 2989.75. The futures quickly pulled back down to 2985.75, and then ran a bunch of buy stops up to a new daily high at 2993.50, up +16.50 handles on the day.

After the high, the ES pulled back down to the 2984.75 at 2:40, as the MiM moved from $75 million to sell, to $480 million to sell. The futures then traded 2986.00 as the 2:45 cash imbalance showed $479 million to sell. From there, the ES went on to print 2987.00 on the 3:00 cash close, and settled at 2989.25 on the 3:15 futures close, up +12.25 handles on the day.

In the end, it was all about squeezing out the shorts. Its was also about a big buying tech stocks and selling the small cap Russell 200 stocks. As I mentioned, it seems like there is some type of rotation going on every day, and how if you choose the right index, the bots do all the heavy lifting for you!

In terms of the markets overall tone, ES was firm, but still seems a bit skittish. In terms of the days overall volume, it was on the low side, with 1.06 million futures traded.