Post-Fed selling took on a life of its own yesterday. So far so good, but isn't the downswing getting a little ahead of itself?

Today, it's primarily the credit and debt markets that will shed more light. And what about today's inflation expectations and consumer sentiment data? Will they drive more selling yet?

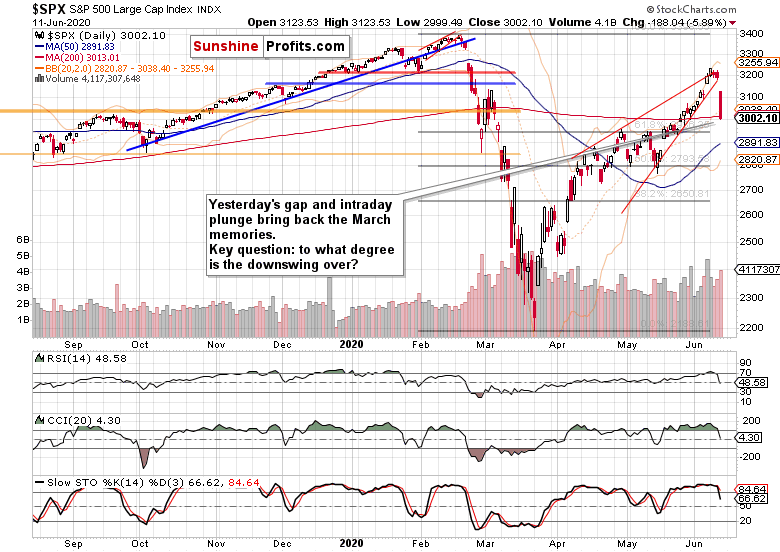

S&P 500 in the Short-Run

Let’s start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

A red candle from an era not-so-long ago gone, might be one's first idea. Rightfully so, the volume has risen with yesterday's selling as well. Likewise, the daily indicators are on their sell signals now. We saw invalidation of the breakout above the red bearish wedge, and also an island reversal – all of these are very bearish signs.

Yet, the rightful question to ask would be how much follow-through selling will we get before the bulls step in. The vacuum they've left has been a profitable one, bringing in a 40-point gain in much less than 24 hours.

The overnight rebound struggles in the 3050-3070 range so far, and given that the inflation expectations will come in still elevated in my opinion, that makes for an interesting dynamic.

Anticipation of higher price tags downs the road could leave some market participants thinking that the Fed will turn less active in its monetary policy stance, exerting short-term pressure on stocks that wouldn't be balanced by the consumer sentiment coming in reasonably strong. That's the potential for a very short-term play.

The narratives driving yesterday's plunge haven't changed, and new ones haven't taken the market's short-term focus either. The Fed is here, and so is the fear of the second corona wave.

However, stocks are largely disregarding that, and every dip earlier today, has been bought. This is making me think that we won't get much more short-term downside price action in stocks – unless fear truly returns and anyone having a handle on policy levers issues some stern warnings.

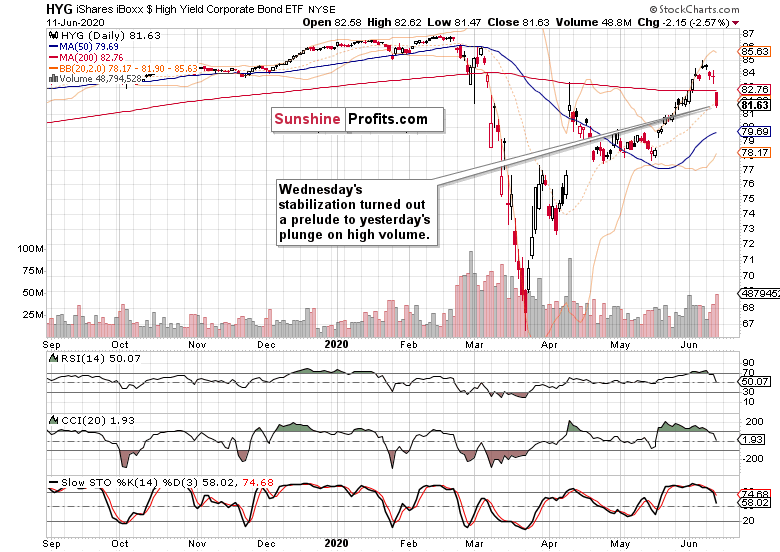

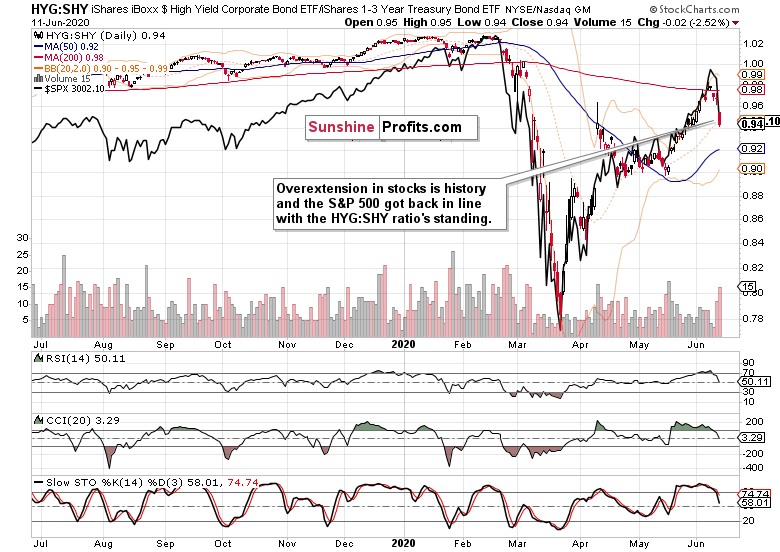

Let's check how attuned to the credit markets the stock downswing was.

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) declined profoundly after their deceptively stable performance on Wednesday. The move down happened on sizable volume, closing near the

daily lows, which is a pretty bearish combination.

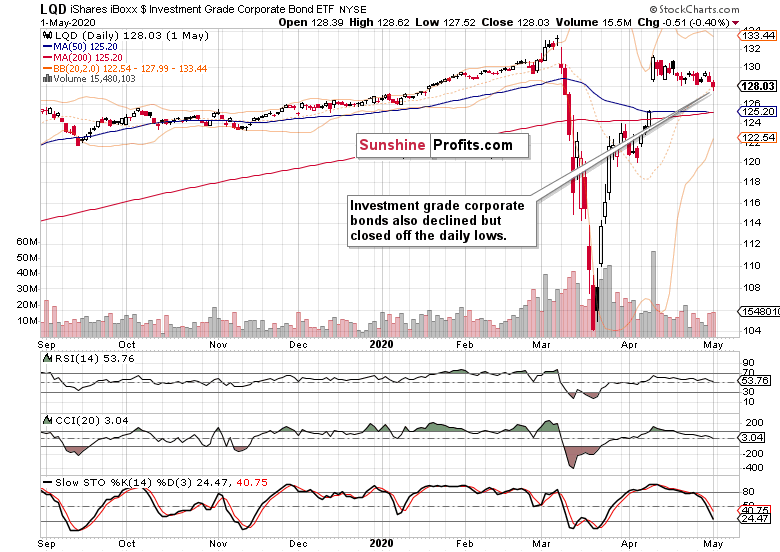

Investment grade corporate bonds (LQD ETF) fared better as they staged a partial rebound off the daily lows. Also, it can't be really said they're breaking down here.

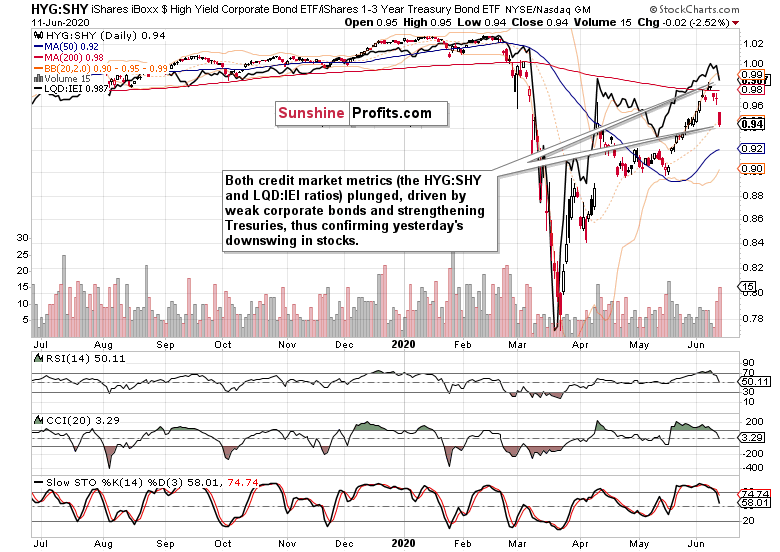

Naturally, both leading credit market ratios (HYG:SHY and LQD:IEI) confirm each other's moves, with the more risk-on one (HYG:SHY) having fallen faster. This just goes to show the

extent of where the risk-off pendulum has swung with yesterday's S&P 500 move.

Today's premarket action in stocks shows that corporate bonds won't probably continue much lower later today. How would their stabilization reflect upon stocks?

It appears that we've seen more panic in the credit markets than in stocks actually. And the fact that the S&P 500 hasn't fallen further given such bearish catalysts, is a subtle sign of

internal strength in stocks, regardless of any short-term patterns that can justifiably lure the bears to sell.

I think that stocks are telling us here that they don't care about corona (at this point), China, riots – it's only the Fed's money spigots. The moment corporate credit recovers, we'll have it

confirmed – otherwise stocks would be just too slow to get it. But they're not again declining with vengeance, which is promising for the bulls.

That's why I expect this sharp panic selling to be followed by short-term stabilization with an upside bias, perhaps a failed selling attempt next, and finally with the measured grind higher

resumption.

Mid-June, I think it's too early for stocks to worry about second corona wave on a continuous basis. Staying nimble in a similarly fluid situation is the right short-term course of action.

Summary

Summing up, yesterday's steep stock selloff didn't follow during the overnight session, and the signs of short-term stabilization are present. We might have seen the local bottom yesterday. The narrative of reopening optimism has been challenged by yet another down-to- earth Fed real economy assessment and returning coronavirus fears – but look how well

stocks recovered when Fed governors last spoke (Jerome Powell at Peterson Institute in mid-May).

Coupled with the expected recovery in the credit markets, this positions the stock bulls to dust themselves off and gradually continue higher – regardless of the rising wedge breakout

invalidation or island top reversal we saw yesterday.