This is getting old.

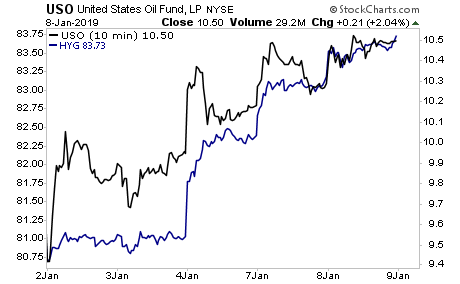

The PPT is now juicing oil higher, because doing so relieves stress in the junk-bond market (a large percentage of junk bond issuers are shale companies that require higher Oil prices to be profitable).

This, in turn, is sending an “all-clear” signal to stocks, inducing algos to buy indiscriminately.

Put simply, the formula for this market rig is:

Buy oil futures, because it will drive junk bonds higher, and stocks will follow.

You can see the rig right here in plain sight… Oil (black line) pulling Junk Bonds higher (blue line) almost tick for tick.

United States Oil (NYSE:USO), iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG)

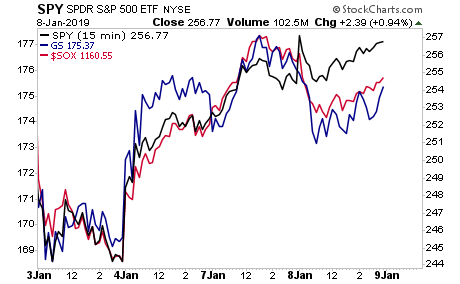

Critical market internals suggest this rig is now coming to an end. Two major market leaders (Goldman Sachs (NYSE:GS) and the Semiconductor index) have not only been lagging on this latest bounce, but both were DOWN yesterday despite stocks rising 1%.

Sure, stocks might bounce a little higher, but at the end of the day, it is clear that corporate profits have peaked, the economy is rolling over, and the Fed is tightening.

Which of these is likely to be better six months from now? What exactly makes stocks an attractive investment right now?

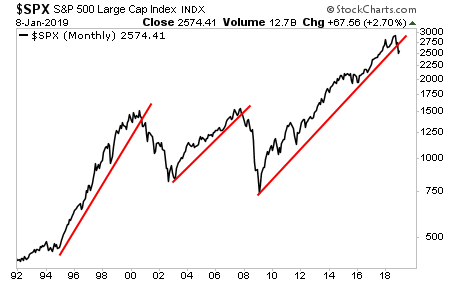

In chart form… what has changed about this?