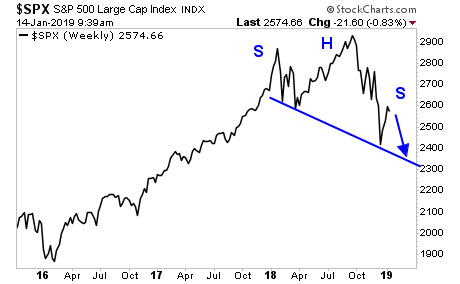

The bounce is just about over.

Multiple interventions, and active buying by the PPT have juiced stocks higher, but the Powers That Be cannot make the Everything Bubble whole again.

The fact is that between higher inflation along with the Fed’s rate hikes/ draining of liquidity has burst the Everything Bubble. It doesn’t mean that we’re moving straight into a systemic crisis right now. But it does mean that debt deflation is appearing again and that eventually it will spread to systemic issues.

That process is already underway.

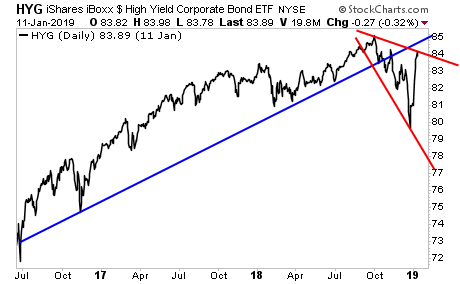

The ramp job in Junk Bonds was impressive, but it DID NOT reclaim its former bull market trendline (blue line). All it’s done is open a descending megaphone pattern that will see it crash to new lows shortly.

iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG)

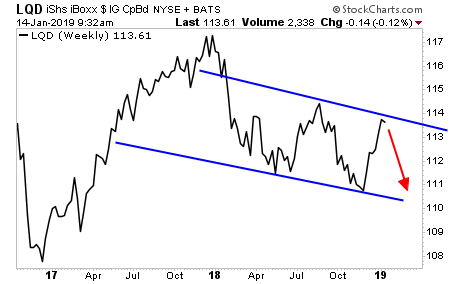

Similarly, Investment Grade bonds, which have been ramped higher, have just slammed into resistance (top blue line). They too suggest we’re going to new lows shortly.

iShares iBoxx $ Investment Grade Corporate Bond (NYSE:LQD)

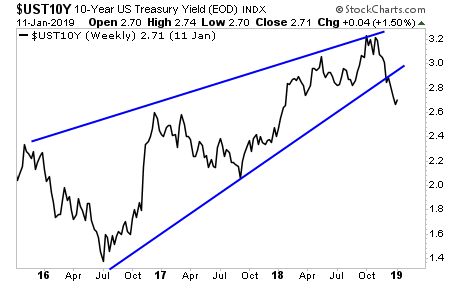

Finally, the 10-Year Treasury yield has broken down from a falling wedge formation. This suggest Treasuries will be rallying HARD, meaning capital is fleeing into them.

What would drive a move into Treasuries?

This:

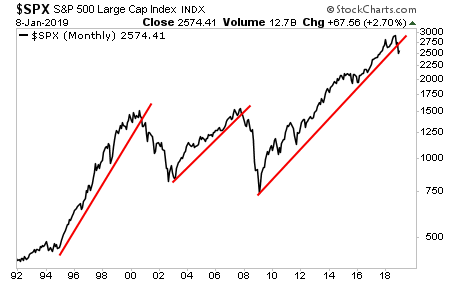

SPX

Unfortunately, after that comes the REALLY bad part.